Tarrant Texas Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate The Tarrant Texas Indemnity Bond is a crucial document that provides protection and ensures peace of mind for individuals who have lost, destroyed, or had their stock certificate stolen within Tarrant County, Texas. This bond safeguards the stockholder's investment and guarantees that they can obtain a replacement certificate without financial loss. Stock certificates are legal documents that represent ownership in a company. They hold significant value, both monetarily and as evidence of ownership. Unfortunately, certificates can be lost, misplaced, damaged beyond recognition, or even stolen. In such cases, the Tarrant Texas Indemnity Bond comes into play, helping mitigate any potential financial loss and ensuring the rightful owner retains their ownership rights. This bond, tailored specifically for Tarrant County residents, offers reassurance to both stockholders and companies by promising financial protection against fraudulent claims. In the event of a lost, destroyed, or stolen stock certificate, the bondholder can file a claim for replacement, ensuring their rightful place as an owner is secured. Different variations of the Tarrant Texas Indemnity Bond may include: 1. Lost Stock Certificate Indemnity Bond: This type of bond covers situations where the stock certificate is misplaced or accidentally lost due to negligence or other circumstances. The bondholder can file a claim with the bond issuer to obtain a replacement certificate. 2. Destroyed Stock Certificate Indemnity Bond: In cases where the stock certificate is destroyed, whether due to fire, natural disasters, or any other unforeseen event, this bond ensures the owner's investment is protected. The bond issuer will cover the costs of replacing the destroyed certificate. 3. Stolen Stock Certificate Indemnity Bond: If the stock certificate is stolen, this bond provides financial security to the rightful owner. By filing a claim with the bond issuer, the owner can obtain a replacement certificate, preventing any unauthorized transfers or ownership changes. Having a Tarrant Texas Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate is essential for any investor or shareholder residing in Tarrant County. It safeguards their ownership rights, prevents potential financial losses, and offers peace of mind knowing that their investment is secure.

Tarrant Texas Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate

Description

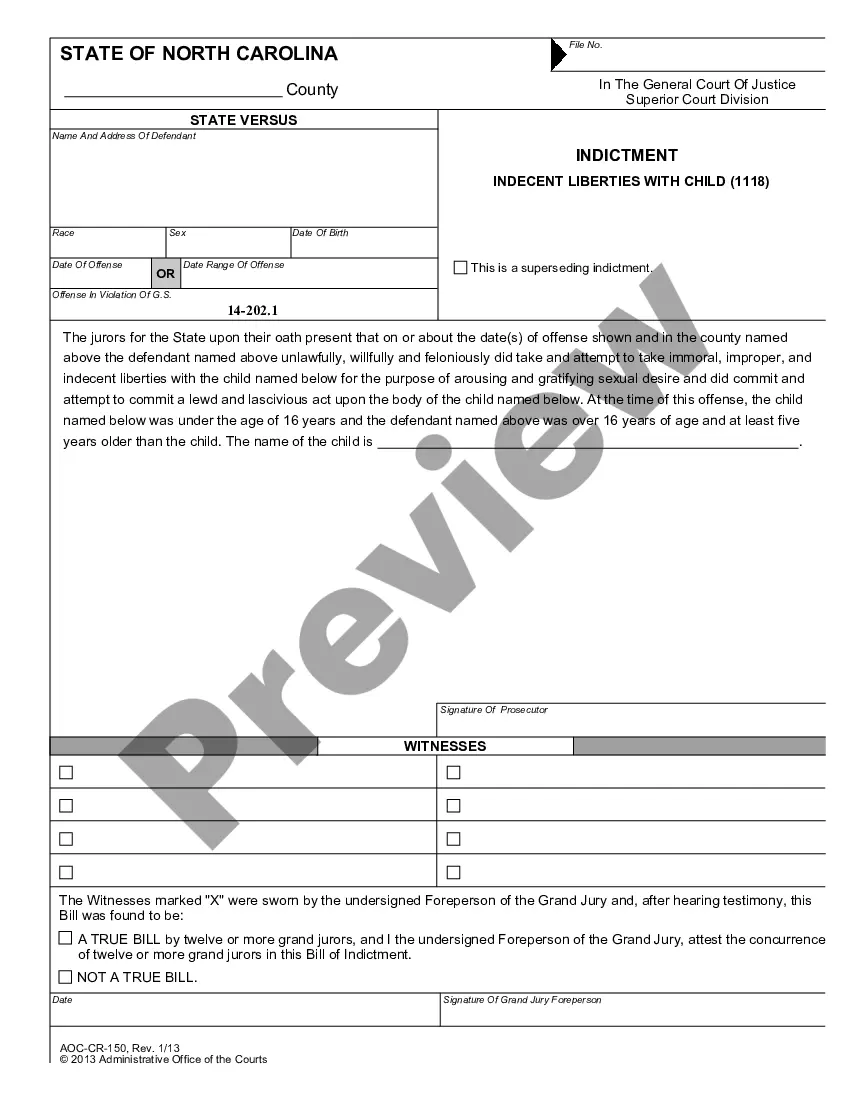

How to fill out Tarrant Texas Indemnity Bond To Replace Lost, Destroyed, Or Stolen Stock Certificate?

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Tarrant Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Tarrant Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate. Follow the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

Surety is a form of guarantee issued by a third party to pay the direct loss suffered by one party in a contract if the other party in that contract breaches their contractual or legal obligations. The organization or person assuming this role as the third party can also be referred to as a surety.

A Lost Stock Certificate Surety Bond is required by the issuing company of the stock, through its transfer agent. The purpose of the bond is to protect the corporation and the agent in case the lost certificate is somehow redeemed by another party at a later date.

If an investor does not have or loses their stock certificate, they are still the owner of their shares and entitled to all the rights that come with them. If an investor wants a stock certificate, or if it is lost, stolen, or damaged, they can receive a new one by contacting a company's transfer agent.

A Lost Stock Certificate Surety Bond is an indemnity bond required by the issuer of the certificate and the SEC when a stock certificate has been lost or stolen. The bond is a safety net for the transfer agent in that if the lost certificate is found and sold, the transfer agent doesn't suffer any economic loss.

An indemnity bond is a type of insurance policy. It ensures that younot the bankwill be liable for any losses if the lost check is found and presented for payment. Otherwise, the bank could be liable for both checks.

If your securities certificate is lost, accidentally destroyed, or stolen, you should immediately contact the transfer agent and request a stop transfer to prevent ownership of the securities from being transferred from your name to another's. Your broker may be able to assist you with this process.

If your securities certificate is lost, accidentally destroyed, or stolen, you should immediately contact the transfer agent and request a stop transfer to prevent ownership of the securities from being transferred from your name to another's. Your broker may be able to assist you with this process.