Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code Date: [Date of the Meeting] Time: [Time of the Meeting] Location: [Physical or Virtual Location] Attendees: — [Name and Title of Attendee 1— - [Name and Title of Attendee 2] — [Name and Title of Attendee 3— - [Name and Title of Attendee 4] — [Name and Title of Attendee 5— - [Name and Title of Attendee 6] Agenda: 1. Call to Order 2. Roll Call 3. Approval of Agenda 4. Adoption of Stock Ownership Plan under Section 1244 5. Discussion and Review of Stock Ownership Plan 6. Q&A Session 7. Vote on Stock Ownership Plan Adoption 8. Adjournment Meeting Minutes: 1. Call to Order: The special meeting of the Board of Directors of (Name of Corporation) was called to order by [Name], [Title], at [Time]. 2. Roll Call: The Secretary called the roll. [Number of Directors] directors were present, constituting a quorum to proceed with the meeting, as required by the bylaws. 3. Approval of Agenda: The agenda for the special meeting was presented and approved unanimously without any amendments. 4. Adoption of Stock Ownership Plan under Section 1244: The purpose of this meeting was to discuss and adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. The Board of Directors acknowledged the importance of implementing such a plan to provide various tax benefits to eligible shareholders. 5. Discussion and Review of Stock Ownership Plan: The Board of Directors thoroughly reviewed the proposed Stock Ownership Plan, examining its provisions, eligibility criteria, implications, and potential benefits for the corporation and its shareholders. The plan was developed in accordance with Section 1244 of the Internal Revenue Code and tailored to suit the specific needs and goals of the corporation. 6. Q&A Session: During the Q&A session, directors had the opportunity to seek clarifications and express concerns regarding the plan. Detailed answers and explanations were provided by [Name], [Title], who presented the plan to the board. 7. Vote on Stock Ownership Plan Adoption: After careful consideration and discussion, a motion was made by [Name of Director] to adopt the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. The motion was seconded by [Name of Director] and unanimously approved by all present directors. 8. Adjournment: There being no further business to discuss, the special meeting was adjourned at [Time] by [Name], [Title]. These minutes will be considered official and will be filed accordingly. Different types or variations of the Fairfax Virginia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code may include meetings for specific corporations or organizations, various dates or times of meetings, and alternative locations such as virtual (online) meetings due to circumstances or preferences.

Fairfax Virginia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Fairfax Virginia Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Fairfax Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Consequently, if you need the latest version of the Fairfax Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code:

- Glance through the page and verify there is a sample for your region.

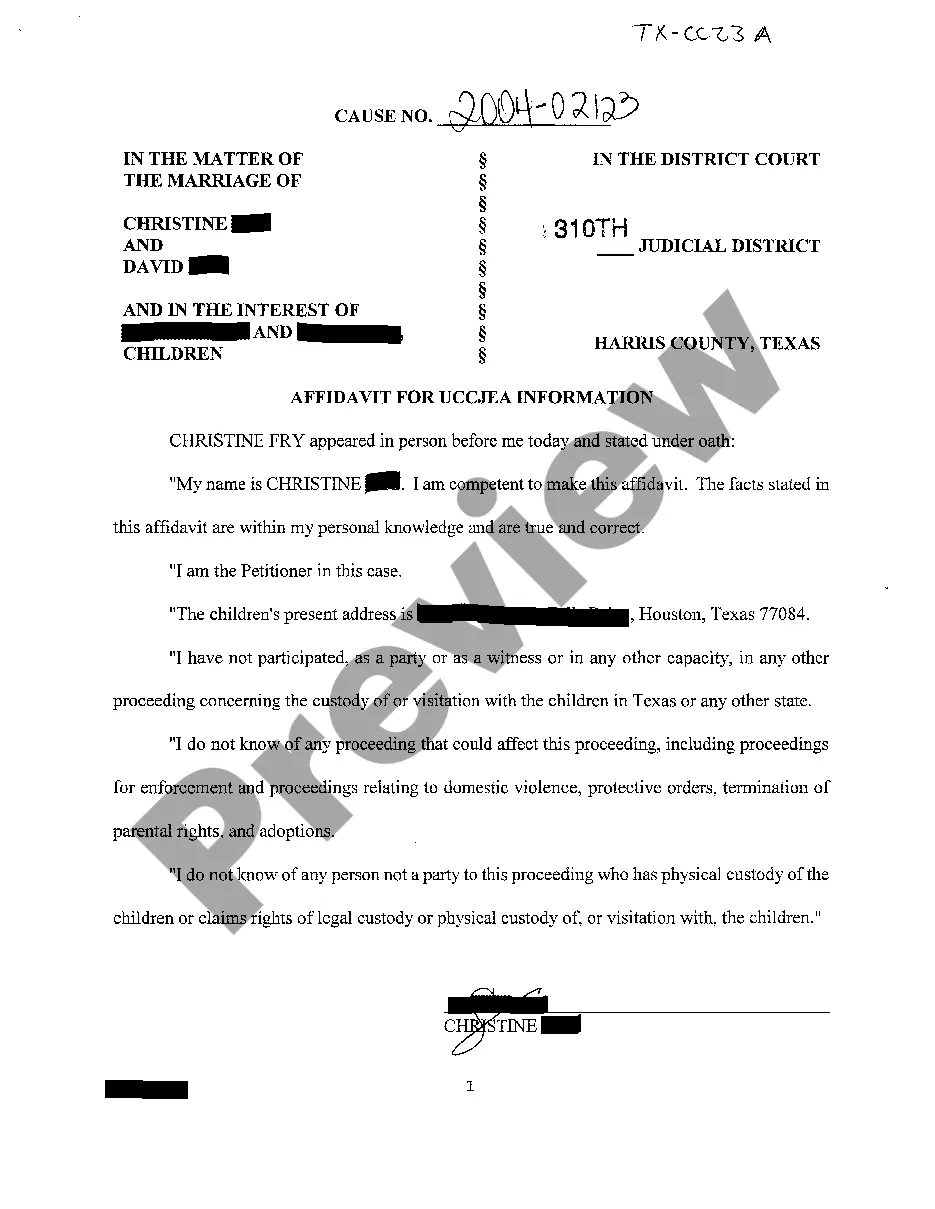

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Fairfax Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!