Allegheny, Pennsylvania, is a vibrant city located in western Pennsylvania, known for its rich history and diverse culture. As the second-largest city in the state, Allegheny is home to numerous industries and offers a variety of recreational opportunities for both residents and visitors. The Minutes of a Special Meeting of the Board of Directors of (Name of Corporation) to Adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code are crucial legal documents that provide a detailed account of the discussions and decisions made during this significant meeting. These minutes serve as an official record and outline the steps taken by the board to establish a stock ownership plan that complies with the provisions of Section 1244 of the Internal Revenue Code. Keywords: Allegheny, Pennsylvania, Special Meeting, Board of Directors, (Name of Corporation), Stock Ownership Plan, Section 1244, Internal Revenue Code. Different types of Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code may include: 1. Initial Meeting Minutes: These minutes would document the first meeting held by the board to initiate the process of adopting a stock ownership plan under Section 1244 of the Internal Revenue Code. They would typically include discussions on the purpose and potential benefits of the plan, as well as any necessary resolutions or approvals. 2. Amendment Meeting Minutes: If the board decides to make changes or amendments to an existing stock ownership plan, separate meeting minutes would be generated. These documents would outline the specific amendments proposed, the reasons behind them, and the board's decision regarding their adoption. 3. Annual Meeting Minutes: In some cases, corporations may hold annual meetings to review and assess the performance and effectiveness of their stock ownership plans. These minutes would document the discussions held during such meetings, including evaluations of the plan's impact and any proposed modifications for the upcoming year. 4. Termination Meeting Minutes: If the board decides to discontinue or terminate a stock ownership plan under Section 1244 of the Internal Revenue Code, separate meeting minutes would be necessary. These minutes would detail the reasons behind the decision, the steps taken to terminate the plan, and any associated legal or financial implications. These different types of meeting minutes play a crucial role in ensuring transparency, compliance, and legal validity of the stock ownership plans adopted by corporations in Allegheny, Pennsylvania, and beyond.

Allegheny Pennsylvania Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Allegheny Pennsylvania Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Allegheny Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Consequently, if you need the recent version of the Allegheny Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Allegheny Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code:

- Glance through the page and verify there is a sample for your region.

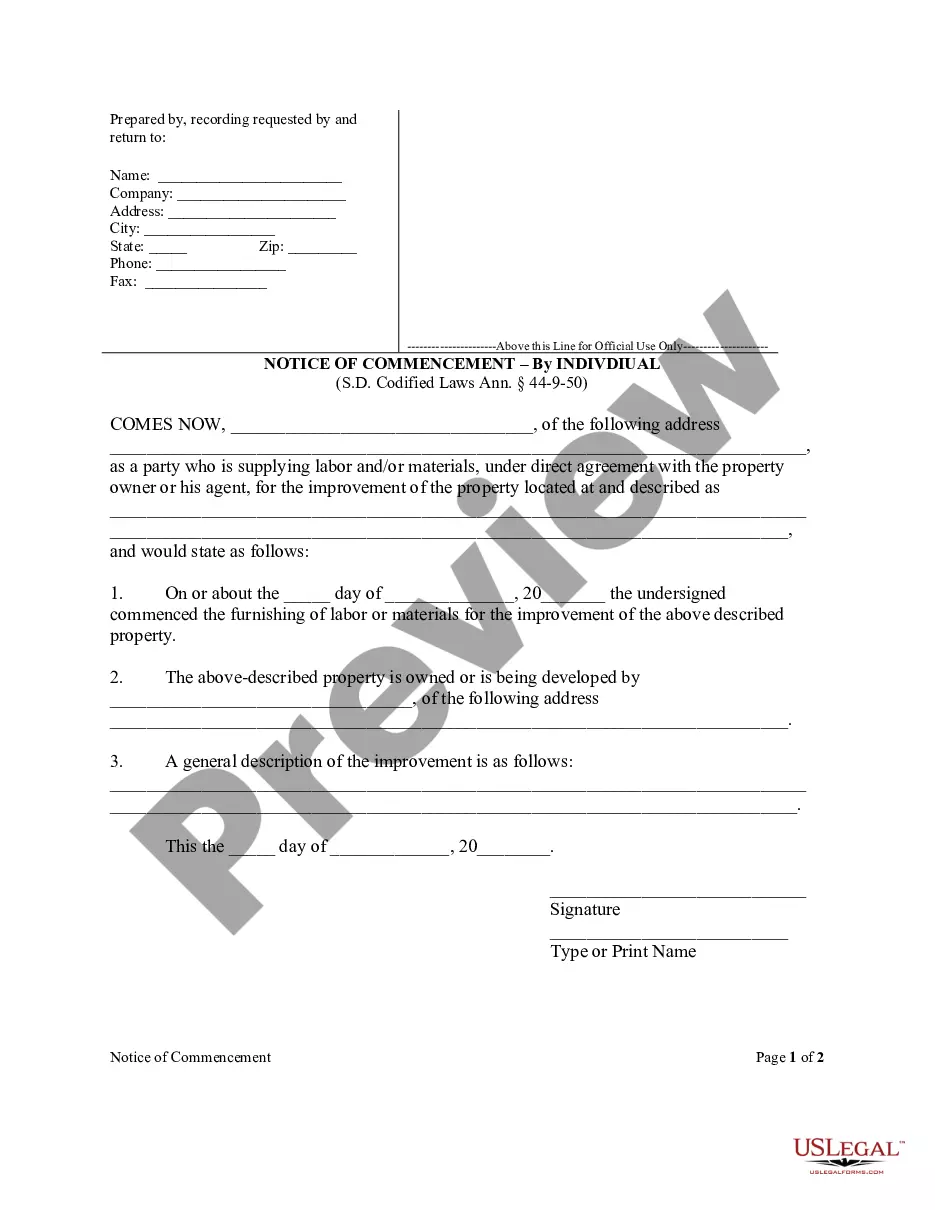

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Allegheny Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!