A San Jose California Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legal document that outlines the specific provisions regarding the distribution of dividends among shareholders in a closely held corporation based in San Jose, California. This agreement ensures that dividends are allocated in accordance with the agreed-upon terms and conditions, addressing the unique dynamics and requirements of the close corporation structure. The shareholders' agreement serves to protect the interests of shareholders, promote transparency, and minimize conflicts by clearly defining the rules and guidelines regarding dividend distribution. It aims to prevent any potential disputes and disagreements by outlining the process, frequency, and criteria for allocating dividends among shareholders. There can be various types of San Jose California Shareholders' Agreements with Special Allocation of Dividends among Shareholders in a Close Corporation, depending on the specific circumstances and preferences of the shareholders involved. Here are a few different types that may exist: 1. Equal Distribution Agreement: This type of agreement ensures that dividends are distributed equally among all shareholders in the close corporation, regardless of their shareholdings or any other factors. 2. Proportional Distribution Agreement: In this type of agreement, dividends are allocated based on each shareholder's proportionate share in the close corporation. Shareholders receive dividends in proportion to their ownership percentage. 3. Preferred Shareholders' Agreement: This type of agreement caters to the preferences of preferred shareholders who may have specific rights or preferential treatment when it comes to dividend distribution. Preferred shareholders might be entitled to receiving dividends before common shareholders or at a fixed rate. 4. Performance-Based Allocation Agreement: This agreement type sets criteria for dividend distribution based on the close corporation's performance or specific financial targets. Shareholders may agree to allocate dividends based on financial metrics such as profits, revenue growth, or other performance indicators. 5. Board Discretion Agreement: In this type of agreement, the close corporation's board of directors has the authority to allocate dividends at their discretion. The agreement outlines the board's guidelines and considerations while distributing dividends among shareholders. When drafting a San Jose California Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, it is essential to consult with an experienced attorney who specializes in corporate law to ensure all legal requirements are met, and the agreement suits the specific needs and goals of the shareholders involved.

San Jose California Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out San Jose California Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

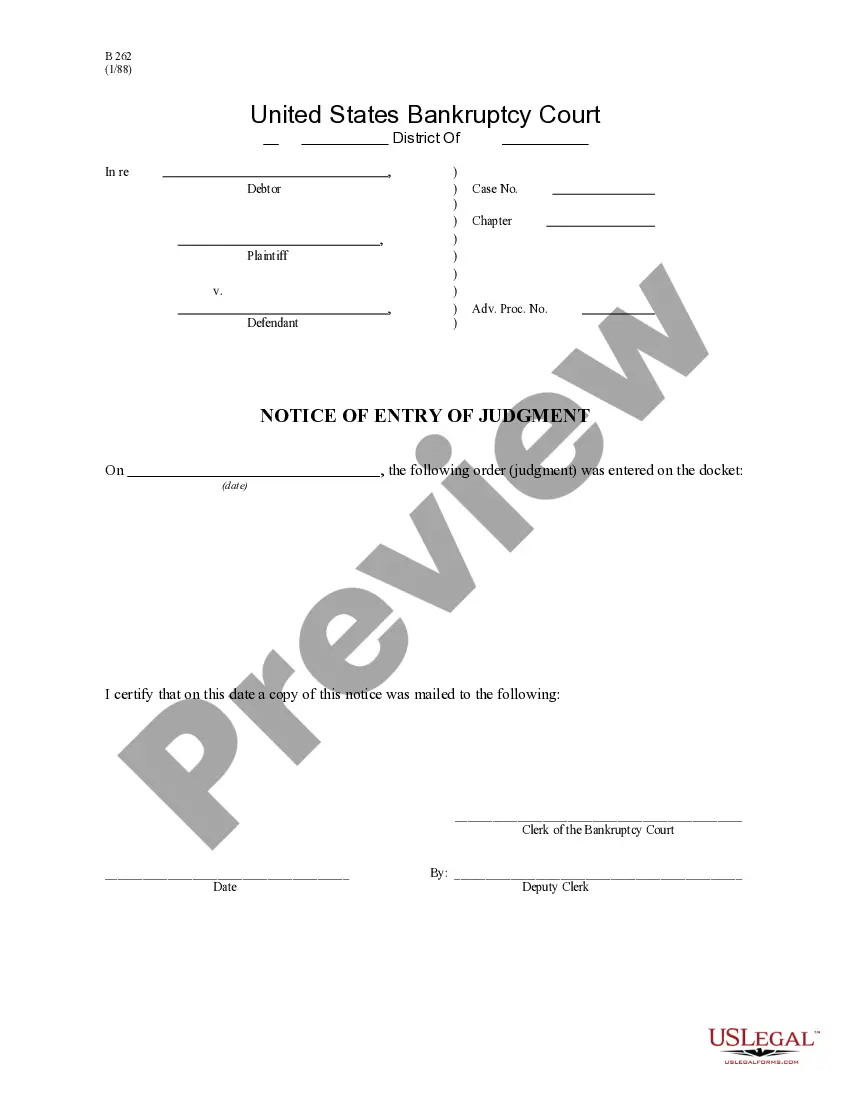

If you need to get a trustworthy legal document provider to obtain the San Jose Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support make it easy to get and complete various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to look for or browse San Jose Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, either by a keyword or by the state/county the form is intended for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the San Jose Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less costly and more affordable. Create your first company, organize your advance care planning, draft a real estate contract, or execute the San Jose Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation - all from the convenience of your sofa.

Sign up for US Legal Forms now!