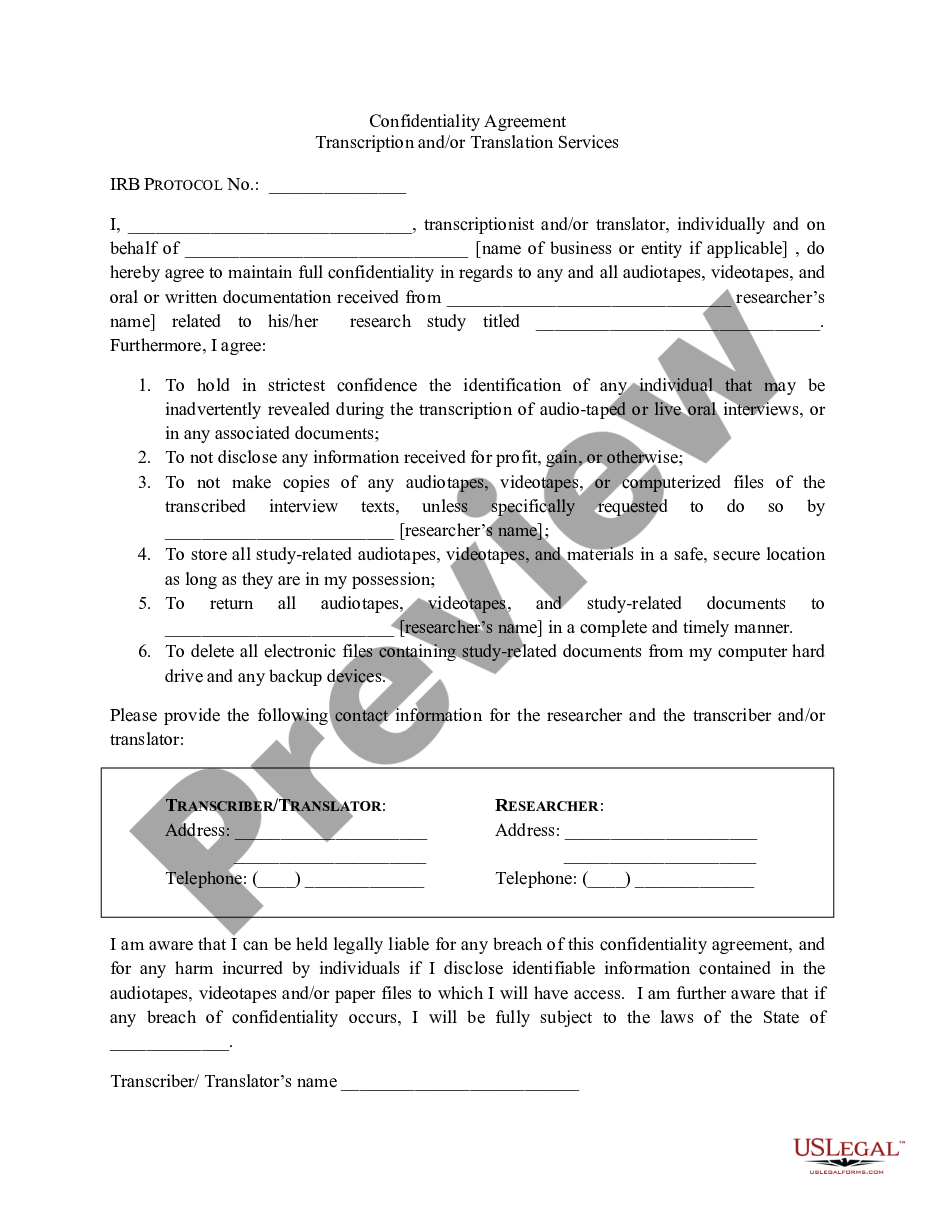

San Antonio Texas Release from Liability under Guaranty is a legal document that outlines the terms and conditions under which a party (the guarantor or surety) is released from any obligations or liabilities related to a guarantee. This agreement typically allows the guarantor to be legally relieved from any further responsibility if the primary party (the debtor or principal) fails to fulfill their obligations. The San Antonio Texas Release from Liability under Guaranty typically includes the following key elements: 1. Parties involved: The agreement will identify the parties involved, including the guarantor, debtor, and any other relevant parties such as lenders, creditors, or guaranty beneficiaries. 2. Description of the guaranty: The agreement will provide a detailed description of the initial guaranty and the specific obligations that were guaranteed by the guarantor. 3. Release conditions: The document will specify the conditions under which the guarantor's liability will be released. This often includes the debtor's failure to meet their payment deadlines, breach of contract, or violation of any specific terms agreed upon in the original guaranty. 4. Notice provisions: The agreement will outline the method and timeframe for providing notice to the guarantor when the release from liability is triggered. This ensures that the guarantor is properly informed and has an opportunity to exercise their rights under the agreement. 5. Full release: The San Antonio Texas Release from Liability under Guaranty will state that upon fulfillment of the release conditions, the guarantor will be fully released from any further obligations, liabilities, or claims related to the initial guaranty. It's worth noting that there may be variations or specific types of Release from Liability under Guaranty in San Antonio, Texas, based on the nature of the guarantee. For example: 1. Payment guaranty release: This type of release may be applicable when the guarantor's obligation is specifically related to ensuring the debtor's payment obligations are met. 2. Performance guaranty release: In situations where the guarantor's responsibility is to guarantee the debtor's performance under a contract, a performance guaranty release may be utilized. 3. Mortgage guaranty release: This type of release may apply when the guarantor is guaranteeing a mortgage, and upon the debtor's fulfillment of certain conditions, the guarantor is released from their mortgage obligation. 4. Commercial guaranty release: If the guaranty relates to a commercial transaction, such as a business loan or a lease agreement, a commercial guaranty release may be tailored to address specific provisions relevant to the business context. In conclusion, the San Antonio Texas Release from Liability under Guaranty is a legal agreement that safeguards the rights and responsibilities of the guarantor, ensuring their release from any liability when specific conditions are met.

San Antonio Texas Release from Liability under Guaranty

Description

How to fill out San Antonio Texas Release From Liability Under Guaranty?

Are you looking to quickly draft a legally-binding San Antonio Release from Liability under Guaranty or probably any other document to handle your own or corporate affairs? You can go with two options: contact a legal advisor to draft a legal document for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get professionally written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-specific document templates, including San Antonio Release from Liability under Guaranty and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, double-check if the San Antonio Release from Liability under Guaranty is tailored to your state's or county's laws.

- If the form includes a desciption, make sure to verify what it's intended for.

- Start the search over if the document isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the San Antonio Release from Liability under Guaranty template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!