San Antonio, Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation A shareholders' agreement is a legal document that outlines the rights, responsibilities, and obligations of the shareholders in a corporation. In the case of a close corporation, which refers to a corporation with a limited number of shareholders, a San Antonio, Texas shareholders' agreement becomes crucial in maintaining a smooth and harmonious business operation. This agreement may include provisions for the special allocation of dividends among shareholders, ensuring equitable distribution of profits based on certain predetermined factors. One of the types of San Antonio, Texas shareholders' agreements with special allocation of dividends is the Equal Share Agreement. Under this arrangement, shareholders in a close corporation agree to distribute dividends equally among themselves, regardless of their individual investments or contributions to the company. This approach promotes fairness and eliminates potential conflicts that may arise due to differing levels of ownership stakes. Another type of San Antonio, Texas shareholders' agreement is the Proportional Share Agreement. Unlike the Equal Share Agreement, this arrangement allocates dividends based on each shareholder's proportionate ownership percentage in the corporation. This means that shareholders receive dividends in direct proportion to their respective investment or ownership stake in the company. By adhering to this approach, the agreement ensures that shareholders' financial rewards reflect their level of involvement and investment in the business. A Hybrid Share Agreement is another variant of the San Antonio, Texas shareholders' agreement with special allocation of dividends. This agreement combines elements of both Equal Share and Proportional Share arrangements, providing flexibility to shareholders in determining the distribution of dividends. For instance, the agreement may stipulate a certain fixed percentage of dividends to be equally distributed among all shareholders, while the remaining portion is allocated based on their respective ownership percentages. This hybrid approach attempts to strike a balance between equitable distribution and recognizing individual investment levels. Moreover, a San Antonio, Texas shareholders' agreement with special allocation of dividends may also include provisions for differentiated dividend treatments based on the shareholders' involvement in corporate operations. Such an agreement might include categories such as Active Investor, Silent Investor, and Key Employee Shareholders. Active Investor Shareholders, for example, who actively participate in the company's day-to-day operations, could be entitled to a greater share of dividends as a reward for their dedicated efforts. On the other hand, Silent Investor Shareholders, who primarily provide capital investment without active involvement, might receive a lower portion of the dividends. Key Employee Shareholders, who are employees with significant responsibilities and decision-making authority, could also be entitled to a special allocation of dividends. In conclusion, a San Antonio, Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a crucial legal document that prevents disputes and ensures a fair distribution of profits. Different types of agreements, such as the Equal Share, Proportional Share, and Hybrid Share Agreements, allow shareholders in close corporations to establish a framework for the allocation of dividends based on various factors like ownership percentages, level of involvement, and individual contributions. These agreements serve to protect the interests of all shareholders and maintain a harmonious business environment.

San Antonio Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

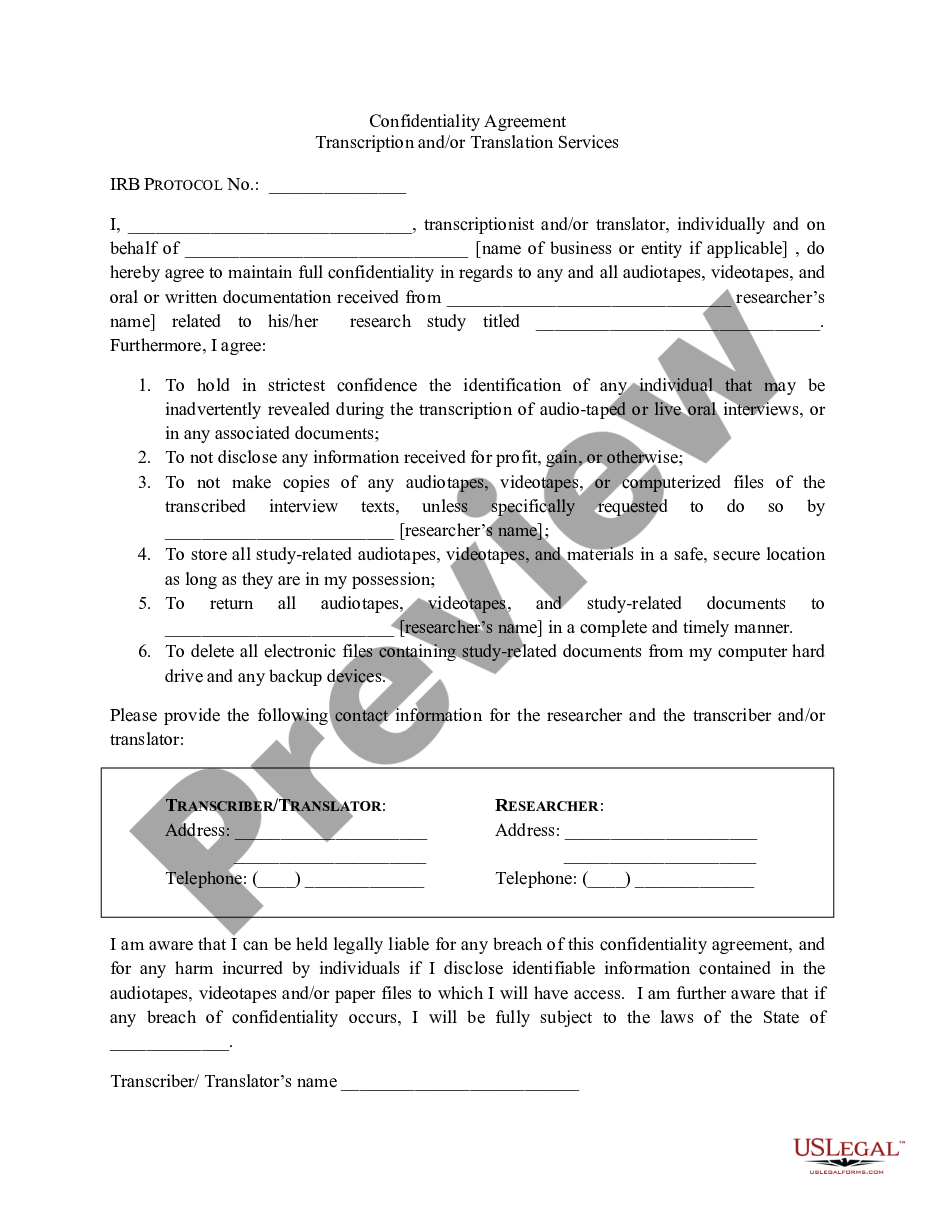

How to fill out San Antonio Texas Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

Draftwing paperwork, like San Antonio Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, to take care of your legal affairs is a difficult and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can take your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents crafted for different cases and life circumstances. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the San Antonio Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading San Antonio Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation:

- Make sure that your form is compliant with your state/county since the rules for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the San Antonio Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our website and download the document.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!