The Dallas, Texas Defined-Benefit Pension Plan and Trust Agreement is a comprehensive retirement plan that provides financial security to eligible employees of the city of Dallas. This plan is designed to offer a fixed and predetermined retirement benefit based on factors such as salary history and years of service. A trust agreement is also established to ensure the proper management and investment of pension funds, ensuring the plan's long-term sustainability. Key features of the Dallas, Texas Defined-Benefit Pension Plan include guaranteed income for life, regardless of market fluctuations, and potential cost-of-living adjustments to help retirees keep up with inflation. This plan is particularly advantageous for individuals seeking stability and a reliable income stream during their retirement years. Different types of Dallas, Texas Defined-Benefit Pension Plans may exist to cater to specific employee groups or sectors. For example, there could be separate plans for police officers, firefighters, or general city employees. While the core principles of a defined-benefit plan remain the same, these variations may include specific eligibility criteria, benefit calculations, or retirement age requirements that align with the unique characteristics of each employee group. It is crucial to note that the Dallas, Texas Defined-Benefit Pension Plan and Trust Agreement is subject to periodic reviews and adjustments to ensure its financial sustainability. The city monitors the plan's funding level and may make alterations to contribution rates or benefits to ensure the long-term viability of the pension fund. In summary, the Dallas, Texas Defined-Benefit Pension Plan and Trust Agreement is a retirement plan designed to offer a secure and predetermined income stream for eligible employees of the city. It provides stability, financial security, and long-term benefits, allowing retirees to enjoy their post-employment years with peace of mind.

Dallas Texas Defined-Benefit Pension Plan and Trust Agreement

Description

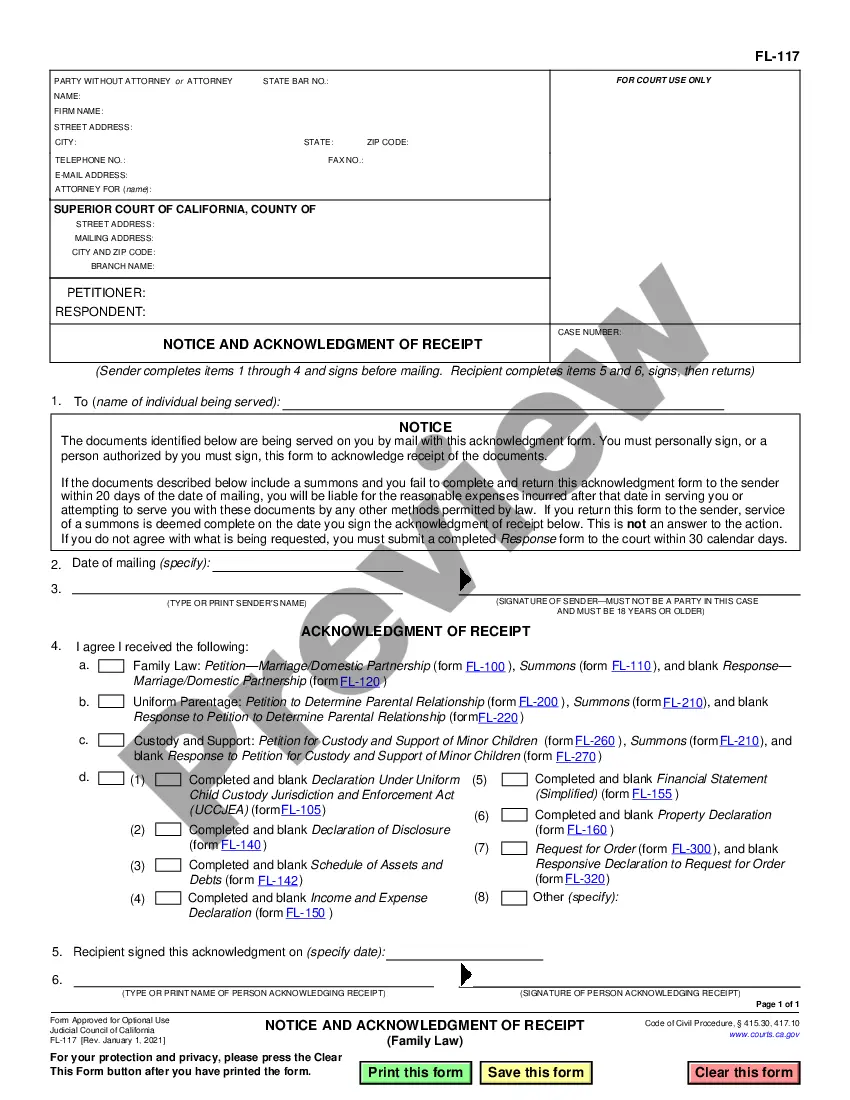

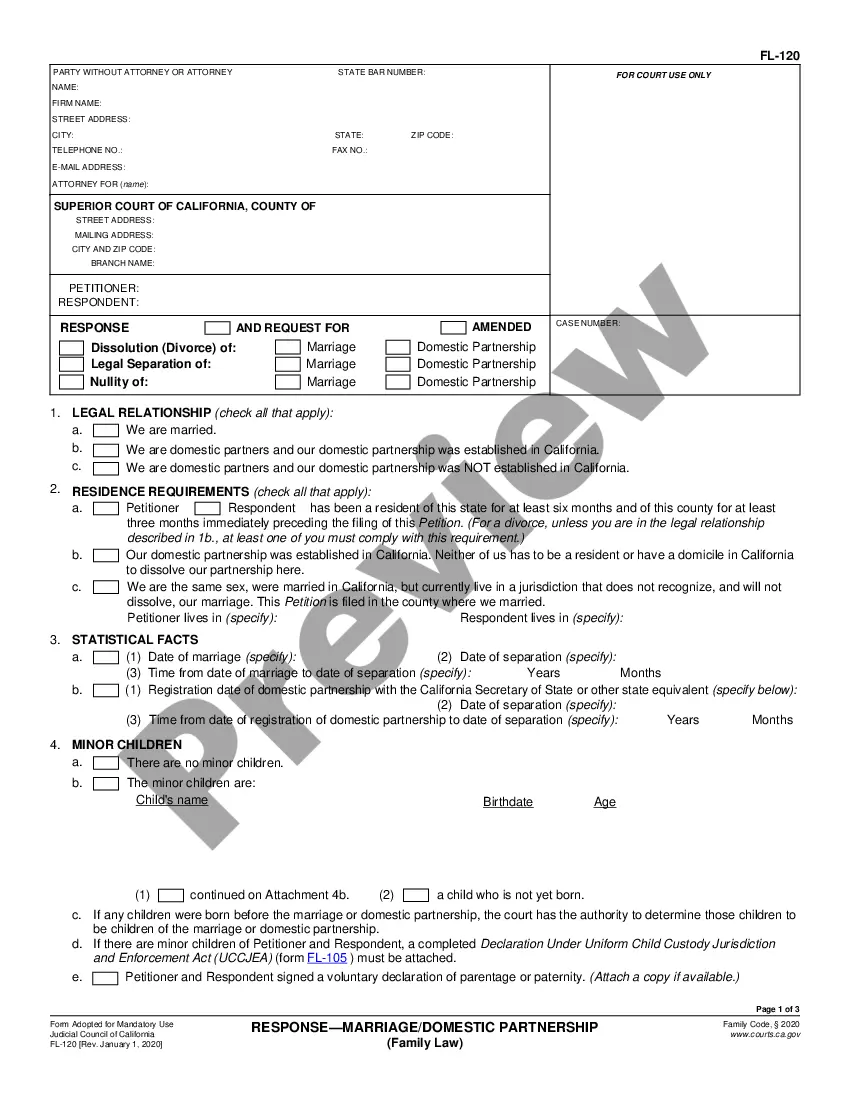

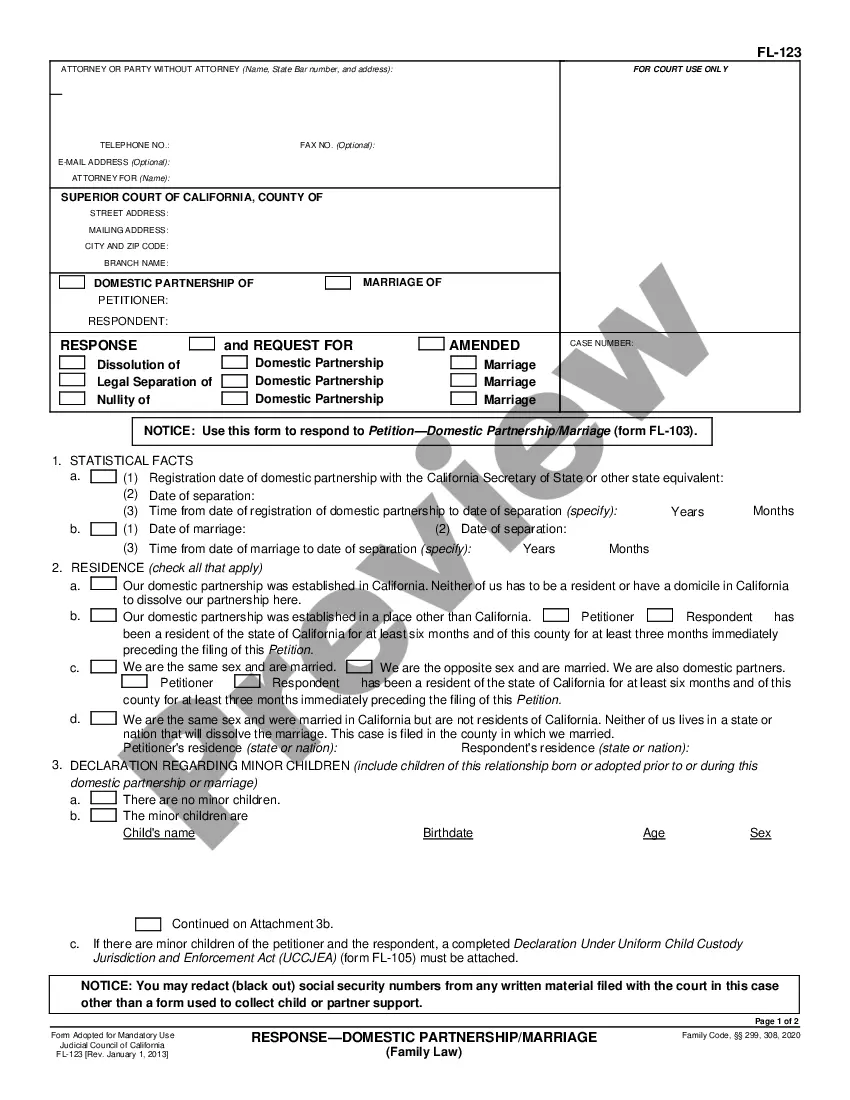

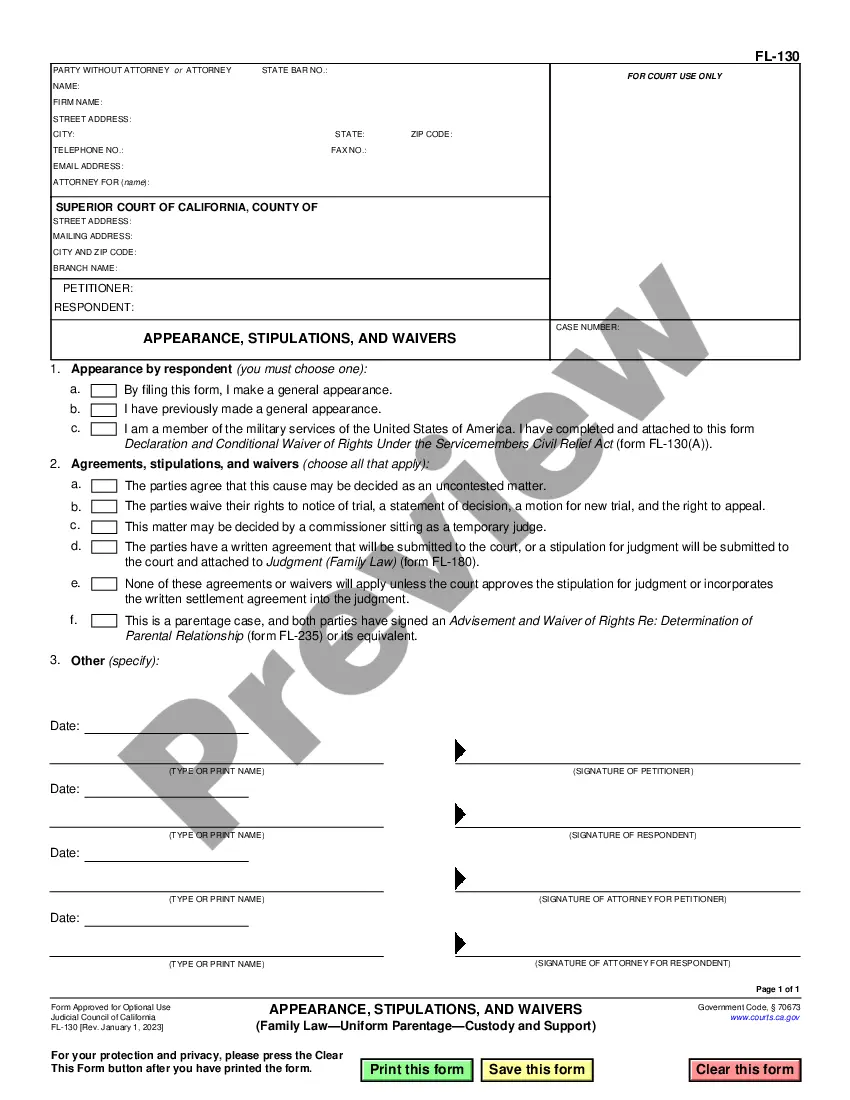

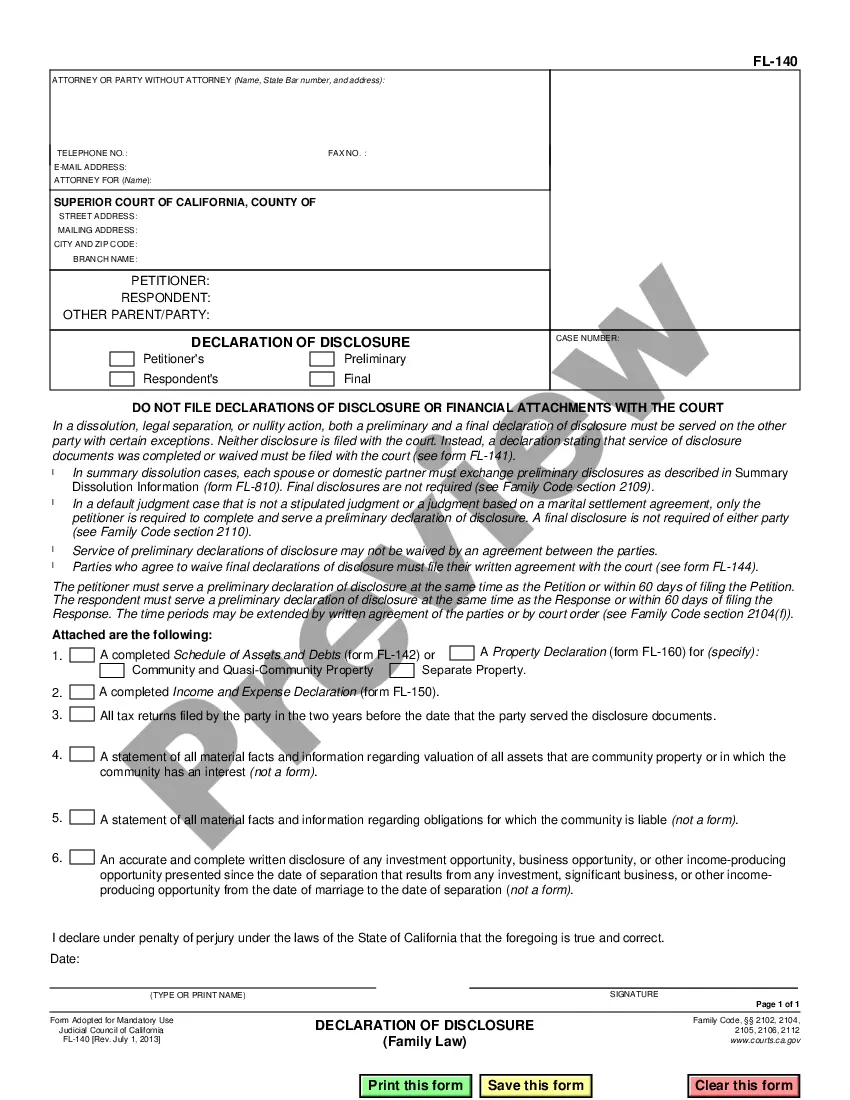

How to fill out Dallas Texas Defined-Benefit Pension Plan And Trust Agreement?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Dallas Defined-Benefit Pension Plan and Trust Agreement is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Dallas Defined-Benefit Pension Plan and Trust Agreement. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Defined-Benefit Pension Plan and Trust Agreement in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!