Salt Lake Utah Notice of Redemption of Preferred Stock is a legal document that outlines the redemption process for preferred stock held by shareholders in Salt Lake, Utah. This notice serves as a formal communication from the issuing company to its investors to inform them of the redemption of their preferred stock investment. Preferred stock is a type of stock that gives shareholders certain preferences over common stockholders, such as a fixed dividend payment and priority in receiving company assets during liquidation. However, unlike common stock, preferred stockholders generally do not have voting rights in the company. The Salt Lake Utah Notice of Redemption of Preferred Stock specifies the terms and conditions under which the redemption will take place. It provides essential details such as the redemption date, the redemption price, any applicable redemption premium or penalty, and instructions for shareholders to follow in order to receive their redemption proceeds. There can be different types of Salt Lake Utah Notice of Redemption of Preferred Stock, categorized based on the reasons behind the redemption. These may include: 1. Voluntary Redemption: This type of redemption occurs when the issuing company decides to redeem the preferred stock voluntarily. The company may do so to decrease its long-term debt, restructure its capital, or eliminate the obligation of paying dividends on the preferred stock. 2. Mandatory Redemption: In some instances, preferred stock may have a predetermined mandatory redemption date or event. This means that the company is obligated to redeem the shares at a specified time or upon the occurrence of a predetermined event, such as the sale of a subsidiary or a certain level of profitability. 3. Call Redemption: Call redemption allows the company to redeem its preferred stock before its maturity date at a fixed price specified in the original issuance agreement. This type of redemption is usually triggered by the company's desire to take advantage of lower interest rates or to restructure its capital. 4. Opposite of Call Redemption: This type of redemption is initiated by the preferred stockholders themselves if they have the option to put their shares back to the company at a predetermined price or upon the occurrence of certain events. Holders exercise this right when they believe it is more beneficial for them to receive back their investment. 5. Partial Redemption: In certain cases, the company may choose to redeem only a portion of its outstanding preferred stock. This type of redemption allows the company to maintain a portion of the preferred stock outstanding while addressing specific financial needs or fulfilling obligations to shareholders. It is crucial for the issuing company to provide a Salt Lake Utah Notice of Redemption of Preferred Stock that complies with the legal requirements and terms outlined in the original issuance agreement and relevant securities regulations. By doing so, the company ensures transparency and fair treatment for its preferred stockholders throughout the redemption process.

Salt Lake Utah Notice of Redemption of Preferred Stock

Description

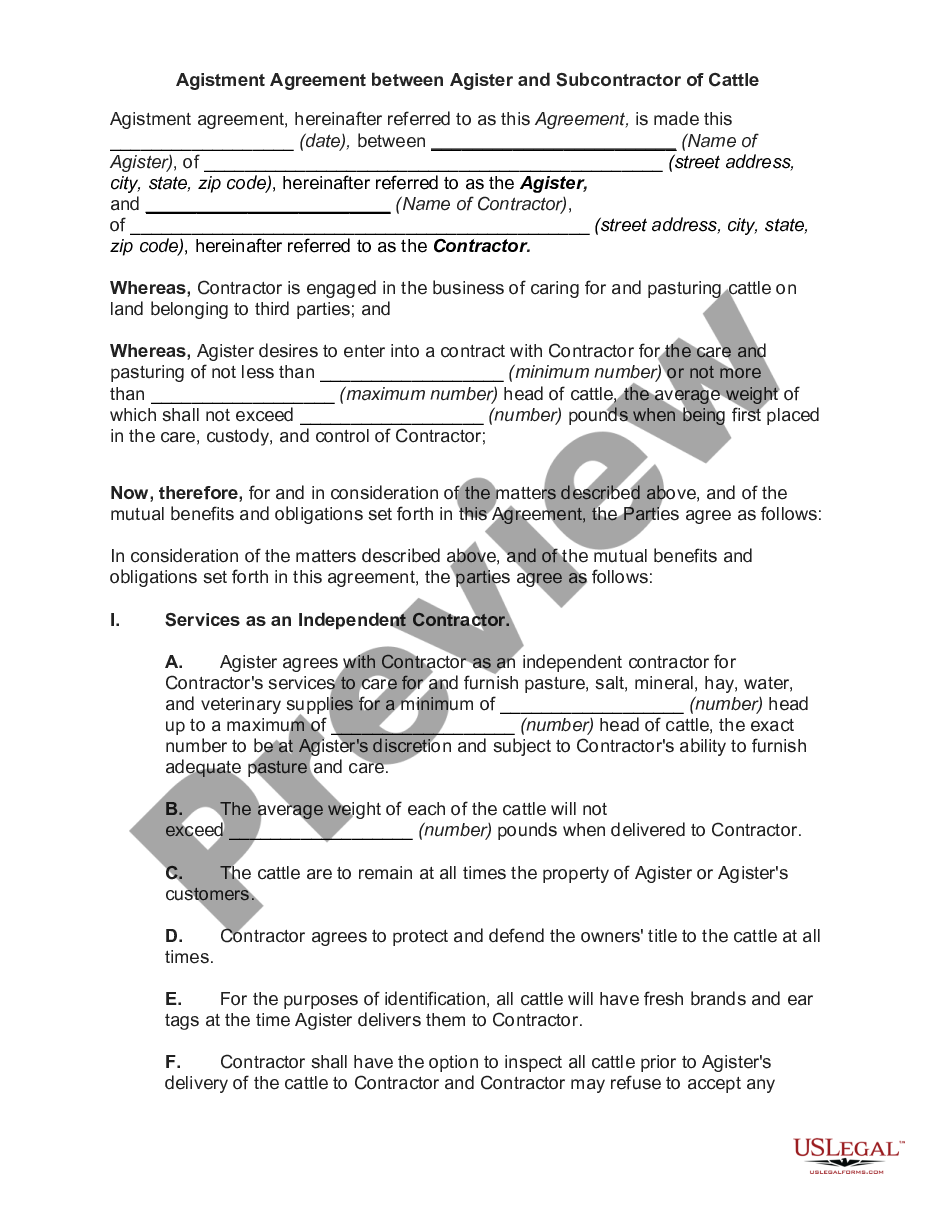

How to fill out Salt Lake Utah Notice Of Redemption Of Preferred Stock?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Salt Lake Notice of Redemption of Preferred Stock is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the Salt Lake Notice of Redemption of Preferred Stock. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Salt Lake Notice of Redemption of Preferred Stock in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!