Suffolk, New York, Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legal document that outlines the specific rules, rights, and responsibilities regarding the distribution of dividends among shareholders in a close corporation based in Suffolk, New York. This agreement provides a comprehensive framework for governing how dividends will be allocated and distributed, ensuring fairness and transparency within the corporation. The main objective of the Suffolk, New York, Shareholders' Agreement with Special Allocation of Dividends is to establish a clear mechanism for distributing profits and dividends among shareholders in a close corporation. By setting guidelines on dividend allocation, this agreement minimizes conflicts and disputes that may arise in the absence of such provisions. This agreement typically defines different types of shareholders and their entitlements to dividend distributions. These distinctions may include: 1. Preferred Shareholders: Preferred shareholders possess specific entitlements to dividends, such as receiving a fixed percentage of the company's profits before they are allocated to other shareholders. This designation often grants preferred shareholders priority over common shareholders in dividend disbursements. 2. Common Shareholders: Common shareholders typically receive dividends after preferred shareholders have been compensated according to the outlined mechanism. The agreement usually defines the ratio or percentage of profits allocated to common shareholders. 3. Special Allocation of Dividends: In some cases, certain shareholders may have unique arrangements or circumstances that warrant special dividend allocation. These provisions can be outlined in the agreement to accommodate specific shareholder needs or incentivize particular actions within the corporation. By including a Special Allocation of Dividends clause, the Shareholders' Agreement allows for flexibility and customization to meet the specific requirements of the close corporation and its shareholders. This provision is particularly valuable when there is a need to differentially reward shareholders based on their contributions, investments, or roles within the corporation. Overall, the Suffolk, New York, Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a crucial legal document that ensures fair and equitable distribution of dividends among different shareholder types. It provides clarity and structure, allowing for smooth operations within the corporation while safeguarding the rights and interests of all stakeholders involved.

Suffolk New York Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Suffolk New York Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a Suffolk Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Suffolk Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Professionals verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Suffolk Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation:

- Examine the content of the page you’re on.

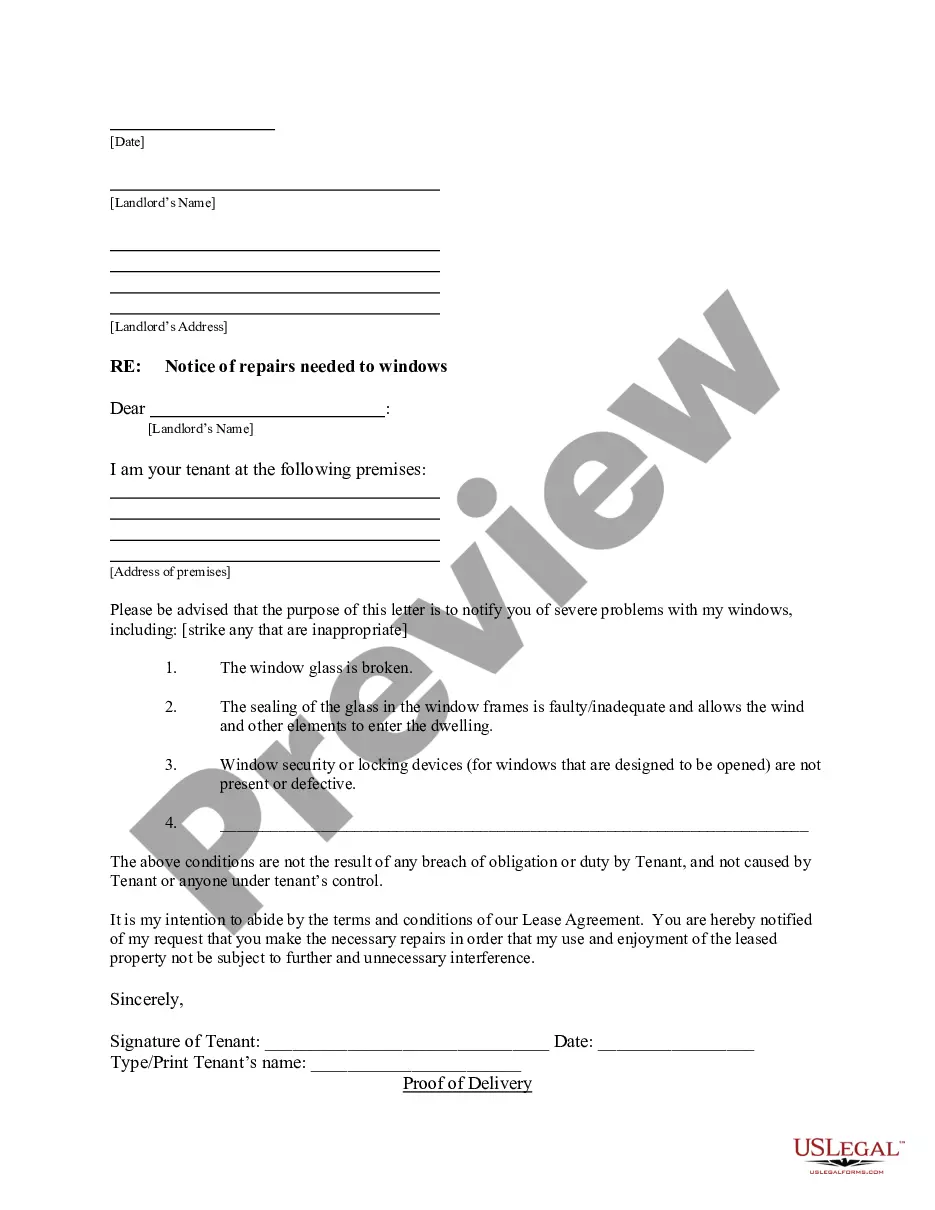

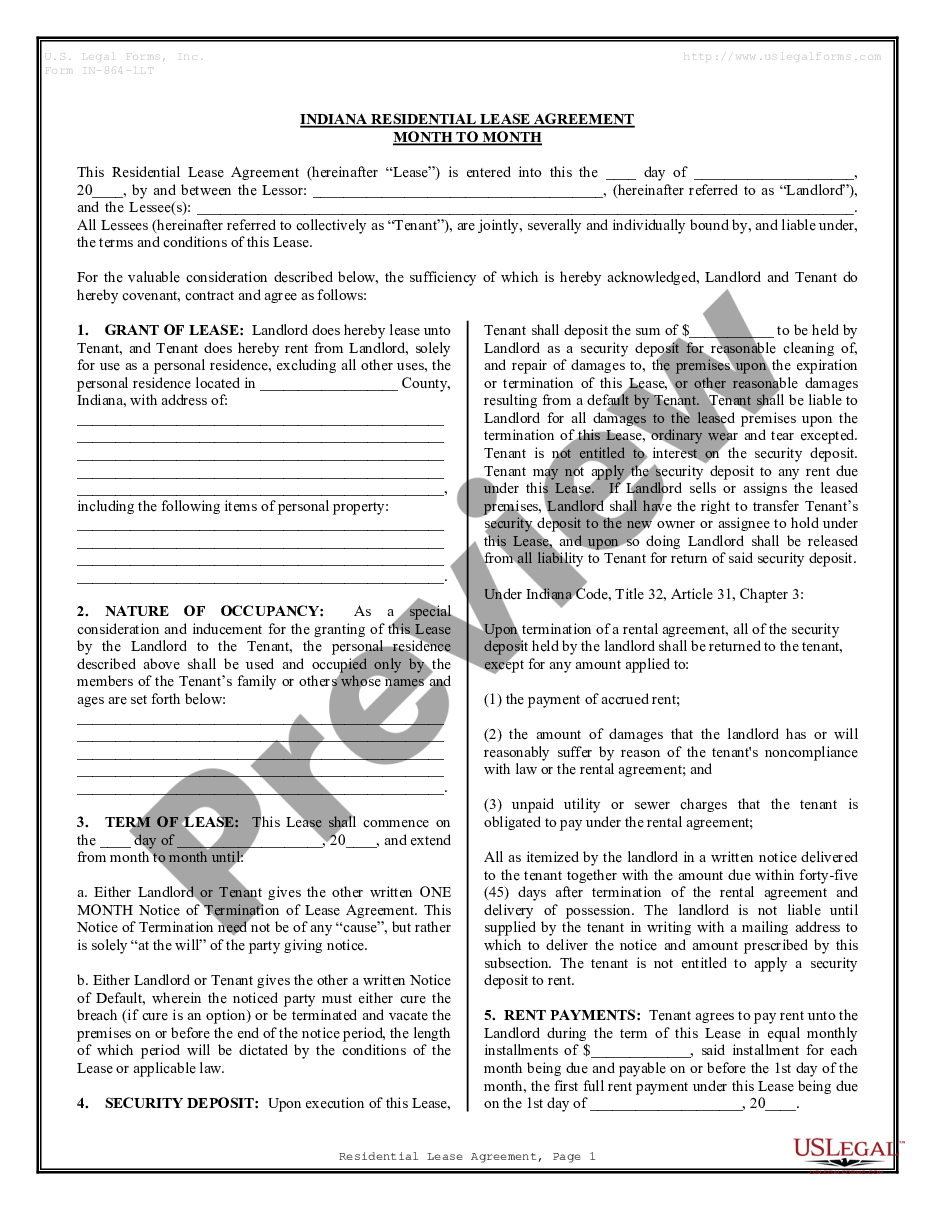

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Suffolk Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!