A Mecklenburg North Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legally binding document that outlines the specific terms and conditions regarding the allocation of dividends among shareholders in a close corporation based in Mecklenburg County, North Carolina. This agreement is designed to ensure fair and equitable distribution of profits while addressing the unique needs and circumstances of the close corporation. Key terms and provisions commonly covered in Mecklenburg North Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation include: 1. Dividend Allocation: The agreement clearly defines how dividends will be allocated among shareholders. It may establish fixed percentages or ratios based on each shareholder's ownership stake in the corporation or outline a different mechanism for the distribution of profits. 2. Special Allocation: This provision accounts for specific circumstances where shareholders may have different preferences or requirements for dividend distribution. For example, one shareholder may need to receive a higher portion of profits to cover personal expenses or repay an investment loan. 3. Voting Rights: The agreement may outline voting rights pertaining to dividend allocation, allowing shareholders to make decisions collectively or granting specific shareholders the authority to determine the dividend allocation without requiring majority approval. 4. Minority Protection: This provision safeguards the interests of minority shareholders in the event of major decisions, such as dividend allocation, that could potentially disadvantage them. It may include provisions for veto rights or the requirement for unanimous consent. 5. Termination: The agreement may specify the conditions under which the shareholders' agreement with special allocation of dividends can be terminated, such as a specified notice period or the occurrence of certain events, like the sale or transfer of shares. Types of Mecklenburg North Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation can vary based on the preferences and unique circumstances of the shareholders. Some potential variations may include: 1. Fixed Percentage Allocation: This type of agreement may establish a fixed percentage or ratio for dividend allocation based on each shareholder's ownership percentage in the close corporation. 2. Profit-Based Allocation: This agreement may distribute dividends proportionally to the profitability of each shareholder's invested capital. Shareholders with larger investments may receive a higher share of profits. 3. Special Rights Allocation: In some cases, specific shareholders may be granted preferential dividend allocation rights due to their significant contributions, specific roles within the corporation, or other predetermined criteria. 4. Time-Based Allocation: This type of agreement may allocate dividends based on the time period during which each shareholder has been invested in the close corporation. Shareholders with longer tenures may receive a higher share of profits. It is crucial for shareholders in a Mecklenburg North Carolina close corporation to draft and execute a Shareholders' Agreement with Special Allocation of Dividends to legally enforce their rights, protect their interests, and ensure a fair distribution of profits in accordance with their specific needs and preferences. Consulting with an experienced attorney knowledgeable in corporate law is advisable to ensure the agreement accurately reflects the shareholders' intentions and complies with applicable state laws.

Mecklenburg North Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

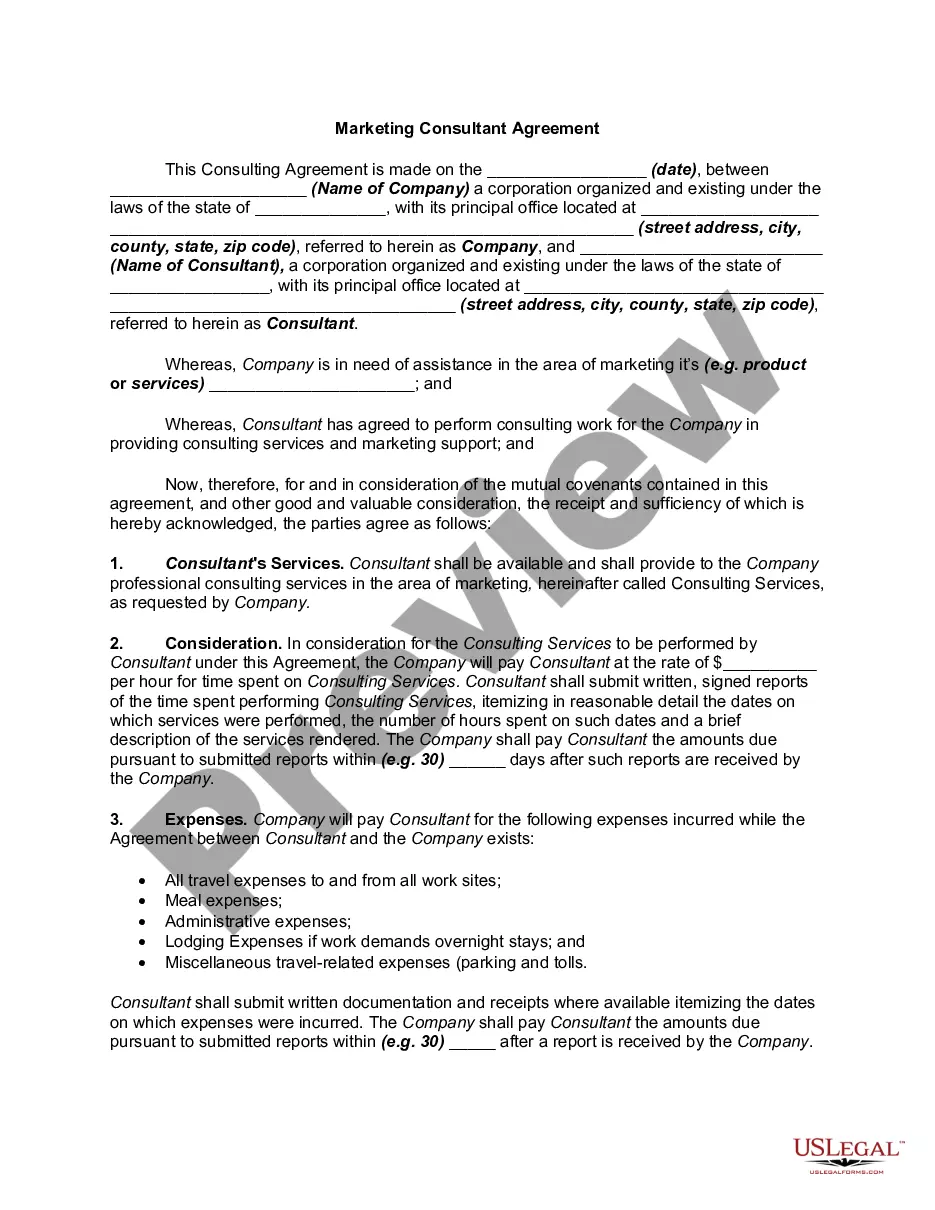

How to fill out Mecklenburg North Carolina Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Mecklenburg Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the current version of the Mecklenburg Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Mecklenburg Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Mecklenburg Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!