Nassau New York Preferred Stock Certificate serves as a legal document representing ownership of preferred stock in a corporation based in Nassau, New York. This type of stock offers certain advantages and privileges to its holders compared to common stock shareholders. Preferred stockholders typically have a higher claim on the company's assets and earnings, entitling them to receive dividends before common shareholders. They also have priority over common shareholders when it comes to receiving payments in the event of liquidation or bankruptcy. These features make Nassau New York Preferred Stock a valuable investment option for individuals seeking more security and consistent income. Within the realm of Nassau New York Preferred Stock Certificates, various types may exist, each with its unique characteristics. Some common types include: 1. Cumulative Preferred Stock: This type of preferred stock guarantees the payment of any missed dividends in the future. If the company suspends dividend payments, they accumulate and must be paid before any dividends can be given to common stockholders. 2. Non-Cumulative Preferred Stock: In contrast to the cumulative type, non-cumulative preferred stock does not carry the right to receive missed dividend payments in the future. If the company suspends or fails to pay dividends, the preferred stockholders have no claim to the unpaid dividends. 3. Convertible Preferred Stock: This form of preferred stock grants investors the option to convert their shares into a predetermined number of common shares. This conversion privilege allows investors to benefit from potential capital appreciation if the company's common stock price rises. 4. Participating Preferred Stock: With participating preferred stock, shareholders receive additional dividends beyond the specified fixed rate if the company achieves exceptional financial performance. This feature enables investors to share in the company's success and amplifies the return on their investment. By holding a Nassau New York Preferred Stock Certificate, investors gain access to a range of advantages and potential financial rewards, depending on the type of preferred stock they own. It is essential for investors to thoroughly understand the terms and conditions of the specific preferred stock they are purchasing to make informed investment decisions.

Nassau New York Preferred Stock Certificate

Description

How to fill out Nassau New York Preferred Stock Certificate?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Nassau Preferred Stock Certificate, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Nassau Preferred Stock Certificate from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Nassau Preferred Stock Certificate:

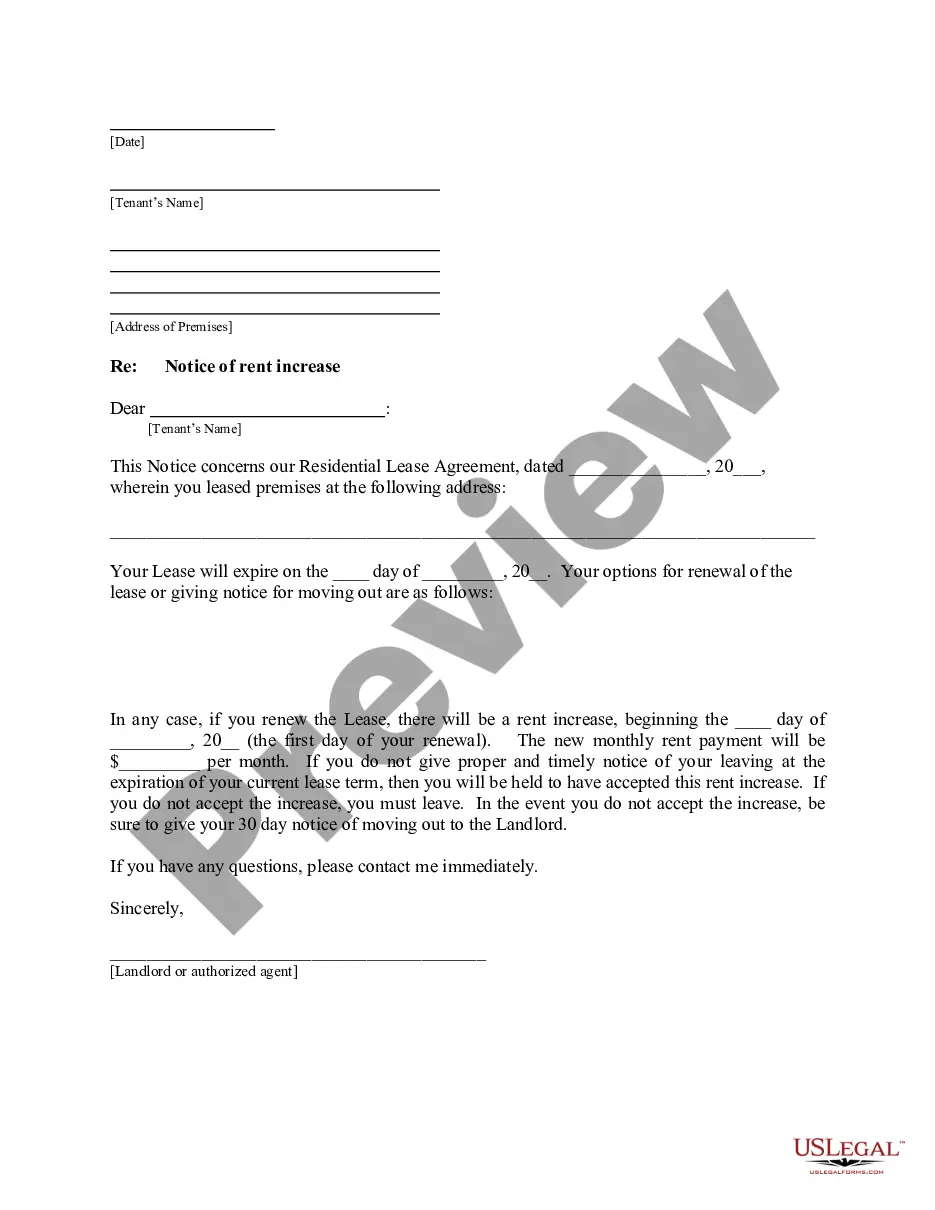

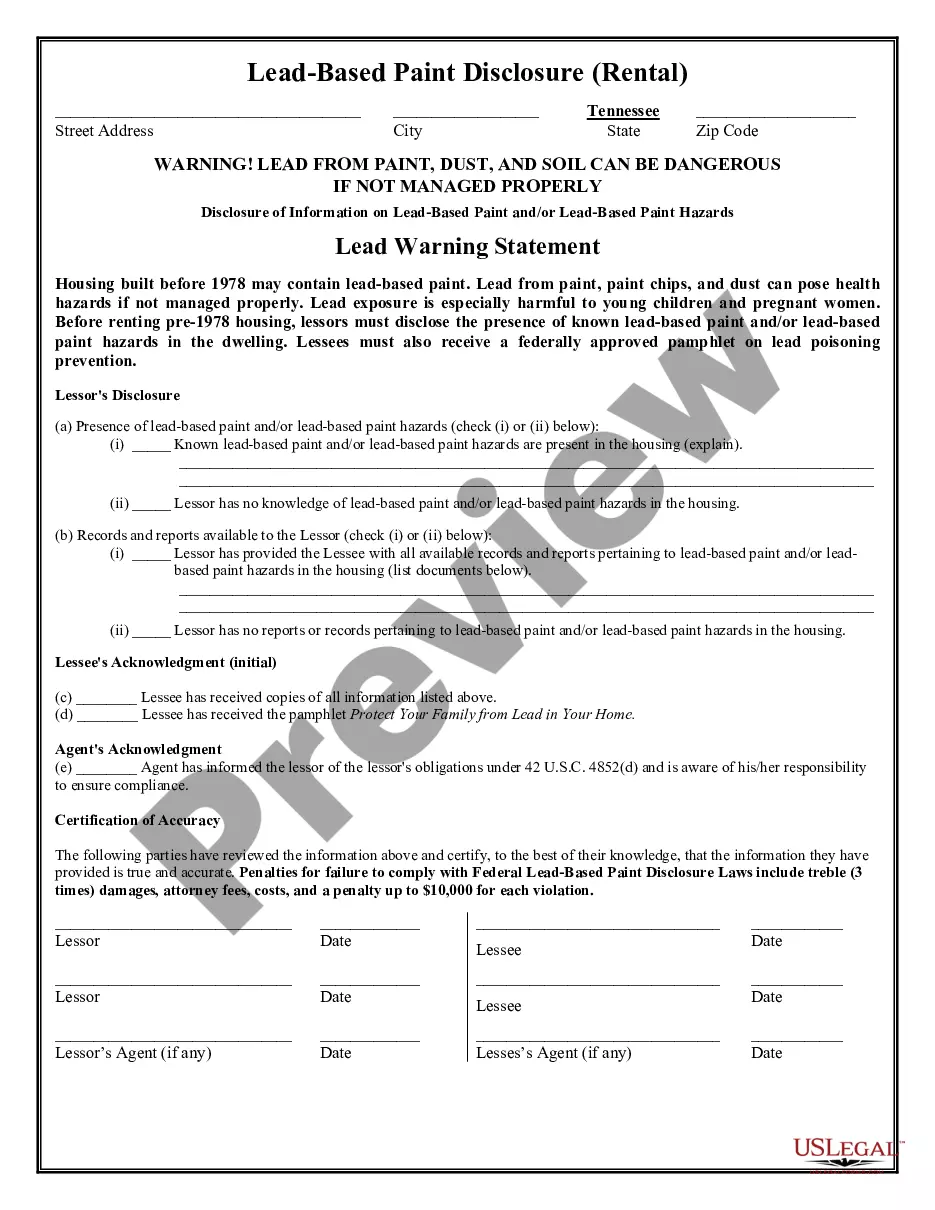

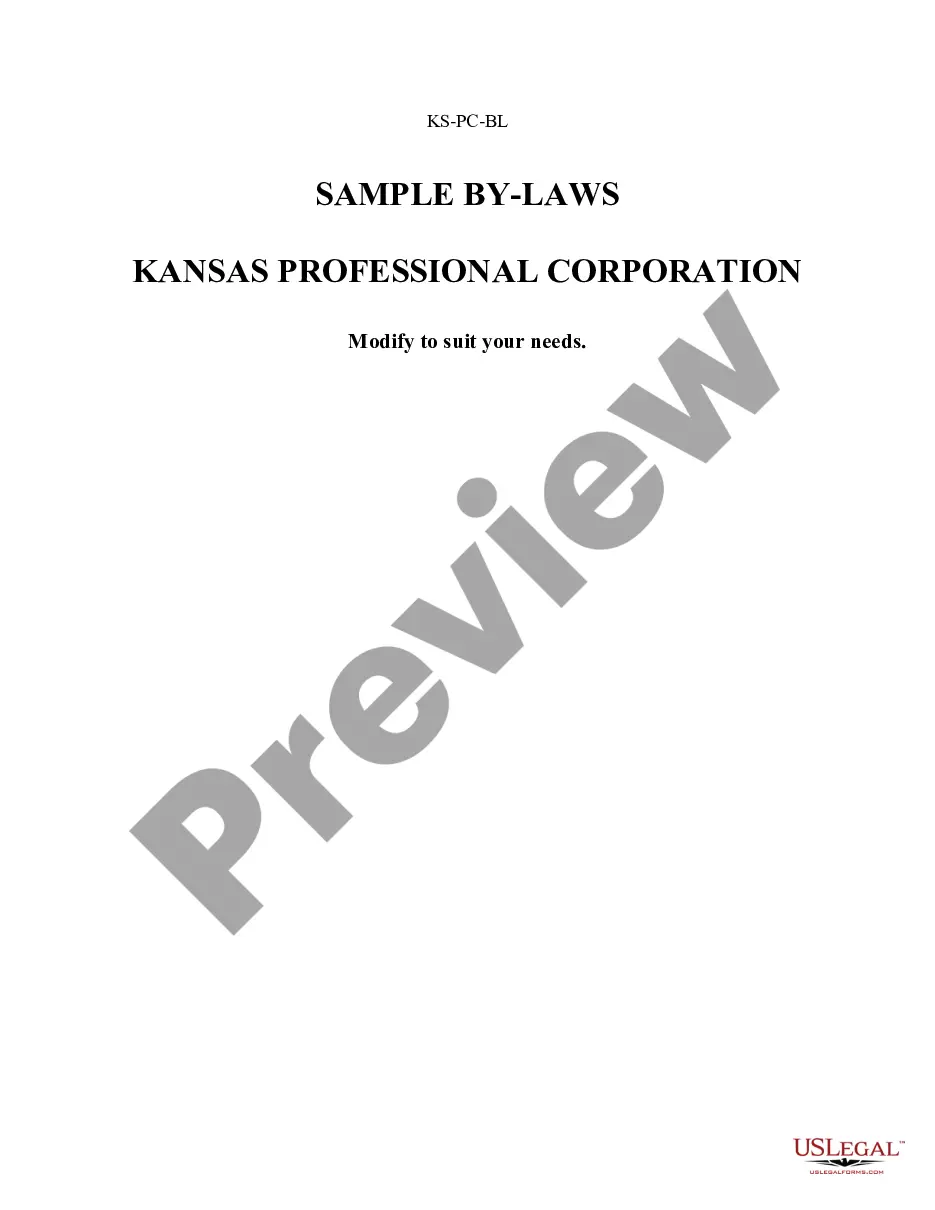

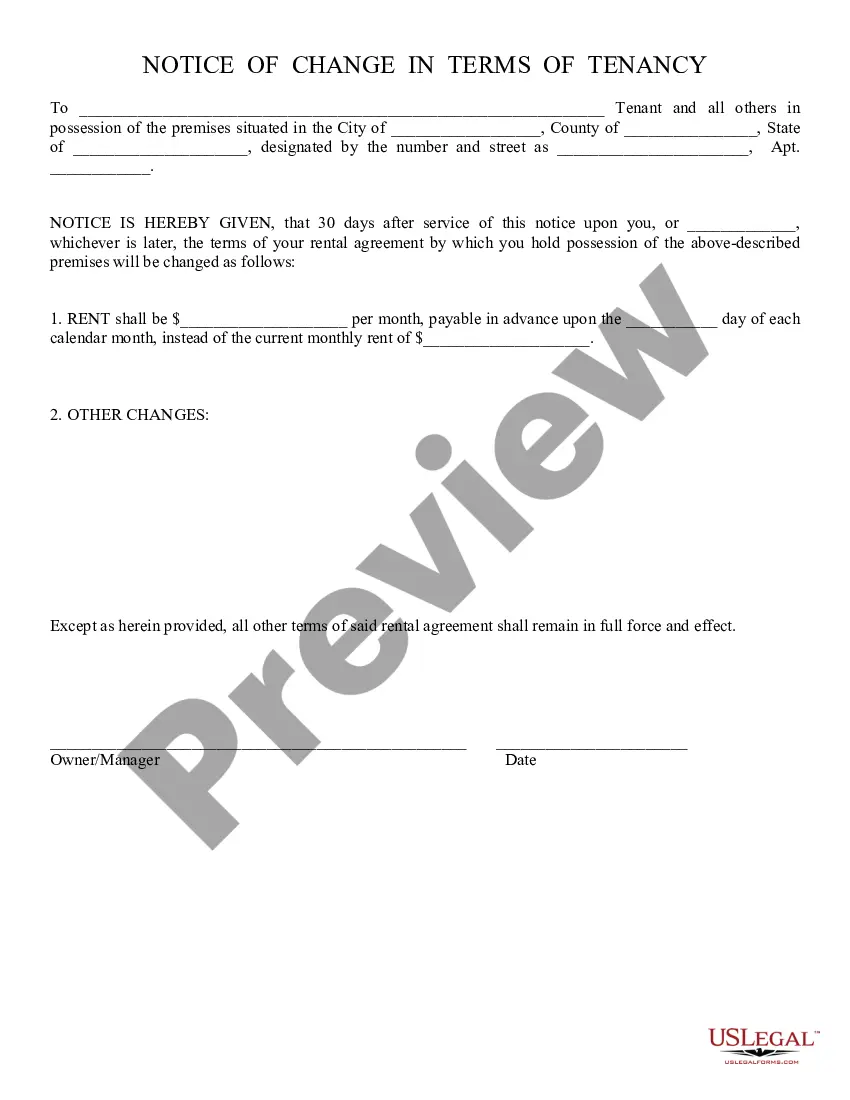

- Take a look at the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!