The Nassau New York Defined-Benefit Pension Plan and Trust Agreement is a legally binding document that outlines the terms and conditions of the pension plan provided to employees by the county of Nassau, New York. This pension plan is a defined-benefit plan, meaning that eligible employees are guaranteed a specific amount of retirement income based on a predetermined formula. The plan is funded by contributions from both the employees and the county, and the pension benefits are paid out to retired employees on a regular basis. The Nassau New York Defined-Benefit Pension Plan and Trust Agreement ensures that employees receive a reliable and secure source of income during their retirement years, allowing them to maintain their standard of living and cover essential expenses. It provides financial security and peace of mind to retired employees who have dedicated years of service to the county. One of the key features of this plan is the establishment of a trust fund. The trust fund is a separate legal entity that holds and manages the pension assets. It helps ensure that the funds allocated to the pension plan are protected and managed prudently for the benefit of the plan participants. Within the Nassau New York Defined-Benefit Pension Plan and Trust Agreement, there might be different variations or modifications depending on various factors such as employment category, employee union affiliations, or specific contract agreements. Examples of different types of this plan may include the Nassau County Police Benevolent Association (PBA) Defined-Benefit Pension Plan and Trust Agreement, the Nassau County Teachers' Association Defined-Benefit Pension Plan and Trust Agreement, or the Nassau County Civil Service Employees Association (SEA) Defined-Benefit Pension Plan and Trust Agreement. In summary, the Nassau New York Defined-Benefit Pension Plan and Trust Agreement is a comprehensive plan that ensures retirement benefits for eligible employees of Nassau County, New York. It offers financial security and a stable source of income during retirement, while the trust fund safeguards the pension assets, ensuring their proper management and utilization.

Nassau New York Defined-Benefit Pension Plan and Trust Agreement

Description

How to fill out Nassau New York Defined-Benefit Pension Plan And Trust Agreement?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Nassau Defined-Benefit Pension Plan and Trust Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find information resources and tutorials on the website to make any tasks related to document completion straightforward.

Here's how to purchase and download Nassau Defined-Benefit Pension Plan and Trust Agreement.

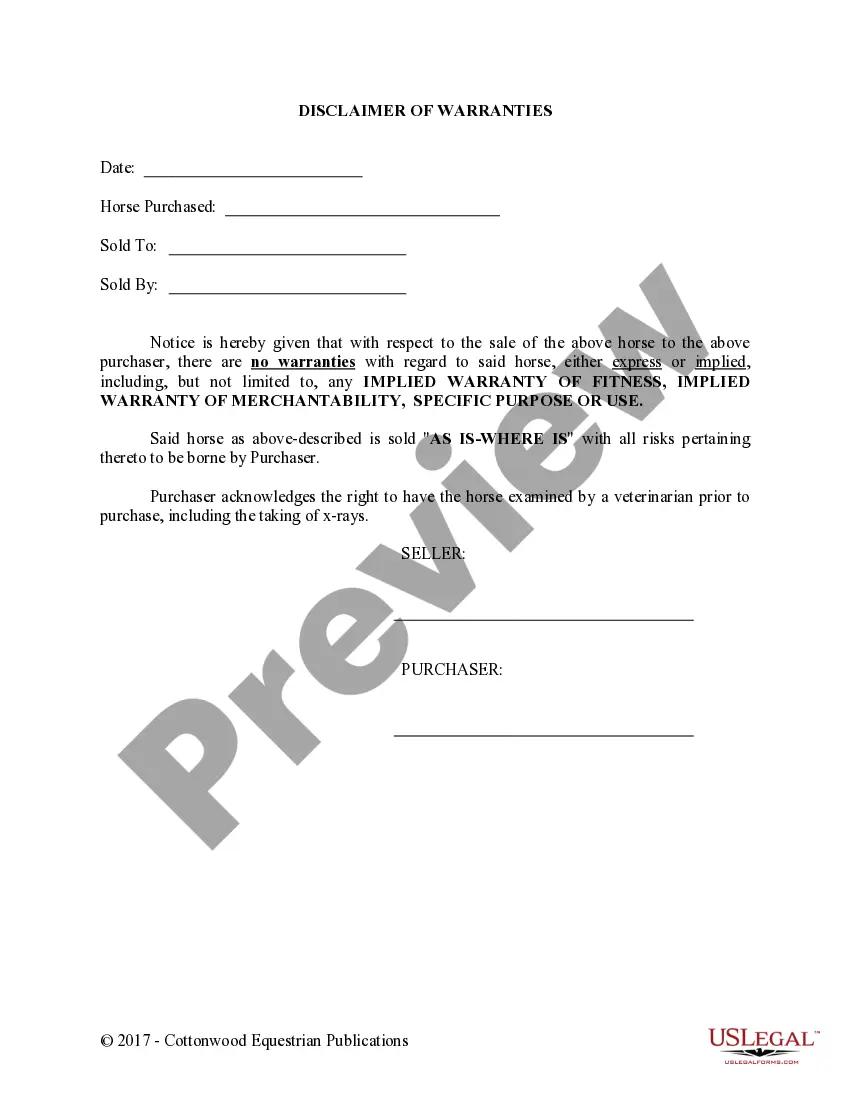

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the validity of some records.

- Examine the related forms or start the search over to locate the correct document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and purchase Nassau Defined-Benefit Pension Plan and Trust Agreement.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Nassau Defined-Benefit Pension Plan and Trust Agreement, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you have to cope with an extremely difficult case, we recommend using the services of an attorney to examine your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific documents with ease!