Maricopa, Arizona Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee: A Comprehensive Overview Introduction: Split-dollar insurance is a contractual arrangement between an employer and an employee, designed to provide life insurance coverage while sharing the premium costs and policy benefits. In Maricopa, Arizona, the split-dollar insurance agreement with the policy owned jointly by the employer and employee is a popular choice for businesses aiming to enhance employee benefits and attract top talent. This article aims to provide a detailed description of this specific agreement, elucidating its key features and potential variations. Key Features: 1. Ownership: In this agreement, both the employer and the employee jointly own the life insurance policy. This arrangement ensures that the employee has certain ownership rights and can access specific policy benefits while working for the employer. 2. Premiums: The premium payment responsibility is shared by the employer and the employee. The proportion typically varies based on the agreed terms outlined in the split-dollar insurance agreement. 3. Death Benefit: The death benefit, a lump sum paid upon the insured individual's death, is one of the primary policy benefits. In the Maricopa, Arizona split-dollar insurance agreement, the employer and the employee determine the death benefit amount, taking into consideration factors such as income replacement, family needs, and potential financial obligations. 4. Cash Value: The cash value component of the life insurance policy is accumulated over time. It refers to the savings portion of the policy that grows tax-deferred. The employer and the employee decide how the cash value is utilized during the agreement's tenure, including potential withdrawals or policy loans. Variations of Maricopa, Arizona Split-Dollar Insurance Agreement: 1. Equity Split-Dollar Agreement: In this type of split-dollar insurance agreement, the employer can gradually transfer the policy ownership solely to the employee over time. This method enables the employee to obtain the full benefits of the policy eventually. 2. Collateral Assignment Split-Dollar Agreement: Under this variant, a collateral assignment is established, granting the employer a claim on policy cash value as collateral in exchange for providing the employee with enhanced or additional death benefit protection. This form of agreement can offer additional security for both parties involved. 3. Endorsement Split-Dollar Agreement: In the endorsement split-dollar agreement, the employer maintains an endorsement ("irrevocable beneficiary") right on the policy, ensuring that the employer's premium contributions and interests are protected. The employee still benefits from the life insurance policy while the employer retains certain involvement and control. Conclusion: The Maricopa, Arizona split-dollar insurance agreement with the policy owned jointly by the employer and employee presents an effective means to provide life insurance coverage while sharing costs and benefits. Various variations, including the equity split-dollar agreement, collateral assignment split-dollar agreement, and endorsement split-dollar agreement, offer flexibility and tailored options for businesses to customize their insurance arrangements. Considering the specifics of each agreement is essential, and consulting with knowledgeable insurance professionals can help employers and employees make informed decisions.

Maricopa Arizona Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee

Description

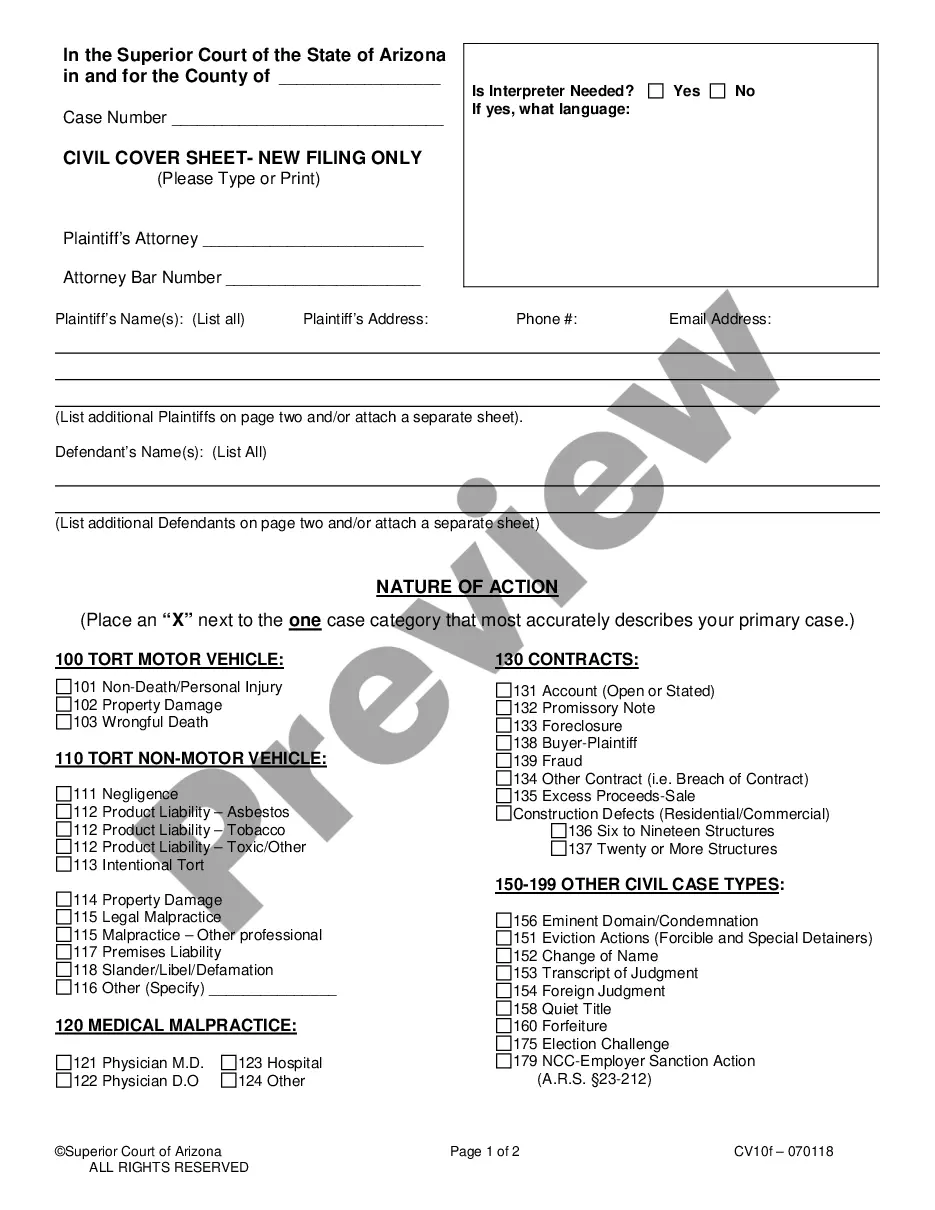

How to fill out Maricopa Arizona Split-Dollar Insurance Agreement With Policy Owned Jointly By Employer And Employee?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Maricopa Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the recent version of the Maricopa Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Maricopa Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!