A Phoenix Arizona Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legally binding document that outlines the terms and conditions governing the distribution of dividends among shareholders in a close corporation based in Phoenix, Arizona. This agreement ensures fairness and transparency in the allocation of profits, taking into account the specific needs and contributions of each shareholder. One type of Phoenix Arizona Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is the Fixed Allocation Agreement. Under this agreement, a predetermined percentage or amount is allocated to each shareholder, regardless of their level of investment, ownership percentage, or involvement in the corporation's operations. This type of agreement is often ideal for ensuring stability and predictability in dividend distribution. Another type of Phoenix Arizona Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is the Dynamic Allocation Agreement. This agreement allows for more flexibility in dividend allocation, taking into consideration variables such as the level of investment, ownership percentage, or active involvement in the corporation's operations. The allocation may vary from year to year, depending on the company's financial performance and the respective contributions of each shareholder. The Shareholders' Agreement with Special Allocation of Dividends also addresses other important issues, such as decision-making authority, dispute resolution mechanisms, restrictions on share transfers, and governance structure within the close corporation. Additionally, it defines the roles and responsibilities of shareholders, protecting the interests of all parties involved. Key provisions within Phoenix Arizona Shareholders' Agreement with Special Allocation of Dividends may include: 1. Dividend Allocation Method: Clearly stating the chosen method (fixed or dynamic) for allocating dividends, ensuring transparency and fairness. 2. Calculation and Distribution of Profits: Outlining how profits will be calculated and when they will be distributed among shareholders. 3. Modification of Allocation: Establishing the process for modifying the dividend allocation method, providing flexibility to adapt to changing circumstances. 4. Breach and Enforcement: Defining the consequences of breaching the agreement and outlining mechanisms for dispute resolution, such as mediation or arbitration. 5. Share Transfer Restrictions: Setting restrictions on the transferability of shares to protect the corporation's stability and prevent unwanted shareholders from entering the company. Overall, a Phoenix Arizona Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation plays a crucial role in maintaining harmonious relationships among shareholders while ensuring a fair and equitable distribution of profits. It provides a clear framework for dividend allocation, protecting the rights and interests of all shareholders and promoting the successful operation of the corporation.

Phoenix Arizona Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

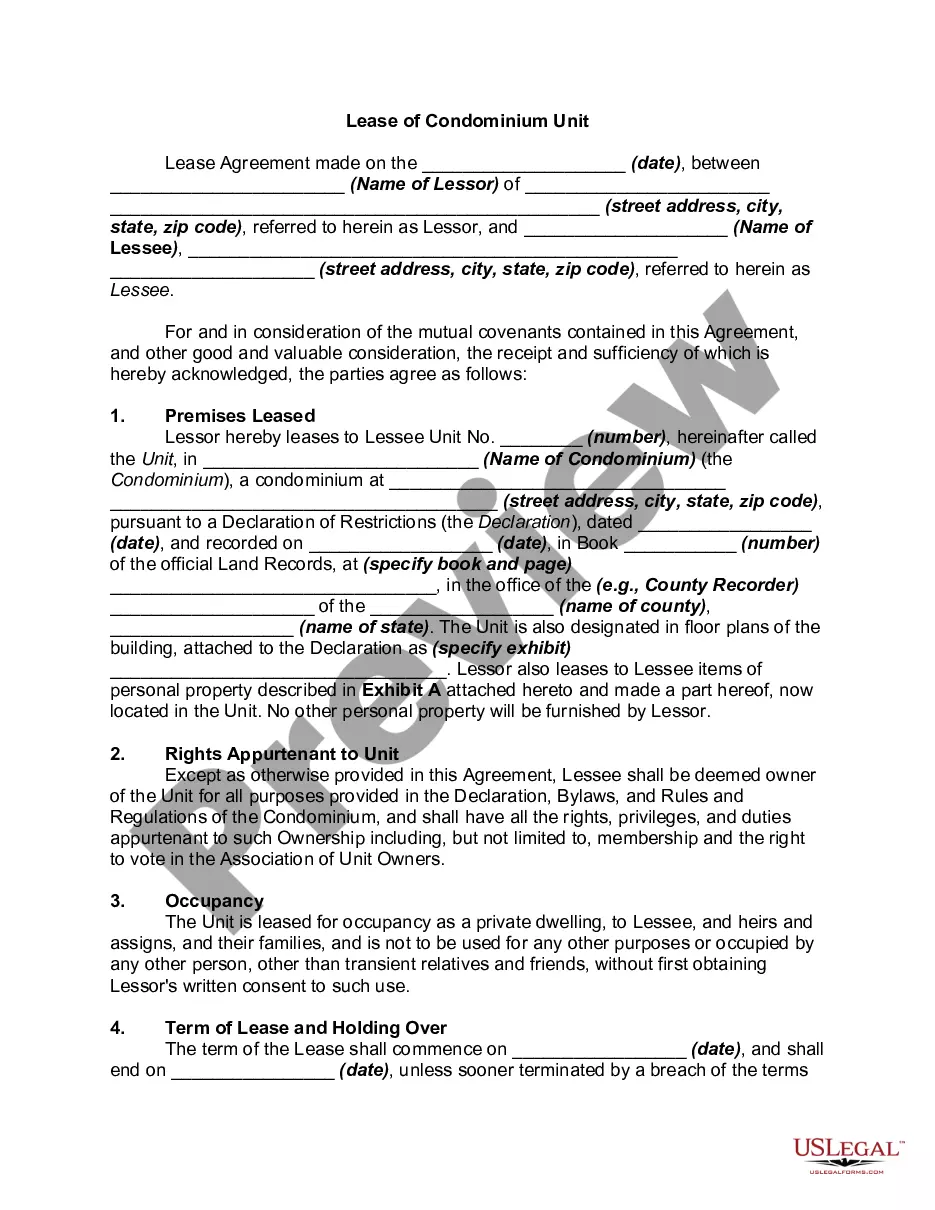

How to fill out Phoenix Arizona Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

If you need to find a trustworthy legal form provider to find the Phoenix Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of learning resources, and dedicated support make it easy to locate and complete different documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse Phoenix Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, either by a keyword or by the state/county the form is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Phoenix Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes this experience less expensive and more reasonably priced. Create your first company, organize your advance care planning, create a real estate contract, or execute the Phoenix Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation - all from the comfort of your home.

Sign up for US Legal Forms now!