Santa Clara California Release from Liability under Guaranty is a legal document that provides protection to parties involved in a guaranty agreement. This written agreement details the terms and conditions under which a party can be released from the obligations of their guaranty. In Santa Clara California, there are two types of Release from Liability under Guaranty: 1. Voluntary Release: A voluntary release occurs when the party seeking release from liability proactively approaches the other party involved in the guaranty agreement, expressing their intention to be released from their obligations. This type of release typically occurs when the guarantor no longer wishes to be bound by the terms of the guaranty or when the underlying obligation has been satisfied. 2. Release by Agreement: A release by agreement takes place when all parties involved in the guaranty agreement mutually agree to release the guarantor from their obligations. This agreement is usually reached through negotiation and the execution of a release document that clearly outlines the terms and conditions of the release. Regardless of the type of release, the Santa Clara California Release from Liability under Guaranty includes several essential components to ensure its validity and enforceability. These elements may include: 1. Identification of Parties: The release document should clearly identify the parties involved in the guaranty agreement, including the guarantor, the creditor, and the debtor. 2. Intent to Release: The document must express the intent of the parties involved to release the guarantor from their obligations. It should outline the reasons for the release and the specific terms and conditions agreed upon. 3. Consideration: There should be a clear statement indicating what consideration, if any, is provided by the guarantor in exchange for their release. This consideration can be monetary or non-monetary, such as the satisfaction of the underlying debt or the fulfillment of certain conditions. 4. Waiver of Rights: The release document may include a waiver, where the guarantor agrees to waive any rights or claims they may have against the creditor or debtor due to the guaranty agreement. 5. Governing Law and Jurisdiction: The release should specify the governing law of Santa Clara County, California, and include provisions on jurisdiction, venue, and dispute resolution mechanisms. It is crucial to consult with an experienced attorney to draft or review the Santa Clara California Release from Liability under Guaranty to ensure compliance with local laws and to protect the interests of all parties involved.

Santa Clara California Release from Liability under Guaranty

Description

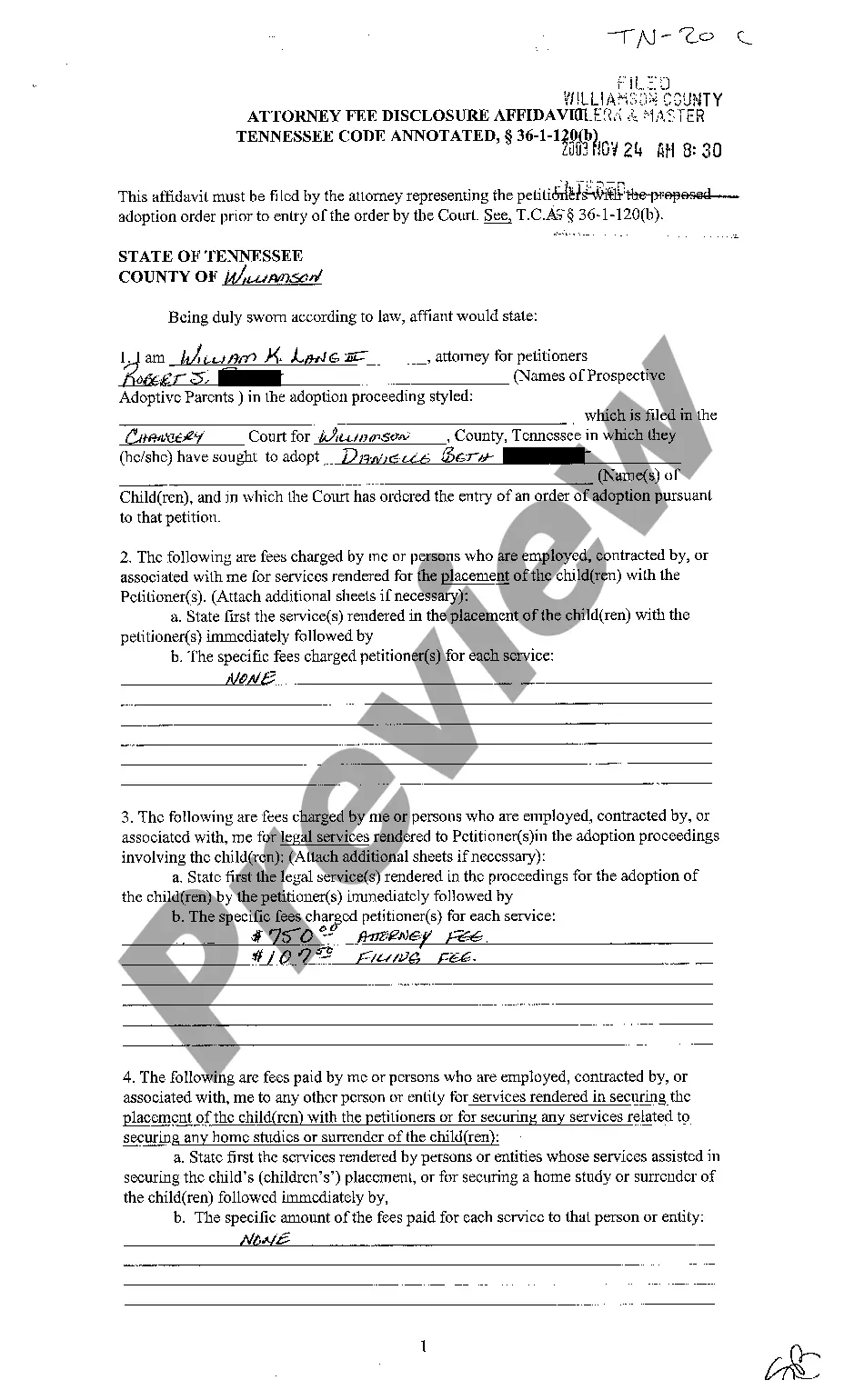

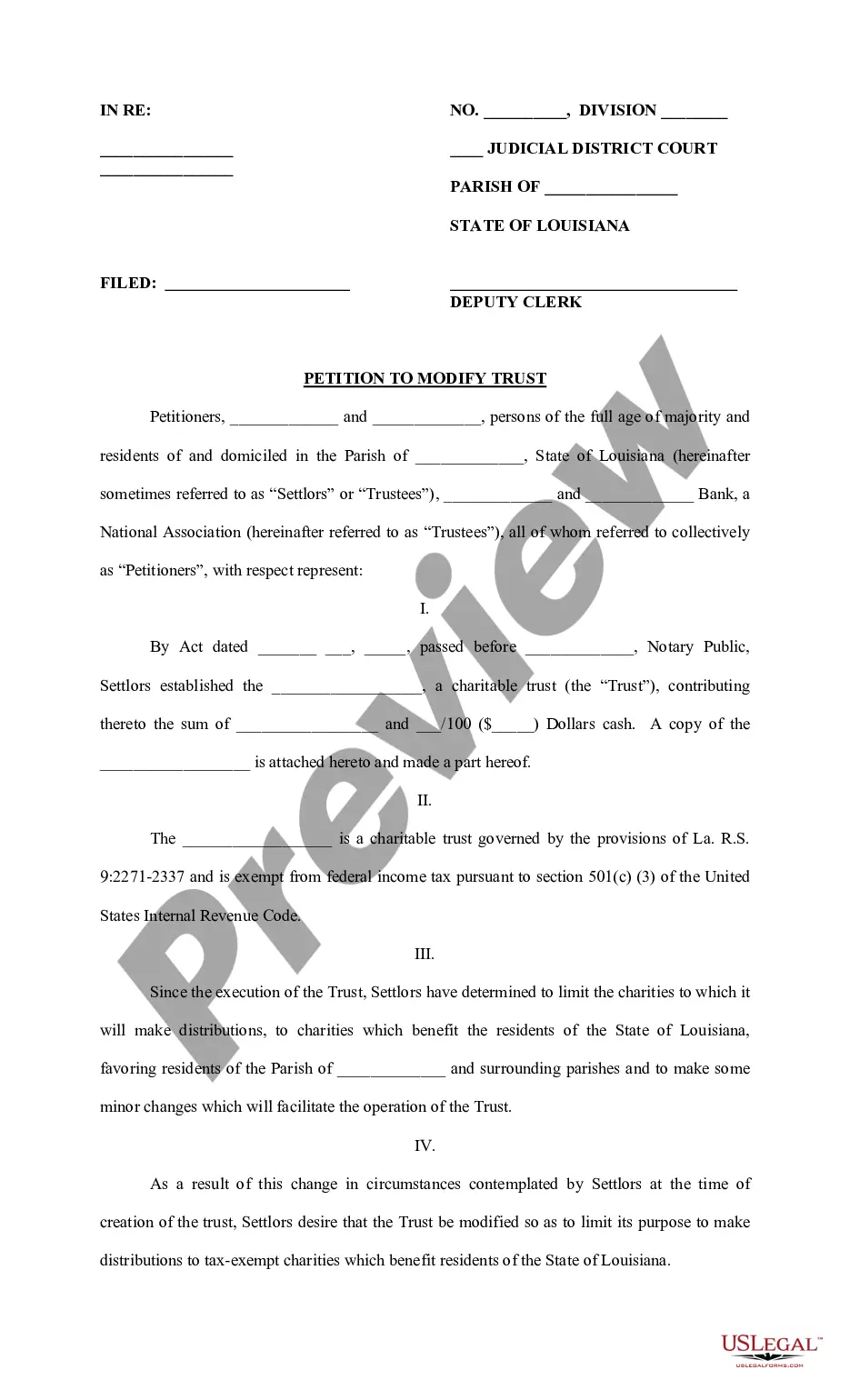

How to fill out Santa Clara California Release From Liability Under Guaranty?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Santa Clara Release from Liability under Guaranty, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Santa Clara Release from Liability under Guaranty from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Santa Clara Release from Liability under Guaranty:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Guarantee of collection means a loan guarantee under which the authority agrees to pay according to the terms of the guarantee agreement if the instrument is not paid when due and the participating lender has pursued all reasonable efforts relative to collection.

Put another way, a guaranty of collection requires that the debtor must exhaust certain remedies against the debtor before proceeding against the guarantor, while a guaranty of payment means that the lender can proceed directly against the guarantor even if the debtor is solvent and otherwise able to pay.

A Release of Guarantee Form is a document that allows a guarantor to free themselves from being financially and/or legally bound to a contract. This is common for loan agreements and lease documents after expiration or when the contract has been fully satisfied.

Someone who promises to fulfill another party's obligation if the other party fails to perform. Financial creditors may require the debtor to find a guarantor, who then signs the loan agreement along with the debtor.

1. A detailed letter from existing SBA borrower(s) and guarantor(s) signed and dated explaining the reasons for the release of guarantor. The letter must state the amount of monetary consideration being offered and the source of the funds. 2.

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead.

A guarantor is a co-signer that assumes financial responsibility for a loan if a borrower defaults. Depending on the terms of your loan, you may be able to remove your guarantor by talking with your lender. Schedule a meeting with your lender or talk to them over the phone if a meeting isn't possible.

The guaranty shall continue in full force and effect and may only be terminated in a writing delivered to Y thirty days before termination of the guaranty and such termination shall not eliminate the guaranty as to sums already advanced.

Interesting Questions

More info

Be honest and precise. The District requires that you include a letter of guarantee in the envelope you provide (do NOT use a business- to-business envelope). You may attach a photocopy of your driver's license or Social Security card. The District also requires that you provide a telephone number if it will be reached. For more details please see: To request copies of Fictitious D.C. Instrument please fill out: Fictitious D.C. Instrument Fill-in-the-Blanks — (FDC-4-F) We will send the copies to you. We do not need any additional documentation. The FDC-4-F is the most important part of your Fictitious D.C. Instrument with a 100.00 refundable deposit, payable to the Fictitious D.C. Instrument Company, LLC. We also offer this FDC form at no cost if you are not a resident of Fictitious D.C. For instructions on how to complete the form, please see: 30. E. There is NO REFUND ON ANY OF THE FOLLOWING: 1. THE FDC-4-F (or FDC-4) 2.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.