Fairfax Virginia Release from Liability under Guaranty is a legal document that provides protection and releases a party (the guarantor) from any potential liabilities or obligations arising from a guaranty agreement. This agreement is commonly used in business transactions, real estate deals, or lending arrangements where a third party guarantees the payment or performance of another party (the debtor) if they fail to fulfill their contractual obligations. The Fairfax Virginia Release from Liability under Guaranty serves as a safeguard for the guarantor by outlining specific terms and conditions that absolve them from any legal responsibilities once the debtor fulfills their obligations. This document helps ensure that the guarantor is not held liable for the debtor's actions or any financial losses that may arise from their non-compliance. Different types of Fairfax Virginia Release from Liability under Guaranty may include: 1. Limited Guarantee Release: This type of release specifies the exact obligations or liabilities from which the guarantor is released. It may cover specific aspects of the guaranty agreement, such as a time limit, monetary amount, or a particular set of obligations, leaving the guarantor liable for the remaining obligations. 2. Complete Guarantee Release: In this type of release, the guarantor is fully released from all liabilities and obligations stated in the original guaranty agreement. Once the debtor fulfills their obligations, the guarantor becomes legally exempt from any further responsibility, effectively terminating their role as guarantor. 3. Contingent Guarantee Release: A contingent release remains in effect until specific conditions or events occur. For example, a guarantor may be released from liability once the debtor reaches a certain credit score or secures an alternate source of funding. 4. Partial Guarantee Release: When a guaranty agreement covers multiple obligations or liabilities, a partial release may be utilized to exempt the guarantor from specific aspects of the agreement. The guarantor remains liable for the remaining obligations not covered by the release. It's crucial to consult with a qualified attorney in Fairfax Virginia to draft or review the Release from Liability under Guaranty document to ensure proper compliance with local laws and regulations. This document protects both parties involved in the guaranty agreement and helps establish clear parameters regarding liability and obligations.

Fairfax Virginia Release from Liability under Guaranty

Description

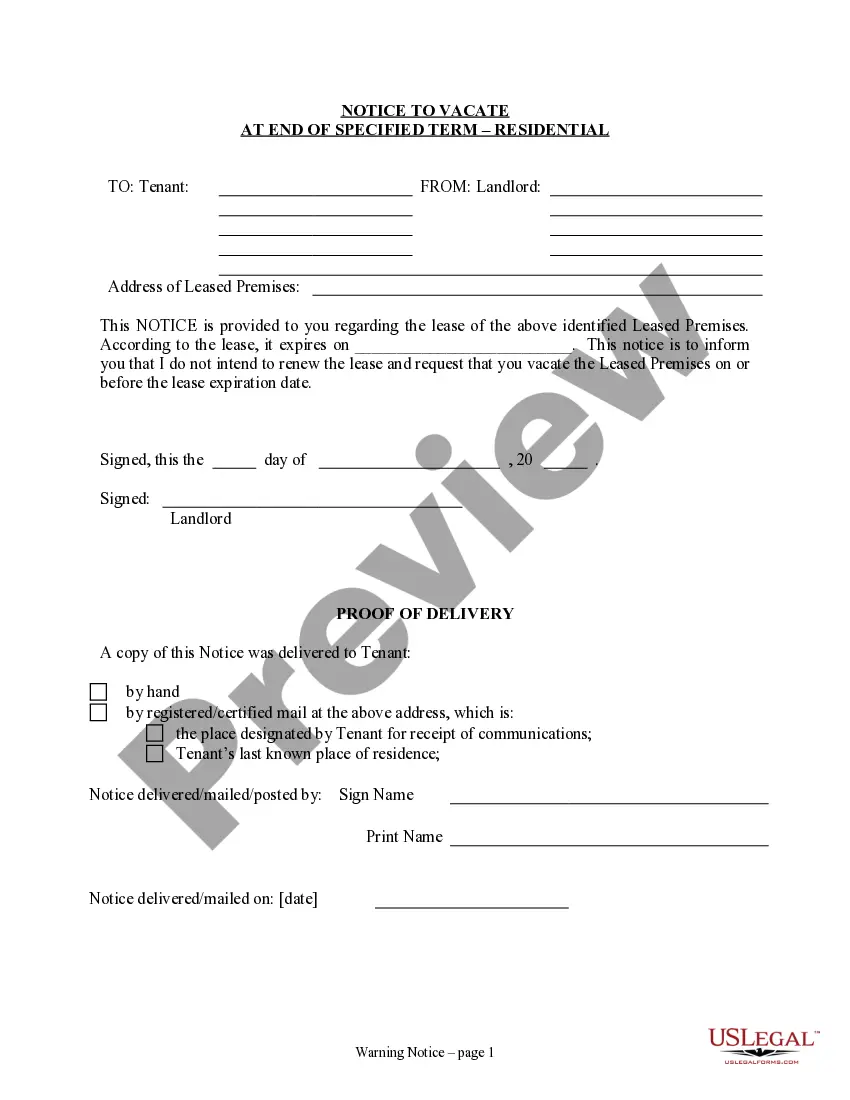

How to fill out Fairfax Virginia Release From Liability Under Guaranty?

Creating forms, like Fairfax Release from Liability under Guaranty, to take care of your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for different scenarios and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Fairfax Release from Liability under Guaranty form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before getting Fairfax Release from Liability under Guaranty:

- Ensure that your document is specific to your state/county since the rules for creating legal documents may differ from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Fairfax Release from Liability under Guaranty isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our website and get the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

ANSWER: Guarantee, the broader and more common term, is both a verb and a noun. The narrower term, guaranty, today appears mostly in banking and other financial contexts; it seldom appears in nonlegal writing. Guarantee, vb. 1.

Rolling guaranty: this can be a 12 month, 24 month or some other number of months, rolling guaranty. It means that the total exposure is the number of months regardless of how many months are remaining in the lease (unless the remaining months are less than the rolling months.

A corporate guarantee is an agreement in which one party, called the guarantor, takes on the payments or responsibilities of a debt if the debtor defaults on the loan.

With a personal guarantee, an individual agrees to be held contractually responsible if a borrower falls behind on repaying a loan. Similarly, a corporate guarantee represents an agreement where a corporate entity agrees to be held responsible.

A limited guaranty is a written undertaking to fulfill a specific obligation. Ordinarily, a limited guaranty is restricted in its application to a single transaction. A limited guarantee is limited to the amount, time, or type of loss.

A lease guarantee is a legal agreement between a landlord, a tenant, and a third party approved by the landlord. This third party is called a lease guarantor. Like a cosigner on a consumer loan, the lease guarantor agrees to be responsible if the tenant defaults on the rental agreement.

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

The Difference Is in the Definition Companies make written or verbal guarantees all the time, but guaranty refers specifically to a written agreement that one party will pay the money required if another party fails to do so.

A person who acts as a guarantor under a GUARANTEE. GUARANTY, contracts. A promise made upon a good consideration, to answer for the payment of some debt, or the performance of some duty, in case of the failure of another person, who is, in the first instance, liable to such payment or performance.

Noun, plural guar·an·ties.