A Statement of Reduction of Capital of a Corporation is a legal document that outlines the process and purpose of decreasing a corporation's capital. Collin Texas, being a county in the state of Texas, adheres to the laws and regulations set forth by the Texas Secretary of State and the Texas Business Organizations Code (BOC) when it comes to the procedure for reducing a corporation's capital. In Collin Texas, a corporation may consider reducing its capital for various reasons, including financial restructuring, return of surplus capital to shareholders, or resolving excess liquidity issues. The specific types of Statements of Reduction of Capital of a Corporation in Collin Texas may include: 1. Voluntary Reduction of Capital: This type of statement is filed with the proper authorities when a corporation chooses to decrease its capital voluntarily. It involves a thorough evaluation of the corporation's financial position, potential impact on shareholders, and compliance with legal requirements. 2. Court-Ordered Reduction of Capital: In some cases, a court may order a reduction of a corporation's capital as part of a legal proceeding or to resolve a financial dispute. This type of statement requires the corporation to provide detailed reasoning and evidence supporting the need for such reduction, as well as obtain court approval. 3. Prohibited Reduction of Capital: If a corporation attempts to reduce its capital without complying with the necessary legal procedures and requirements, it may be considered a prohibited reduction. This can have severe consequences, including legal penalties and potential liabilities for directors and officers. When preparing a Collin Texas Statement of Reduction of Capital of a Corporation, it is essential to include relevant keywords or phrases such as "corporation," "reduction of capital," "Texas Secretary of State," "Texas Business Organizations Code," "Collin County," and "legal requirements." Additionally, it is crucial to provide detailed information regarding the type of reduction, the rationale behind it, and any supporting financial or legal documentation to ensure compliance with the laws and regulations of Collin Texas.

Collin Texas Statement of Reduction of Capital of a Corporation

Description

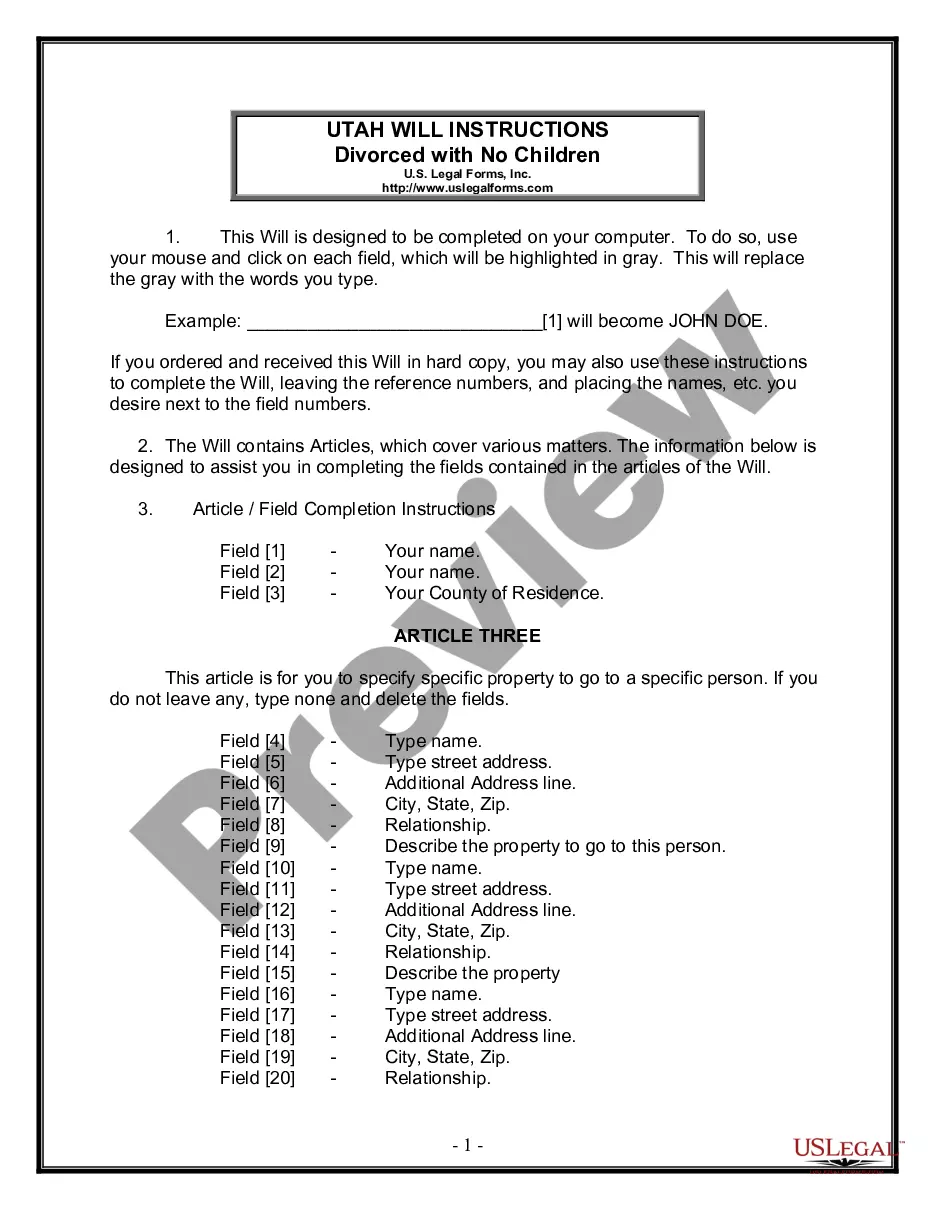

How to fill out Collin Texas Statement Of Reduction Of Capital Of A Corporation?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Collin Statement of Reduction of Capital of a Corporation suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Aside from the Collin Statement of Reduction of Capital of a Corporation, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Collin Statement of Reduction of Capital of a Corporation:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Collin Statement of Reduction of Capital of a Corporation.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!