A Wake North Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legally binding document that outlines the terms and conditions pertaining to the distribution of dividends among shareholders in a close corporation located in Wake County, North Carolina. This agreement governs how dividends are allocated based on a predetermined allocation arrangement agreed upon by the shareholders. The purpose of this agreement is to ensure transparency and fairness in the distribution of profits when a close corporation generates dividends. It aims to provide clear guidelines to shareholders on how they will receive their respective share of dividends based on the agreed special allocation arrangement. There are different types or variations of Wake North Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation that can be created based on the specific needs of the corporation and its shareholders. Some of these variations include: 1. Percentage Allocation: This type of agreement specifies the percentage share of dividends that each shareholder will receive. For example, if there are two shareholders, shareholder A may receive 60% of the dividends, while shareholder B receives 40%. 2. Fixed Amount Allocation: This type of agreement sets a predetermined fixed amount of dividends that each shareholder will receive. For instance, shareholder A may receive $10,000, shareholder B may receive $5,000, and so on. 3. Preferred Allocation: This type of agreement designates certain shareholders as preferred shareholders who receive a higher priority in dividend distribution compared to other shareholders. Preferred shareholders typically have specific rights or privileges associated with their shares, such as the obligation to receive dividends before other shareholders. 4. Proportionate Allocation: This type of agreement allocates dividends proportionally based on the number of shares held by each shareholder. For instance, if shareholder A holds 60% of the shares and shareholder B holds 40%, they will receive dividends in the same proportion. It is important to note that the specific terms and conditions of the Wake North Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation may vary depending on the corporation's unique circumstances and the preferences of its shareholders. It is advisable for corporations to consult legal professionals to draft an agreement that best suits their needs and complies with relevant local laws and regulations.

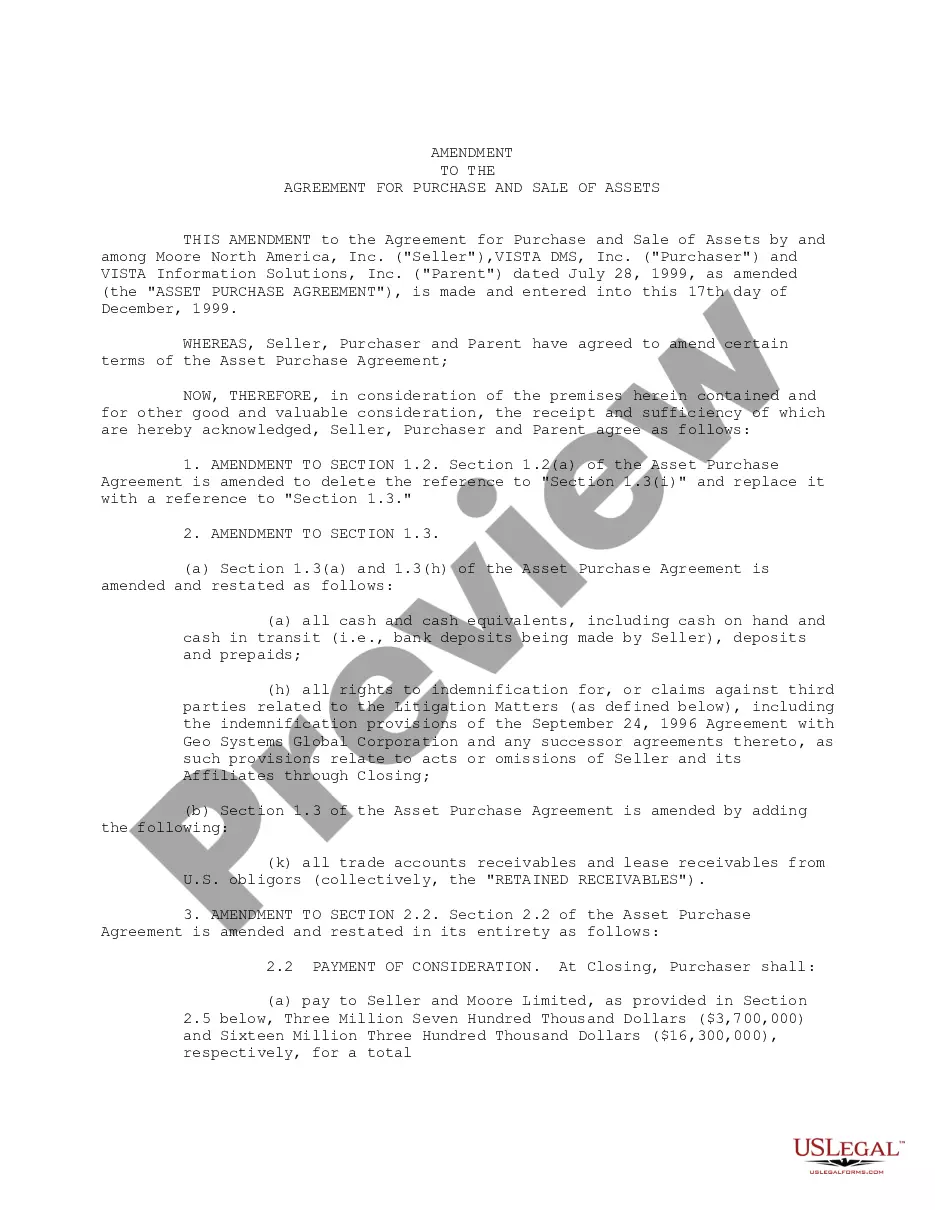

Wake North Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Wake North Carolina Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business objective utilized in your county, including the Wake Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Wake Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the Wake Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation:

- Make sure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Wake Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!