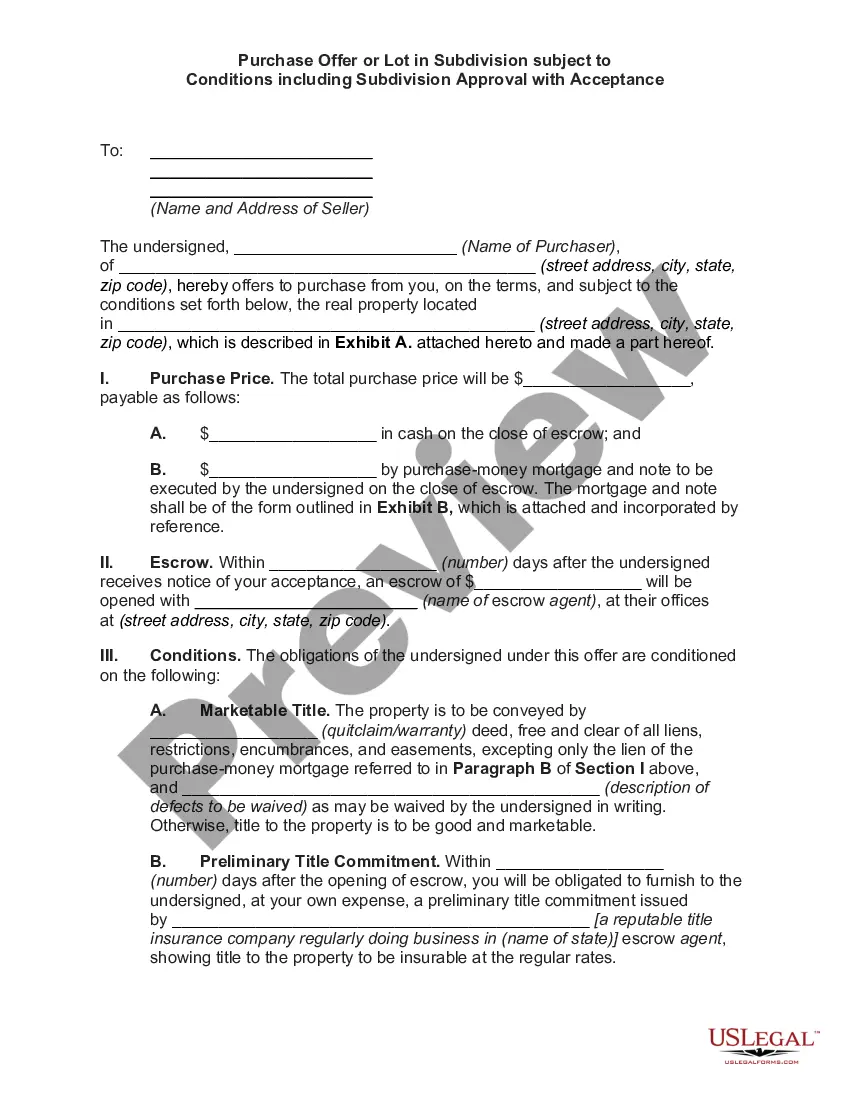

Salt Lake City, Utah is the capital and largest city of the state of Utah, located in the western United States. It is situated in a valley surrounded by the stunning Wasatch and Quarry mountain ranges. Known for its beautiful landscapes, vibrant culture, and outdoor recreational opportunities, Salt Lake City offers a unique and diverse experience to its residents and visitors. The Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code refers to the official record of a meeting held by the board of directors of a specific corporation in Salt Lake City, Utah. This meeting's main objective is to discuss and adopt a stock ownership plan that complies with the regulations outlined in Section 1244 of the Internal Revenue Code. The Minutes of this Special Meeting detail the discussions, decisions, and resolutions made by the board members regarding the stock ownership plan. These minutes usually include the names of the directors present, a summary of the discussions, any motions or resolutions proposed and passed, explanations of the plan's structure and benefits, and any other relevant information. It's important to note that there may be various types of Stock Ownership Plans available under Section 1244 of the Internal Revenue Code, depending on the specific needs and goals of the corporation and its shareholders. Some possible variations include Employee Stock Ownership Plans (Sops), Restricted Stock Ownership Plans, Qualified Small Business Stock Ownership Plans, or any custom plan designed to fit the corporation's unique requirements. The minutes of this special meeting play a crucial role in documenting the corporation's compliance with legal and regulatory requirements, providing transparency to shareholders and authorities, and serving as an official record of important decisions made by the board of directors. In conclusion, the Salt Lake Utah Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code refers to the detailed record of a meeting held in Salt Lake City, Utah, where a specific corporation's board of directors discusses and adopts a stock ownership plan in accordance with Section 1244 of the Internal Revenue Code. Different types of stock ownership plans may exist, tailored to the corporation's specific needs, with the minutes serving as an official record of the meeting's discussions, decisions, and resolutions.

Salt Lake Utah Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Salt Lake Utah Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

If you need to find a trustworthy legal paperwork provider to get the Salt Lake Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to locate and execute various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to search or browse Salt Lake Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Salt Lake Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less expensive and more reasonably priced. Create your first company, organize your advance care planning, create a real estate agreement, or execute the Salt Lake Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code - all from the comfort of your home.

Sign up for US Legal Forms now!