San Jose, California Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate: In San Jose, California, an indemnity bond is a legal instrument used to replace lost, destroyed, or stolen stock certificates. This type of bond provides financial protection to the issuing company against any potential liabilities that may arise due to the replacement of the stock certificate. As the heart of Silicon Valley, San Jose is home to numerous technology giants and has a thriving business community. Stock ownership often plays a crucial role in these companies, and the loss or theft of stock certificates can cause significant financial and legal complications for both the shareholders and the issuing companies. When faced with the loss or theft of a stock certificate, individuals or companies in San Jose have the option to obtain an indemnity bond. This bond acts as a form of insurance, providing compensation to the issuing company if the lost, destroyed, or stolen stock certificate is wrongfully redeemed in the future. There are different types of San Jose, California indemnity bonds available, depending on the specific circumstances and requirements of the situation. These may include: 1. Lost Stock Certificate Bond: This bond is obtained when a stock certificate is lost or misplaced, and its replacement is needed to secure the shareholders' rights and protect the issuing company. 2. Destroyed Stock Certificate Bond: In cases where a stock certificate has been accidentally or intentionally destroyed, this type of bond is required to facilitate the issuance of a new certificate to maintain the shareholder's ownership rights. 3. Stolen Stock Certificate Bond: If a stock certificate is stolen, an indemnity bond can be obtained to protect the issuing company against potential fraudulent activities or unauthorized transfers of ownership. It is important to note that each type of indemnity bond may have varying requirements and conditions. Typically, the bond's value is equal to the market value of the stock certificate being replaced, ensuring adequate financial protection for the issuing company. To obtain a San Jose, California indemnity bond, individuals or companies are usually required to provide proof of ownership, evidence of the loss or theft, and other supporting documentation. The bond is then issued by a licensed surety company, establishing a legally binding agreement between the bondholder and the issuing company. By obtaining an indemnity bond, shareholders and issuing companies in San Jose, California can alleviate the potential risks and financial burdens associated with the loss, destruction, or theft of a stock certificate. This ensures the secure and efficient transfer of ownership rights, safeguarding the interests of both parties involved in the transaction.

San Jose California Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate

Description

How to fill out San Jose California Indemnity Bond To Replace Lost, Destroyed, Or Stolen Stock Certificate?

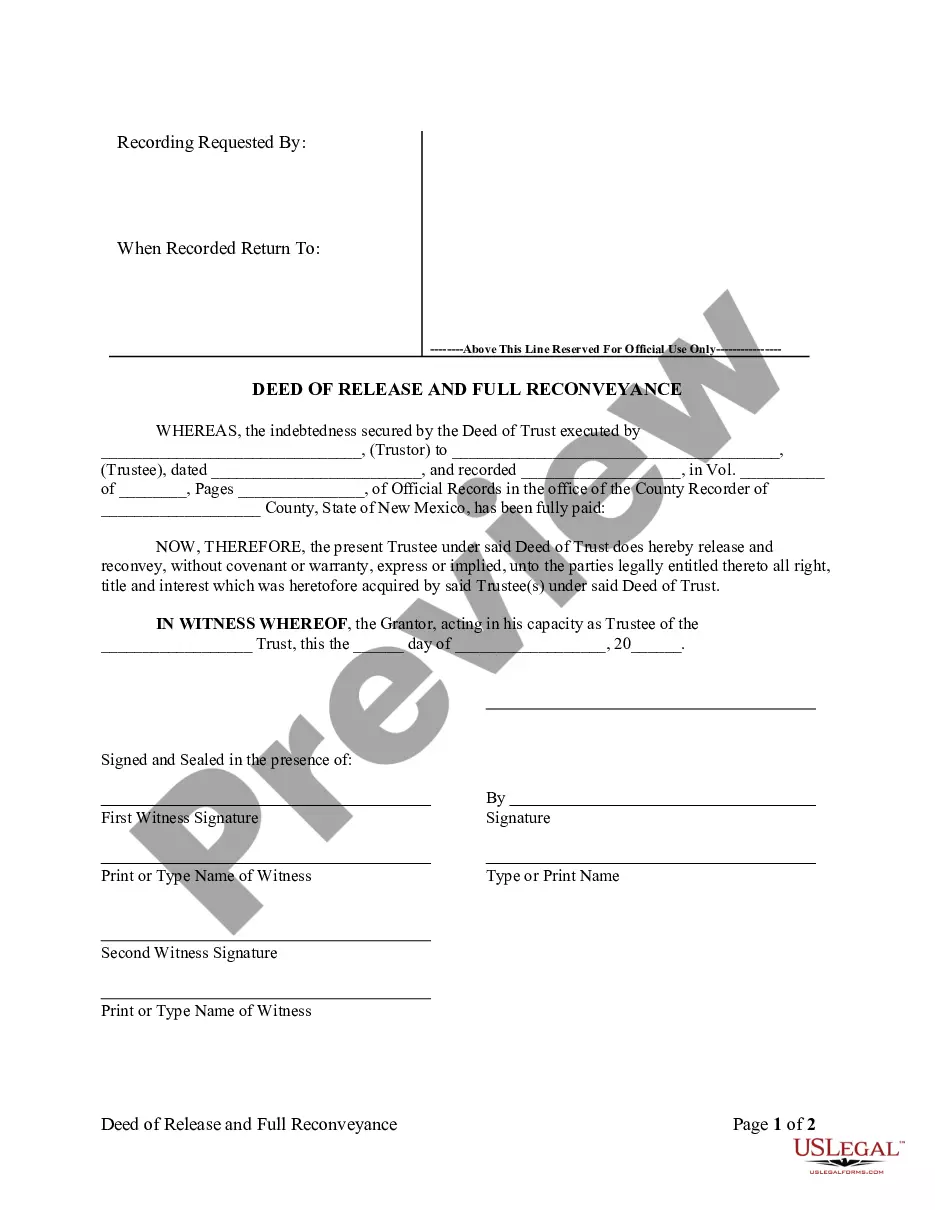

Are you looking to quickly create a legally-binding San Jose Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate or probably any other document to manage your personal or corporate affairs? You can go with two options: hire a legal advisor to write a valid paper for you or create it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant document templates, including San Jose Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate and form packages. We offer documents for an array of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, carefully verify if the San Jose Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate is tailored to your state's or county's laws.

- If the form comes with a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the San Jose Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

If an investor does not have or loses their stock certificate, they are still the owner of their shares and entitled to all the rights that come with them. If an investor wants a stock certificate, or if it is lost, stolen, or damaged, they can receive a new one by contacting a company's transfer agent.

A Lost Stock Certificate Surety Bond is required by the issuing company of the stock, through its transfer agent. The purpose of the bond is to protect the corporation and the agent in case the lost certificate is somehow redeemed by another party at a later date.

If your securities certificate is lost, accidentally destroyed, or stolen, you should immediately contact the transfer agent and request a stop transfer to prevent ownership of the securities from being transferred from your name to another's. Your broker may be able to assist you with this process.

Surety bonds guarantee the obligee the lowest compliant bidder will perform the work for the quoted price. It assures the work will be completed as per the contract. Obligees are ensured suppliers will be paid regardless of financial difficulty at the contractor's end.

A Lost Stock Certificate Surety Bond is an indemnity bond required by the issuer of the certificate and the SEC when a stock certificate has been lost or stolen. The bond is a safety net for the transfer agent in that if the lost certificate is found and sold, the transfer agent doesn't suffer any economic loss.

Stock certificates can be damaged or destroyed and also are at risk of being lost or stolen. If you need to replace a lost stock certificate, you can do so by contacting the brokerage or the company that issued it.

Surety bonds are typically required for contractors who seek to work on high-cost government contracts. Even when not compulsory, surety bonds make sense when a contract requires performance, because they help compensate obligees when principals fail to meet their contractual obligations.

Because a stock certificate is your only legal proof of ownership, you can't sell or transfer the stock without it. Once the affidavit is completed, have your brokerage firm ask the company whose stock you hold to issue a new stock certificate, which you can then keep or use to sell or transfer the stock as you wish.

If your securities certificate is lost, accidentally destroyed, or stolen, you should immediately contact the transfer agent and request a stop transfer to prevent ownership of the securities from being transferred from your name to another's. Your broker may be able to assist you with this process.