The Clark Nevada Statement of Reduction of Capital of a Corporation is a legal document that outlines the authorized reduction of a corporation's capital. This statement is required to be filed with the Clark County, Nevada Secretary of State's office when a corporation intends to reduce its previously authorized capital. A reduction of capital can occur for various reasons, such as to adjust the company's financial structure, redistribute surplus funds among shareholders, or address financial distress. In Clark County, Nevada, several types of Clark Nevada Statements of Reduction of Capital of a Corporation can be identified, including: 1. Voluntary Reduction of Capital: This type of reduction is initiated by the corporation's management or board of directors, with the purpose of adjusting the capital structure to better align with the company's current needs or objectives. The reduction can involve a decrease in the par value of shares or a decrease in the number of shares outstanding. 2. Court-Ordered Reduction of Capital: In certain cases, a court may order a corporation to reduce its capital as part of a resolution to address financial problems or to comply with specific legal requirements. This can occur when a corporation is undergoing a financial reorganization or facing insolvency. 3. Special Purpose Reduction of Capital: This type of reduction is undertaken for a specific purpose, such as facilitating a stock buyback program, a merger or acquisition, or a change in the company's ownership structure. These reductions are usually conducted to streamline operations or optimize shareholder value. The Clark Nevada Statement of Reduction of Capital of a Corporation typically includes specific details related to the reduction, such as the total authorized capital before and after the reduction, the type of reduction being pursued, the reason for the reduction, the shareholders' rights and entitlements, and any other relevant information required by the Nevada Secretary of State. It is crucial for corporations to ensure compliance with relevant laws and regulations while preparing and filing the Clark Nevada Statement of Reduction of Capital. Working with experienced legal professionals or corporate attorneys is highly recommended navigating the complexities and avoid potential pitfalls that may arise during the process.

Clark Nevada Statement of Reduction of Capital of a Corporation

Description

How to fill out Clark Nevada Statement Of Reduction Of Capital Of A Corporation?

Drafting documents for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Clark Statement of Reduction of Capital of a Corporation without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Clark Statement of Reduction of Capital of a Corporation on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Clark Statement of Reduction of Capital of a Corporation:

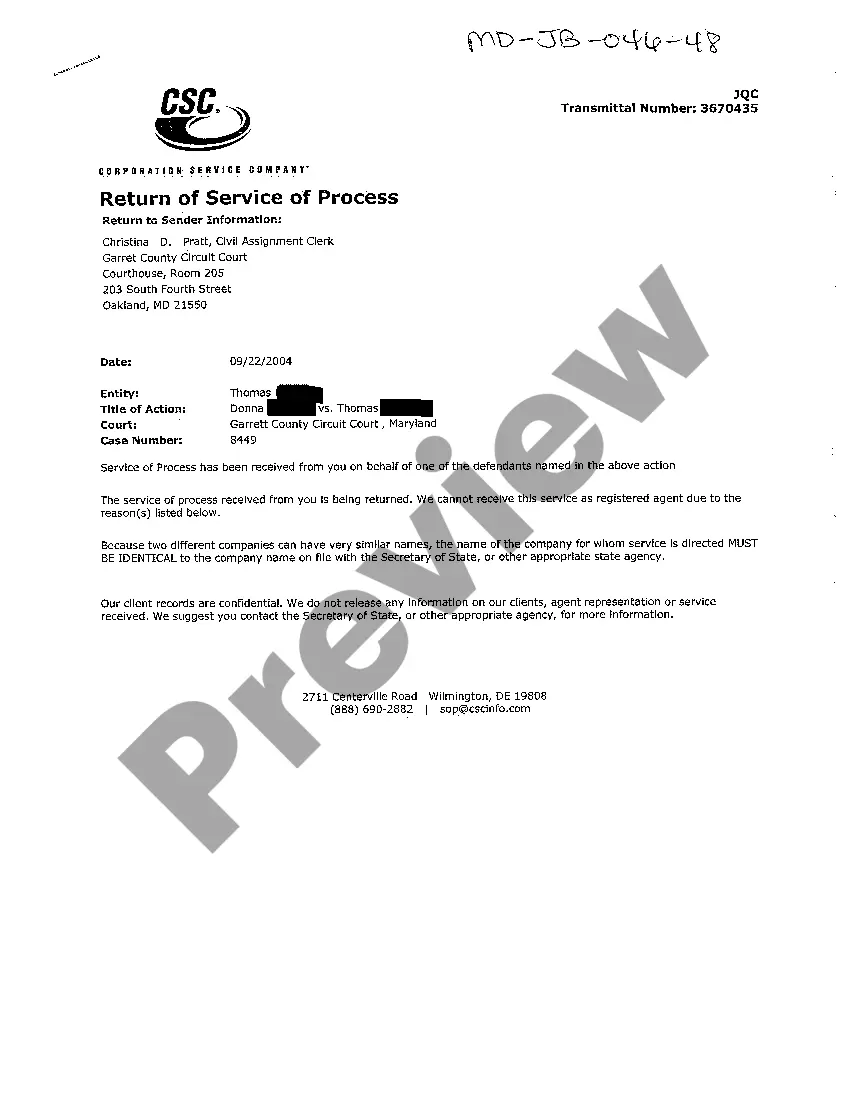

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!