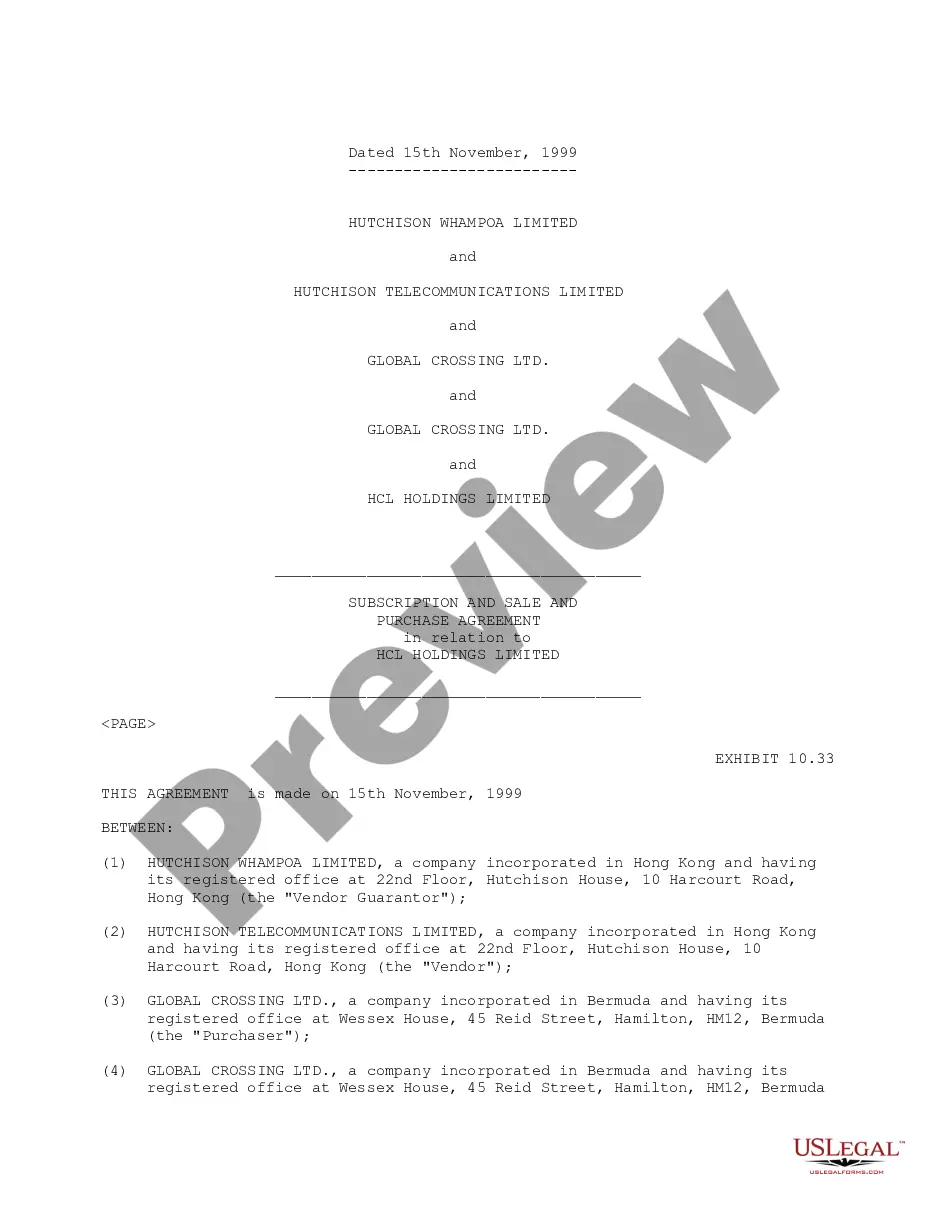

San Diego California Preferred Stock Certificate, also known as San Diego Preferred Stock Certificate, is a legal document issued by corporations in San Diego, California, to shareholders who hold preferred shares of the company's stock. This certificate represents ownership in the company and entitles the shareholder to certain privileges and benefits. The San Diego California Preferred Stock Certificate serves as evidence of the shareholder's ownership of preferred stock in the corporation. It contains pertinent information about the shareholder, including their name, address, and the number of shares owned. This certificate also includes the unique certificate number, issue date, and the par value of each share. Preferred stockholders in San Diego, California, typically enjoy several advantages over common stockholders. These privileges may include preferential dividends, which means they receive a fixed dividend amount before any dividends are distributed to common stockholders. Additionally, if the corporation goes bankrupt or liquidates, preferred stockholders have a higher claim on the company's assets compared to common stockholders. There are various types of San Diego California Preferred Stock Certificates categorized based on their specific features and conditions. Some common types include: 1. Cumulative Preferred Stock Certificate: This type of certificate ensures that if the corporation fails to pay dividends, the unpaid dividends accumulate and must be paid to the preferred stockholders before any dividends are paid to common stockholders. 2. Convertible Preferred Stock Certificate: This certificate allows the preferred stockholder to convert their preferred shares into a specified number of common shares. This conversion privilege provides flexibility to shareholders if they believe the common stock will offer higher returns to the future. 3. Participating Preferred Stock Certificate: With this certificate, preferred stockholders not only receive their fixed dividend but also have the right to additional dividends if the corporation exceeds a specified level of profitability. This type of certificate provides an opportunity for stockholders to share in the company's success. 4. Non-Cumulative Preferred Stock Certificate: Unlike cumulative preferred stock, non-cumulative certificates do not accumulate unpaid dividends. If the corporation fails to pay dividends in a particular period, preferred stockholders do not have the right to claim those unpaid dividends in the future. San Diego California Preferred Stock Certificates are crucial for both corporations and shareholders. They provide documentation of ownership and the associated rights and privileges, ensuring transparency and accountability in the corporate world. Shareholders holding these certificates have a legal claim to their entitlements, making them valuable assets in the world of investing in San Diego, California.

San Diego California Preferred Stock Certificate

Description

How to fill out San Diego California Preferred Stock Certificate?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life scenario, finding a San Diego Preferred Stock Certificate meeting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Apart from the San Diego Preferred Stock Certificate, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your San Diego Preferred Stock Certificate:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Diego Preferred Stock Certificate.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Redeemable preferred stock is a type of preferred stock that allows the issuer to buy back the stock at a certain price and retire it, thereby converting the stock to treasury stock. These terms work well for the issuer of the stock, since the entity can eliminate equity if it becomes too expensive.

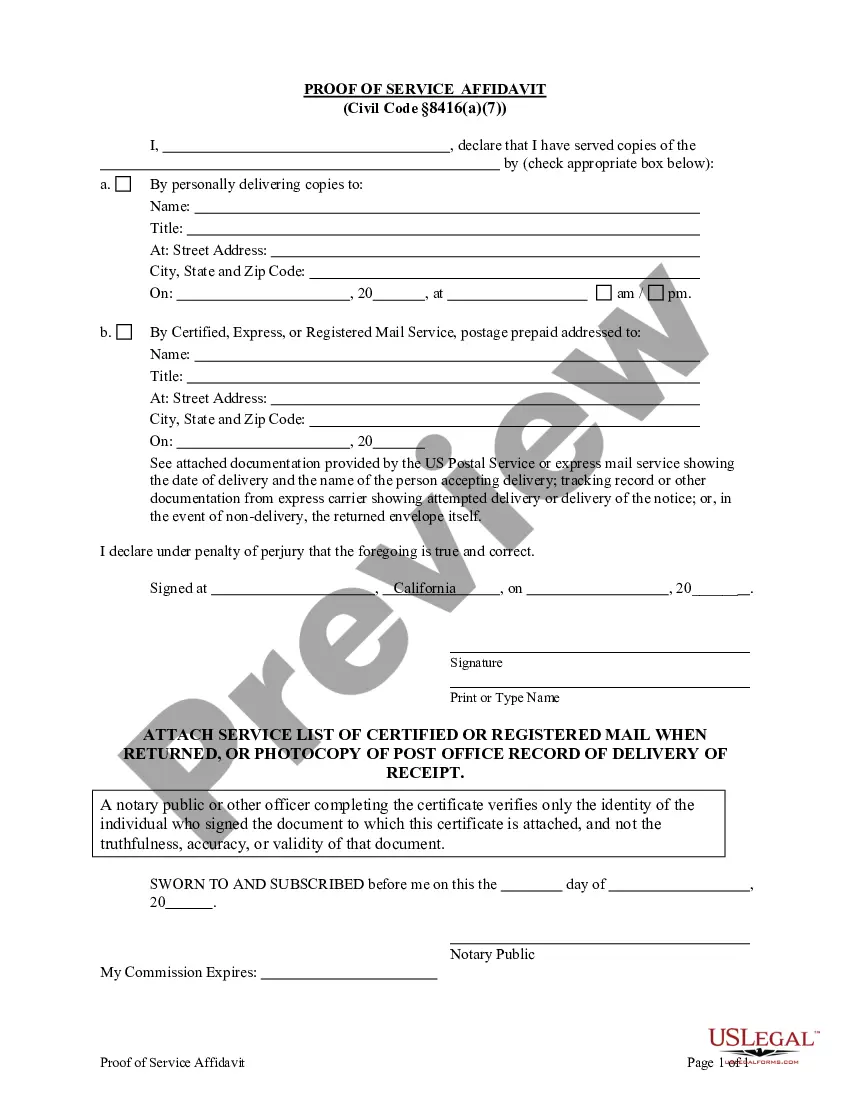

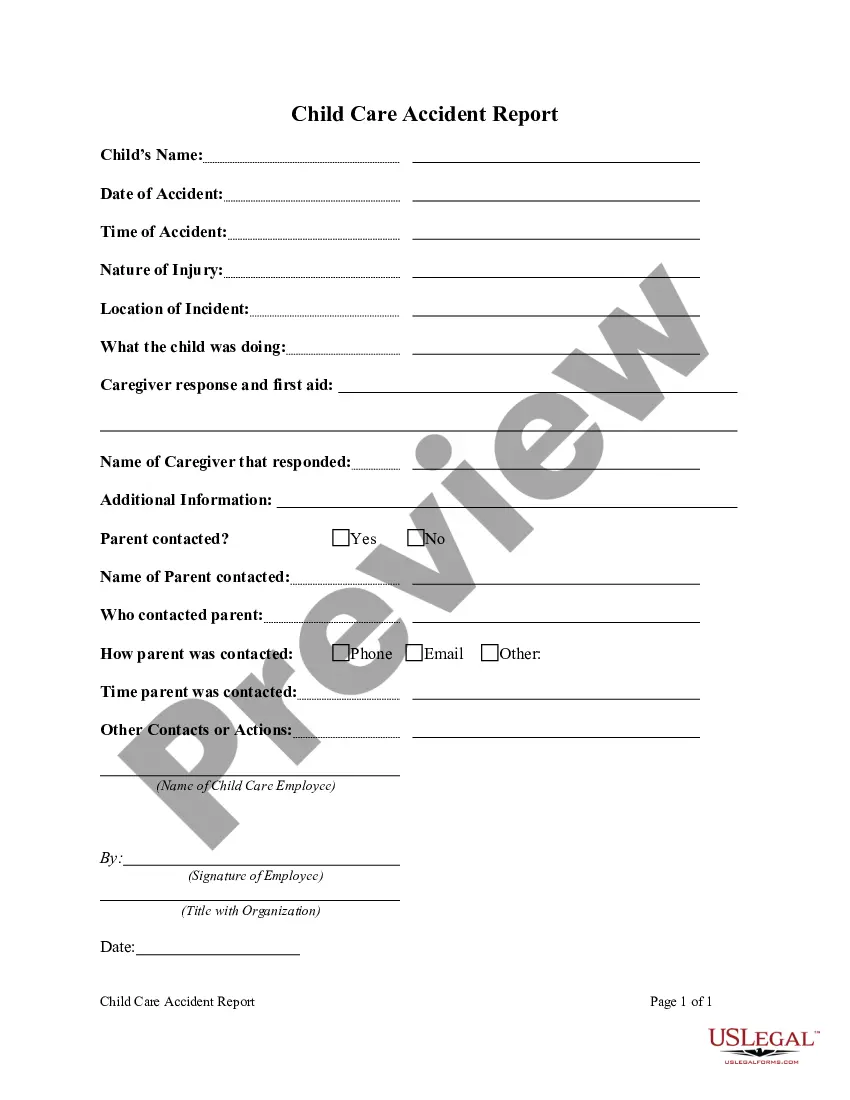

Key Takeaways. A stock certificate is a physical piece of paper that represents a shareholder's ownership of a company. Stock certificates include information such as the number of shares owned, the date of purchase, an identification number, usually a corporate seal, and signatures.

Disadvantages of preferred shares include limited upside potential, interest rate sensitivity, lack of dividend growth, dividend income risk, principal risk and lack of voting rights for shareholders.

Callable preferred stock are preferred shares that may be redeemed by the issuer at a set value before the maturity date. Issuers use this type of preferred stock for financing purposes as they like the flexibility of being able to redeem it.

A preferred stock is a type of hybrid investment that acts like a mix between a common stock and a bond. Like common stocks, a preferred stock gives you a piece of ownership of a company. And like bonds, you get a steady stream of income in the form of dividend payments (also known as preferred dividends).

The company that sold you the preferred stock can usually, but not always, force you to sell the shares back at a predetermined price. Companies might choose to call preferred stock if the interest rates they're paying are significantly higher than the going rate in the market.

Determine the collectible value of your certificate if it no longer has stock value. A stock can have worth based on who signed it, historical interest, or the engraving. This value can be found by contacting dealers, researching libraries, or searching listings on eBay.

However, more like stocks and unlike bonds, companies may suspend these payments at any time. Preferred stocks oftentimes share another trait with many bonds the call feature. The company that sold you the preferred stock can usually, but not always, force you to sell the shares back at a predetermined price.

Contact your broker. Preferred stock sells in the same way as equities. You will need to know the CUSIP (Committee on Uniform Securities Identification Procedures) number for the issue for the broker to look up prices for you. This should be on your broker statement or the prospectus for the preferred stock issue.

A preferred stock certificate is a document that identifies the ownership share of an investor in a corporation.