Wayne, Michigan Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation A Shareholders' Agreement is a crucial legal document that outlines the rights and responsibilities of shareholders in a close corporation. In Wayne, Michigan, there are several types of Shareholders' Agreements with special provisions for the allocation of dividends among shareholders. These agreements aim to ensure fairness, transparency, and efficient distribution of profits within the corporation. Let's explore the key aspects of these agreements and the different types available in Wayne, Michigan. 1. Standard Shareholders' Agreement: This agreement sets out the general framework of the relationship between shareholders and the corporation. It includes provisions related to the allocation of dividends, such as establishing a fair and equitable method for determining each shareholder's share based on their ownership percentage. 2. Special Allocation Shareholders' Agreement: This type of agreement goes beyond the standard framework and provides specific guidelines for the distribution of dividends. It allows shareholders to negotiate and agree upon customized rules, taking into account certain factors such as contributions to the corporation, preferred returns, or special skills possessed by individual shareholders. 3. Pro Rata Allocation Shareholders' Agreement: This type of agreement ensures that dividends are distributed to shareholders in proportion to their ownership interests. It aims to maintain equity among all shareholders by preventing certain individuals from receiving a larger portion of dividends solely based on personal relationships or other non-merit factors. 4. Qualified Dividend Shareholders' Agreement: This agreement may be relevant when shareholders have varying classes of shares or when there are different types of dividends, such as preferred dividends. It outlines the specific criteria that must be met for a shareholder to be eligible to receive the respective type of dividend. 5. Weighted Allocation Shareholders' Agreement: In certain cases, shareholders may negotiate an agreement that factors in additional considerations, such as the duration of their investment or the number of years the company has been operating. This weighted allocation approach ensures that long-term shareholders or those who have actively supported the corporation receive a greater portion of dividends. Wayne, Michigan Shareholders' Agreements with special allocations of dividends among shareholders are crucial for close corporations as they provide a clear roadmap for profit distribution. These agreements help foster trust and maintain a harmonious relationship among shareholders, leaving no room for ambiguity or disputes. Regardless of the specific type chosen, it is essential to consult with legal professionals experienced in corporate law to draft a comprehensive and enforceable agreement tailored to the unique needs of the corporation.

Wayne Michigan Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Wayne Michigan Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

Preparing paperwork for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Wayne Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation without professional help.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Wayne Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Wayne Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation:

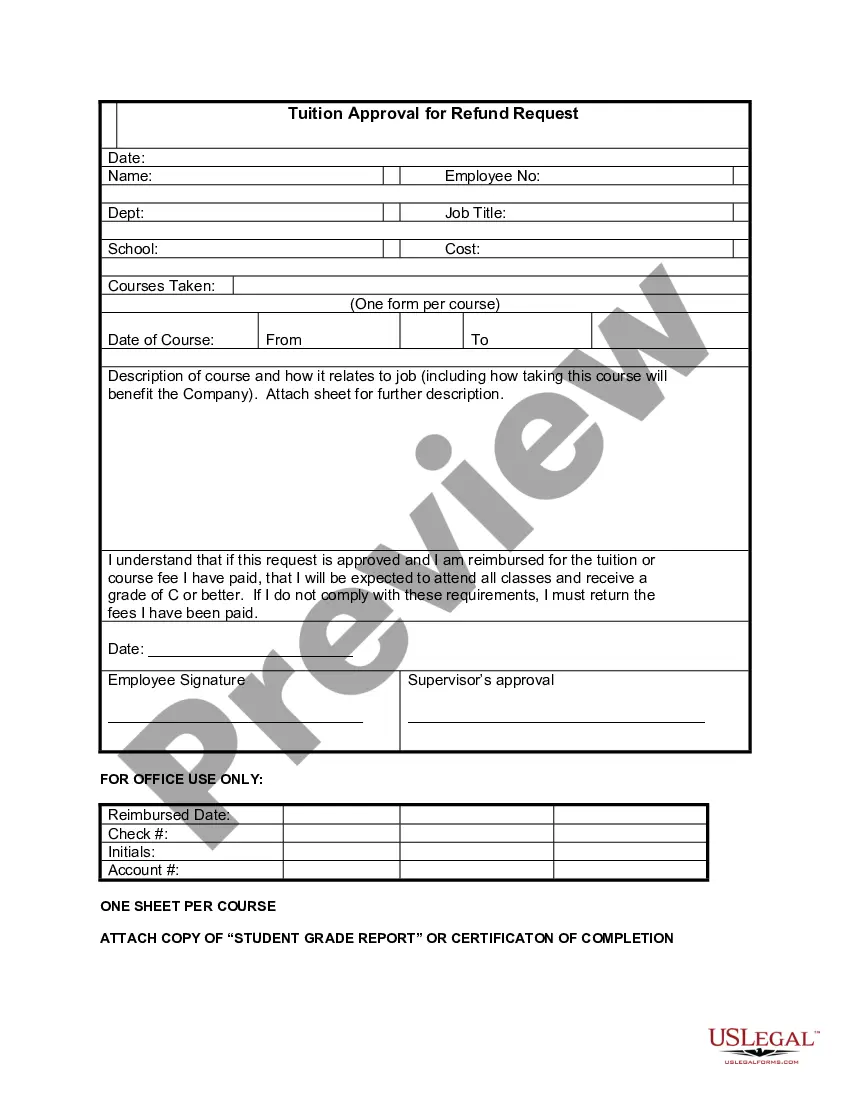

- Look through the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any scenario with just a couple of clicks!