Clark Nevada Split-Dollar Insurance Agreement is a type of insurance arrangement wherein the policy is jointly owned by both the employer and the employee. It is a strategic and flexible way for employers to provide life insurance benefits to their employees, while also enjoying certain tax advantages. This arrangement involves the employer paying the premiums for the policy, while the employee is designated as the insured individual. Under the Clark Nevada Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee, there are two main variations: 1. Endorsement Split-Dollar: In this type, the employer endorses the policy and pays the premiums. The policy is owned by the employee, who can designate beneficiaries, borrow against the cash value, and retain certain rights. Upon the death of the insured, the employer is entitled to receive a portion of the policy's proceeds equal to the premiums paid. 2. Collateral Assignment Split-Dollar: With this arrangement, the employer gains a collateral assignment interest in the policy as security for any premium payments made. Similar to the endorsement split-dollar, the employee remains the policy's owner, retaining specific rights and privileges. Upon the insured's death, the employer will be reimbursed for the premiums or any outstanding loan amounts from the policy's proceeds. Both types of Clark Nevada Split-Dollar Insurance Agreement ensure that the employee benefits from life insurance coverage, providing financial security for their loved ones in case of unexpected events. Simultaneously, the employer has a vested interest in the policy, either as a beneficiary in the event of the employee's death or through collateral assignment provisions. This type of arrangement can be particularly beneficial for key employees or business owners who require enhanced life insurance coverage. It is crucial to consult with financial and legal professionals to determine the most suitable type of Clark Nevada Split-Dollar Insurance Agreement for specific circumstances. They can provide guidance on structuring the agreement to comply with relevant tax laws and optimize the benefits for both the employer and the employee.

Clark Nevada Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee

Description

How to fill out Clark Nevada Split-Dollar Insurance Agreement With Policy Owned Jointly By Employer And Employee?

Whether you plan to open your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Clark Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Clark Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee. Follow the guide below:

- Make sure the sample fulfills your individual needs and state law regulations.

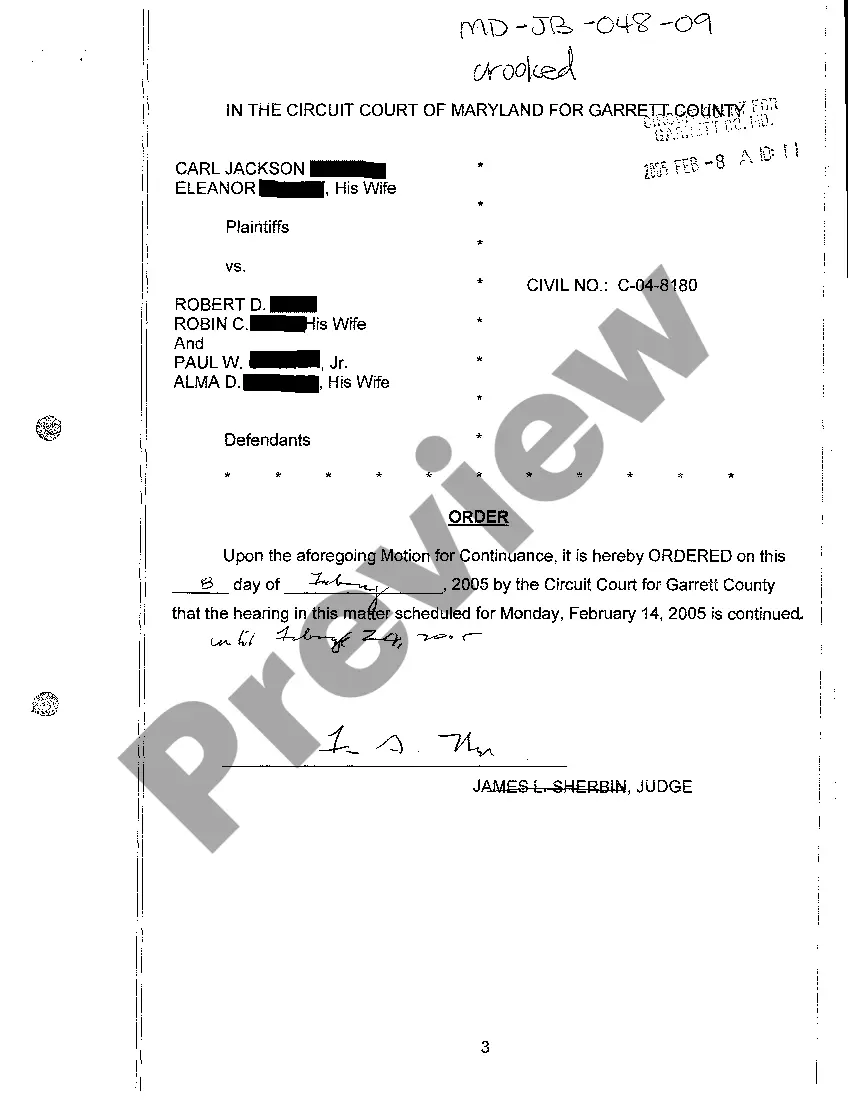

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Clark Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!