Contra Costa California Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee A Contra Costa California Split-Dollar Insurance Agreement with a policy owned jointly by an employer and an employee is a mutually beneficial arrangement that serves as a life insurance solution while also providing tax advantages. This type of insurance agreement is primarily designed to protect key employees or executives and their families, while offering significant financial advantages. In this arrangement, the employer and the employee enter into a split-dollar insurance agreement for the purpose of jointly owning a life insurance policy. The policy's death benefit is paid to the designated beneficiary upon the insured employee's passing. However, during the employee's lifetime, the policy's cash value can grow tax-deferred, offering an additional benefit. There are various types of Contra Costa California Split-Dollar Insurance Agreements with Policy Owned Jointly by Employer and Employee: 1. Endorsement Split-Dollar Plan: In this arrangement, the employer purchases a life insurance policy and endorses a portion of the policy's death benefit to the employee. The employee typically has the option to increase the death benefit coverage by paying premiums or receiving cash value benefits upon policy termination. 2. Collateral Assignment Split-Dollar Plan: In this type of split-dollar insurance agreement, the employer takes a collateral assignment on the policy while paying the insurance premium. Upon the insured employee's death, the employer recovers the total amount paid in premiums, and any remaining death benefit is paid to the designated beneficiary. 3. Equity-Based Split-Dollar Plan: This arrangement involves the employer offering an employee an opportunity to earn equity in the company based on the premiums paid on a life insurance policy. The employee has the potential to gain ownership in the policy's cash value or death benefit. 4. Restrictive Split-Dollar Plan: In this type of agreement, the employer restricts the employee's access to the policy's cash value. This restriction ensures that the employer recovers the premium payments during the employee's lifetime, while the death benefit is ultimately paid to the designated beneficiary. By entering into a Contra Costa California Split-Dollar Insurance Agreement with a policy owned jointly by the employer and employee, both parties can benefit. The employee gains access to life insurance coverage, potential cash value growth, and various tax advantages. Meanwhile, the employer may recoup premiums paid or benefit from equity-based incentives. It is essential to consult with an insurance professional or legal advisor to determine the most suitable split-dollar insurance plan based on individual needs and circumstances.

Contra Costa California Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee

Description

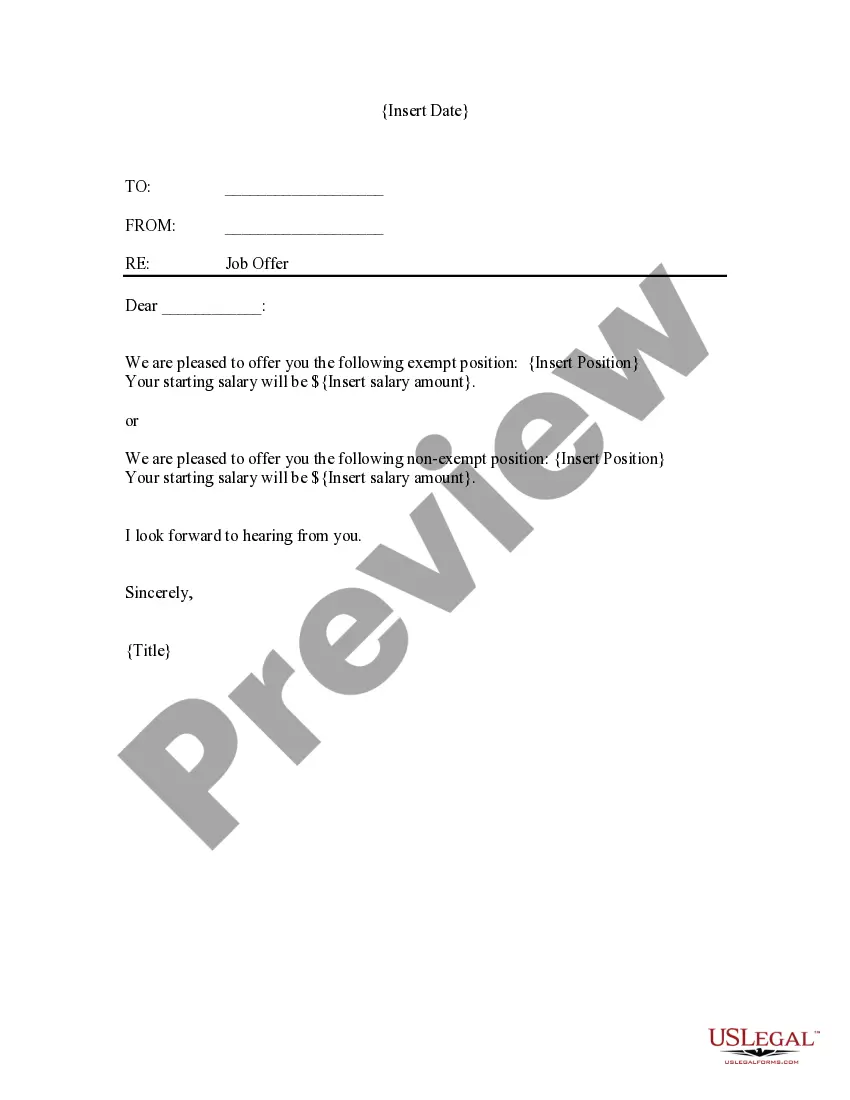

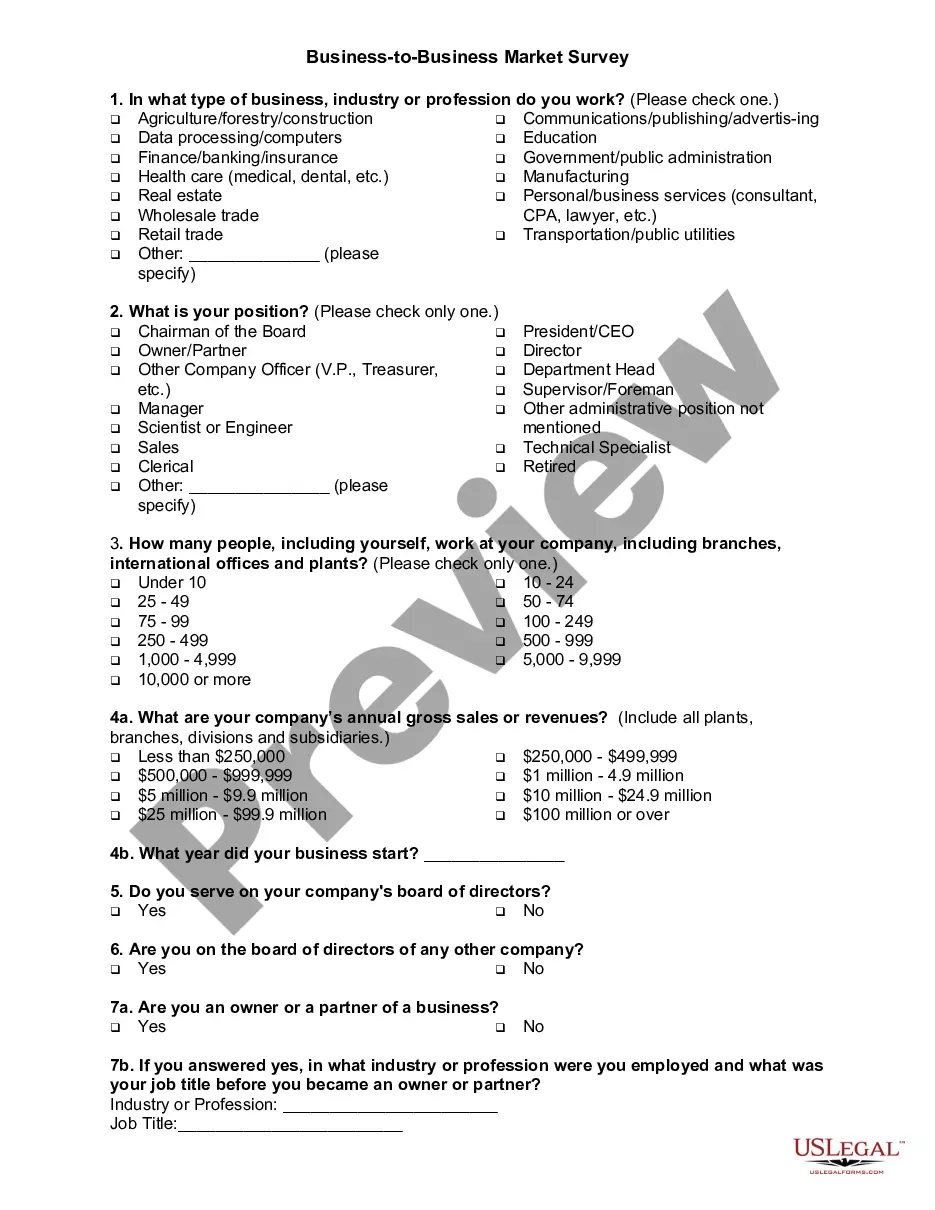

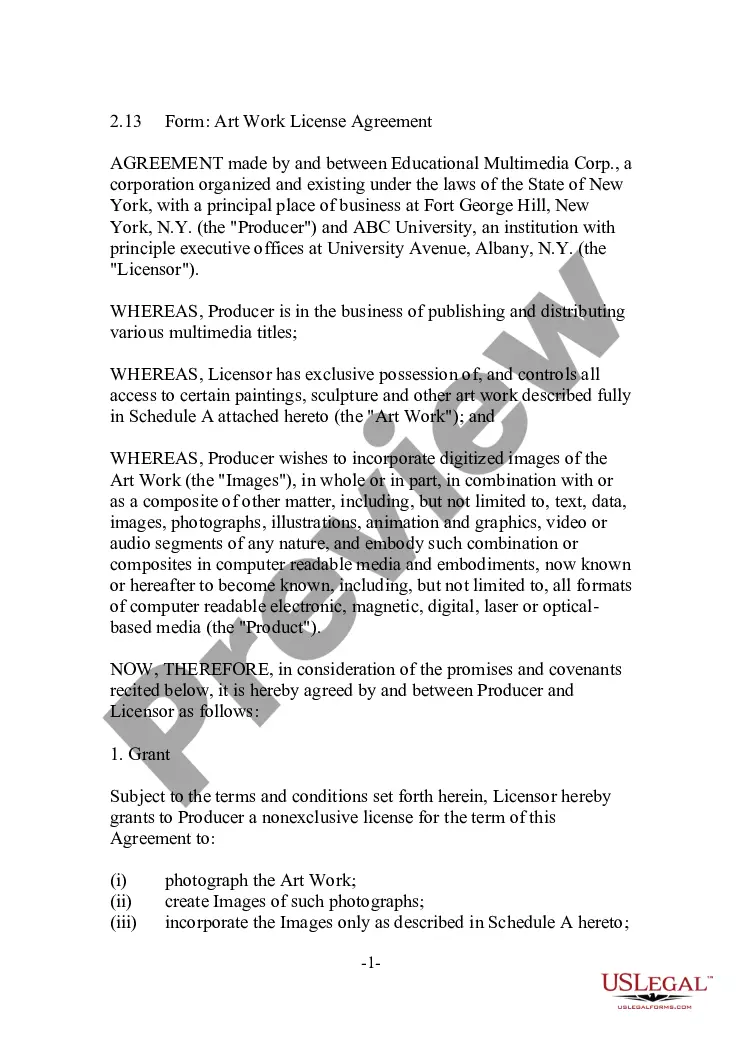

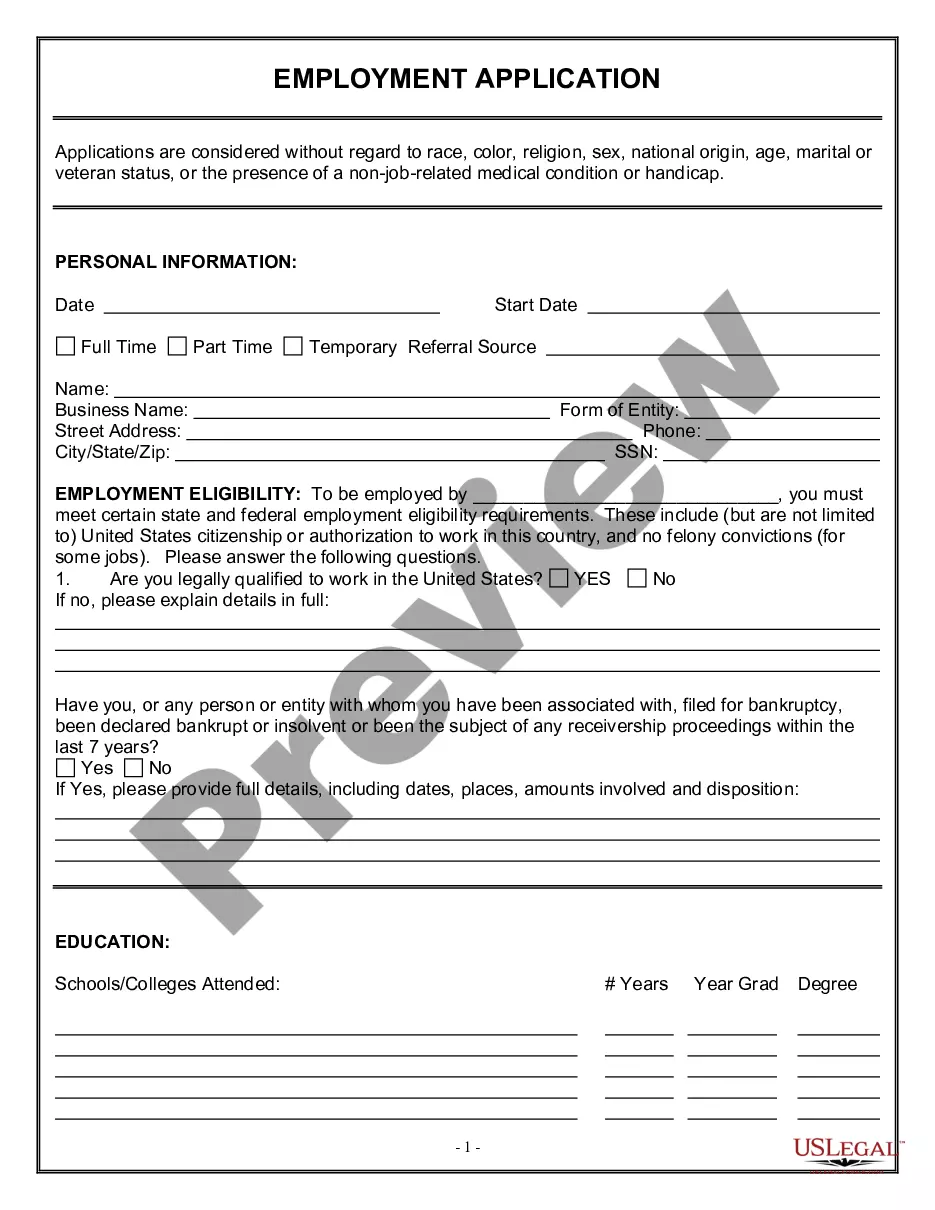

How to fill out Contra Costa California Split-Dollar Insurance Agreement With Policy Owned Jointly By Employer And Employee?

Creating forms, like Contra Costa Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee, to manage your legal affairs is a challenging and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms created for a variety of cases and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Contra Costa Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Contra Costa Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee:

- Ensure that your template is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Contra Costa Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our service and get the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

The split-dollar arrangement could allow the employee to borrow from the cash value, provided it exceeds the assigned collateral portion. Since the employee owns the policy, at retirement, he/she can decide then whether to allow the policy to expire or take over the premium payments.

The endorsement split dollar plan is one that is owned by the employer. The premiums are paid by the employer and the beneficiary is listed as the employee.

A split dollar arrangement is a plan in which a life insurance policy's premium, cash values, and death benefit are split between two parties. A split dollar arrangement can be helpful in estate liquidity planning to minimize income, estate, and gift taxes.

Split-dollar plans are frequently used by employers to provide supplemental benefits for executives and to help retain key employees. Split-dollar plans also require record-keeping and annual tax reporting. Generally, the owner of the policy, with some exceptions, is also the owner for tax purposes.

dollar policy is not an insurance policy but refers to a contract between the parties that sets out their duties to split the costs and their rights to share in the proceeds of an insurance policy.

Split Dollar and Deferred Compensation Adding a Split Dollar arrangement means that any death benefits paid to the employee's named beneficiary in excess of the amount received by the employer (usually the life insurance policy's cash value) are generally received income tax free by the employee's beneficiary.

There are 2 types of split dollar plans. Collateral assignment / loan regime. Endorsement split dollar / economic benefit regime.

Split-dollar life insurance is a contract under which the premium payments and death benefit of a permanent insurance policy with a cash value is shared, usually between an employee and their employer.

Reverse split dollar plans are a split property arrangement between an individual and a corporation. Under a reverse split dollar arrangement, the individual owns the life insurance policy, and the corporation pays the IRS Table 2001 costs.

Generally, under a split dollar plan, a permanent life insurance policy's death benefit and cash values are split between the owner and non-owner of the life insurance contract. Typically, one party has the cash flow to fund the majority of the policy premiums.