Cuyahoga, Ohio Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation: An Overview In Cuyahoga, Ohio, a Shareholders' Agreement is a legally binding contract that serves as a foundation for the operation of a close corporation. This agreement outlines the rights, obligations, and responsibilities of shareholders, and it often includes provisions governing the distribution of dividends among shareholders. In some cases, there may be different types or variations of Cuyahoga, Ohio Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation. Let's delve into the details of this agreement and explore potential variations. Background of a Close Corporation: A close corporation refers to a type of business entity that operates similarly to a regular corporation but with a smaller number of shareholders. Such entities often have a limited number of shareholders who actively participate in the management and decision-making processes. In many close corporations, the allocation of dividends is a significant concern for shareholders. Understanding the Shareholders' Agreement: A Shareholders' Agreement is an essential contractual document that establishes the governance framework for a close corporation. It is typically tailored to the specific needs of the shareholders and provides guidelines on various aspects of corporate operations, including profit distribution among shareholders. This agreement helps maintain transparency, protect shareholder interests, and avoid disputes by clearly defining the rules governing dividend allocation. Special Allocation of Dividends: The "Special Allocation of Dividends" clause in the Cuyahoga, Ohio Shareholders' Agreement allows shareholders to agree on a specific method for distributing dividends. This provision acknowledges that shareholders may have different ownership percentages, investment levels, or roles within the corporation. By employing a special allocation methodology, shareholders can customize dividend distribution to reflect these variations. Types of Cuyahoga, Ohio Shareholders' Agreement with Special Allocation of Dividends: 1. Proportionate Ownership-Based Allocation: One type of Special Allocation of Dividends in Cuyahoga, Ohio Shareholders' Agreement is a proportionate ownership-based allocation. This approach distributes dividends based on the shareholders' proportional ownership in the close corporation. Shareholders receive dividends relative to their respective ownership stakes, ensuring a fair distribution according to their investment contributions. 2. Role-Based Allocation: In some close corporations, shareholders may play diverse roles, such as executives, directors, or actively involved employees. This type of Cuyahoga, Ohio Shareholders' Agreement may incorporate a role-based allocation of dividends. Here, shareholders receive dividends based on the significance of their roles within the corporation, which recognizes their contributions beyond mere ownership. 3. Preference-Based Allocation: Certain shareholders may have unique rights or preferences defined in the Shareholders' Agreement. This type of Cuyahoga, Ohio Shareholders' Agreement allows for a preference-based allocation of dividends. Shareholders with specific preferences outlined in the agreement receive dividends prioritized over others, ensuring their unique rights and entitlements are respected. 4. Combination of Allocation Methods: Depending on the circumstances and the specific needs of the close corporation, shareholders may agree to a combination of allocation methods. Such an agreement could incorporate elements of proportionate ownership, role-based, and preference-based allocations. By combining multiple allocation methods, shareholders can create a more nuanced approach to dividend distribution that aligns with their particular circumstances. Conclusion: The Cuyahoga, Ohio Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a comprehensive legal document that outlines how dividends will be distributed among shareholders. By selecting the appropriate type or combination of allocation methods, shareholders can ensure a fair and satisfactory distribution of profits based on their ownership, roles, and preferences within the corporation.

Cuyahoga Ohio Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Cuyahoga Ohio Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your county, including the Cuyahoga Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Cuyahoga Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Cuyahoga Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation:

- Make sure you have opened the right page with your local form.

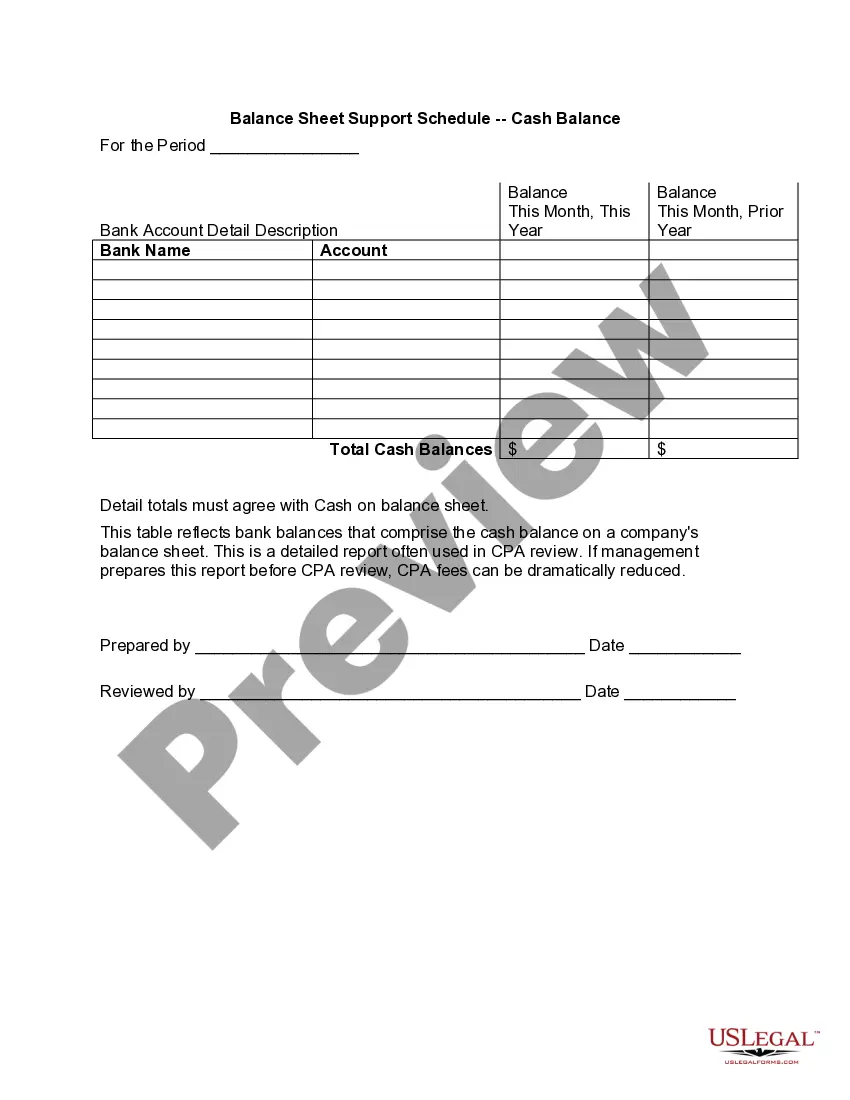

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Cuyahoga Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!