San Antonio, Texas Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee: Explained A Split-Dollar Insurance Agreement is a popular way for employers to provide valuable life insurance benefits to their employees while also enjoying significant tax advantages. In San Antonio, Texas, this type of arrangement is commonly used to attract and retain top talent in a competitive job market. Split-Dollar Insurance refers to a life insurance policy that is jointly owned by both the employer and the employee. The employer pays a portion of the premiums, thus offering a cost-sharing structure that benefits both parties. In San Antonio, employers often implement this strategy alongside competitive benefits packages to attract skilled individuals and create a more stable workforce. There are a few different types of Split-Dollar Insurance Agreements commonly used in San Antonio, Texas. These include: 1. Endorsement Split-Dollar: In this variation, the employer agrees to pay the premium on a life insurance policy owned by the employee. Upon the insured's death, the employer will be reimbursed for the premiums paid from the death benefit, with the remaining amount going to the designated beneficiary. 2. Collateral Assignment Split-Dollar: This agreement involves the employer loaning the premium payments to the employee, who then assigns the policy's death benefit to the employer as collateral. Upon the insured's death, the employer will be repaid the loaned premiums from the death benefit, with the remaining amount going to the beneficiary. 3. Equity Split-Dollar: This arrangement grants the employer an ownership interest in the policy's cash value. The employer contributes to the policy premiums and is entitled to a portion of the policy's cash value growth. Upon the insured's death, the employer receives their equity portion, and the remaining amount goes to the designated beneficiary. Split-Dollar Insurance Agreements present various benefits for both employees and employers in San Antonio. For employees, this arrangement provides them with a valuable life insurance policy, often at no cost or with significantly reduced premiums. It can also serve as a supplemental retirement savings vehicle or a means to fund education expenses. Employers benefit from Split-Dollar Insurance Agreements by being able to offer an attractive benefit package that can help attract and retain top talent. Additionally, the employer may receive tax advantages such as deducting premiums paid, potentially avoiding the alternative minimum tax, and enjoying tax-deferred cash value growth. In conclusion, San Antonio, Texas Split-Dollar Insurance Agreements with Policies Owned Jointly by Employers and Employees are valuable arrangements that provide employees with life insurance coverage and employers with a competitive edge and tax advantages. With various variations available, both parties can tailor the agreement to suit their specific needs and goals.

San Antonio Texas Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee

Description

How to fill out San Antonio Texas Split-Dollar Insurance Agreement With Policy Owned Jointly By Employer And Employee?

Drafting paperwork for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to generate San Antonio Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee without professional help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid San Antonio Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the San Antonio Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee:

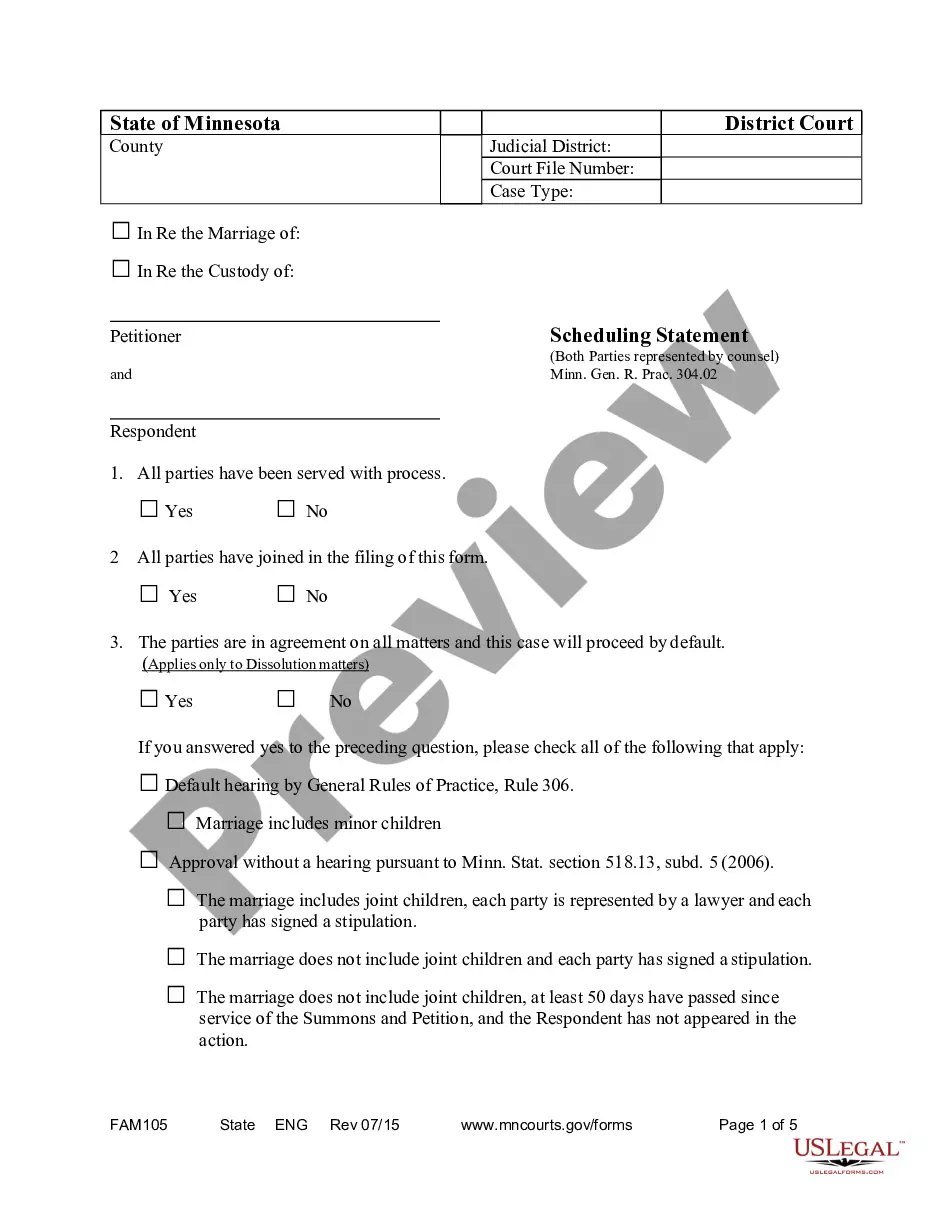

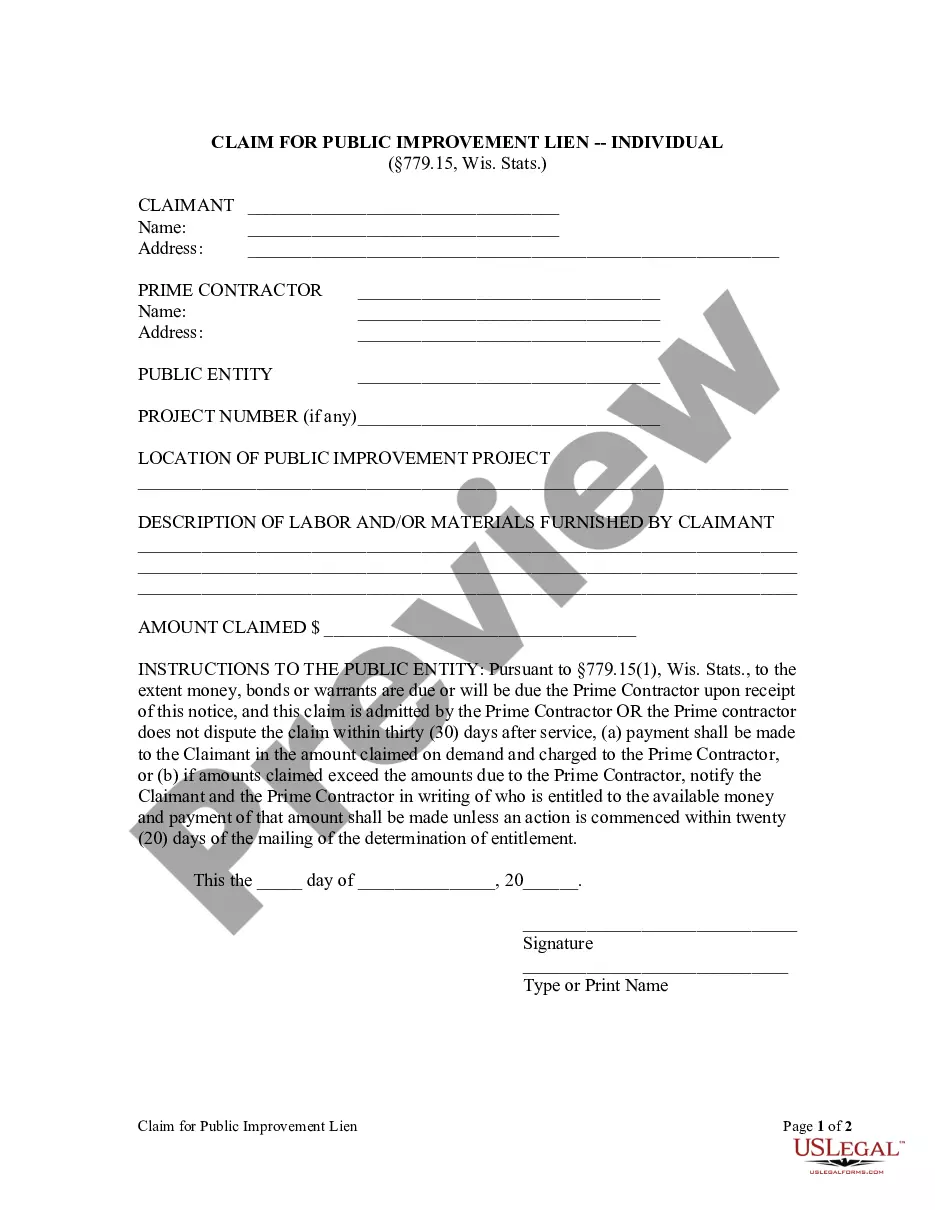

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!