Travis Texas Statement of Reduction of Capital of a Corporation

Description

How to fill out Statement Of Reduction Of Capital Of A Corporation?

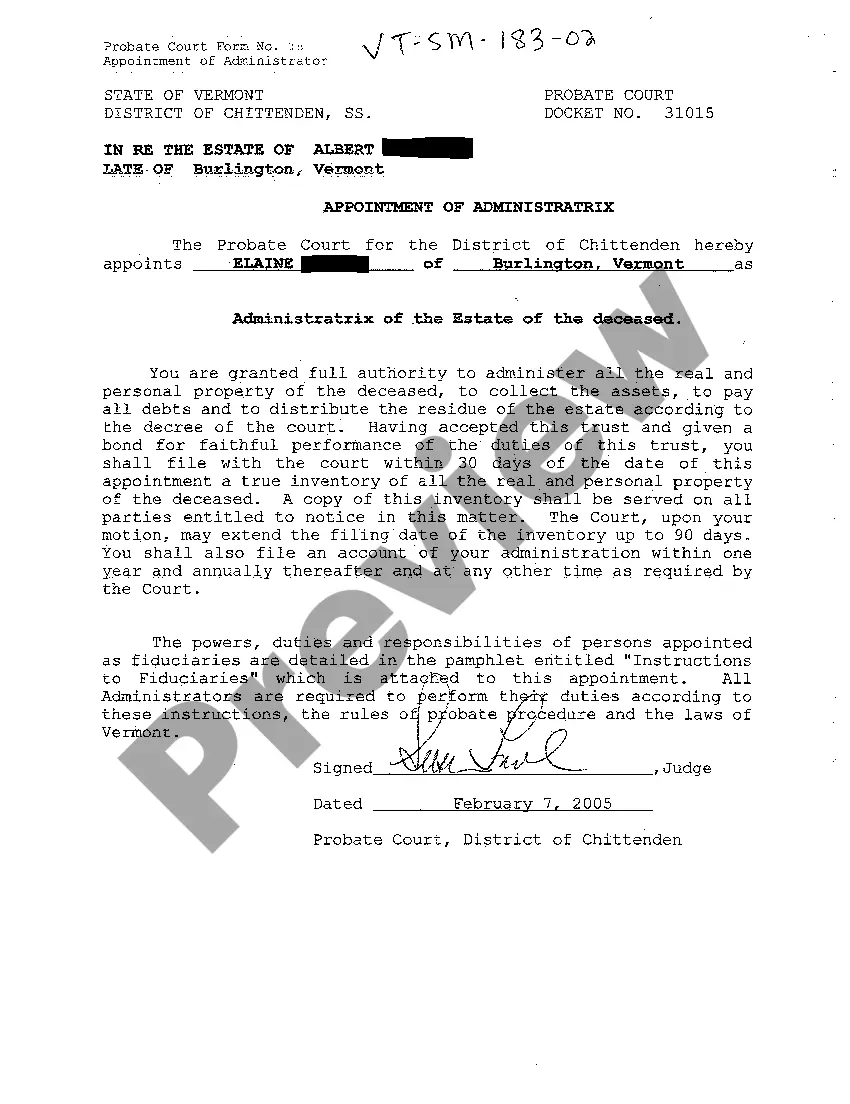

Do you require to rapidly create a legally enforceable Travis Statement of Reduction of Capital of a Corporation or perhaps any other document to manage your personal or business matters.

You can opt for one of two choices: engage an expert to prepare a legal document for you or undertake it entirely by yourself. Fortunately, there’s an alternative option - US Legal Forms. It will assist you in obtaining professionally crafted legal documents without incurring exorbitant fees for legal services.

If the document isn’t what you were looking for, restart your search by using the search bar at the top.

Select the plan that best aligns with your requirements and proceed to make the payment. Choose the file format you prefer to receive your document in and download it. Print it, fill it out, and sign where indicated. If you already have an account, you can simply Log In, find the Travis Statement of Reduction of Capital of a Corporation template, and download it. To re-download the form, just navigate to the My documents section. It's effortless to obtain and download legal forms using our catalog. Additionally, the templates we offer are refreshed by industry professionals, which enhances your assurance when handling legal matters. Experience US Legal Forms today and witness the difference!

- US Legal Forms boasts an extensive collection of over 85,000 state-specific document templates, including the Travis Statement of Reduction of Capital of a Corporation and various form packages.

- We offer documents for a myriad of life situations: from separation papers to property-related documents.

- We have been in the business for over 25 years and have built an impeccable reputation among our customers.

- Here’s how you can join them and acquire the necessary document without unnecessary complications.

- First and foremost, thoroughly confirm if the Travis Statement of Reduction of Capital of a Corporation is aligned with your state’s or county’s laws.

- If the document contains a description, make sure to understand its purpose.

Form popularity

FAQ

A company may generally reduce its share capital in any way. In particular, a company may do so by cancelling or reducing the liability on partly paid shares, repaying any paid-up share capital in excess of the company's wants, or cancelling any paid-up share capital that is lost or unrepresented by available assets.

A decrease in the owner's equity can occur when a company loses money during the normal course of business and owners need to move equity into normal business operations. It also decreases when an owner withdraws money for personal use.

The Capital Reduction Account is a temporary account opened in order to carry out the internal reconstruction. When the scheme is carried out, the account is closed. The Capital Reduction Account represents the sacrifice made by the Shareholders, Debenture-holders, Creditors etc.

Capital reduction is the process of decreasing a company's shareholder equity through share cancellations and share repurchases, also known as share buybacks. The reduction of capital is done by companies for numerous reasons, including increasing shareholder value and producing a more efficient capital structure.

Capital reduction is the process of decreasing a company's shareholder equity through share cancellations and share repurchases, also known as share buybacks. The reduction of capital is done by companies for numerous reasons, including increasing shareholder value and producing a more efficient capital structure.

Paid-up share capital for the purpose of capital reduction would include securities premium and capital redemption reserve. Unless a special resolution, as authorised by the articles, is passed for reduction of share capital, a company cannot effect share capital reduction.

Introduction extinguish or reduce the liability on any of its shares in respect of the share capital not paid-up or. either with or without extinguishing or reducing liability on any of its shares. cancel any paid-up share capital which is lost or is unrepresented by available assets or.

The entry is: Where any paid up share capital is being reduced the liability on the shares, for instance, a share of Rs. 10 on which Rs. 6 has been paid up is being reduced to fully paid share of Rs. 10, Rs.

A reduction of capital can be achieved in one of two ways by following a statutory process under The Companies Act 2006 - either through a court process or by using a solvency statement.

If the amount of paid up capital including share premium is reduced then the share capital will be debited with the amount of the reduction. If the reduction was effected by a repayment then the credit will go to cash, otherwise a reserve account will be created which is treated as a realised profit.