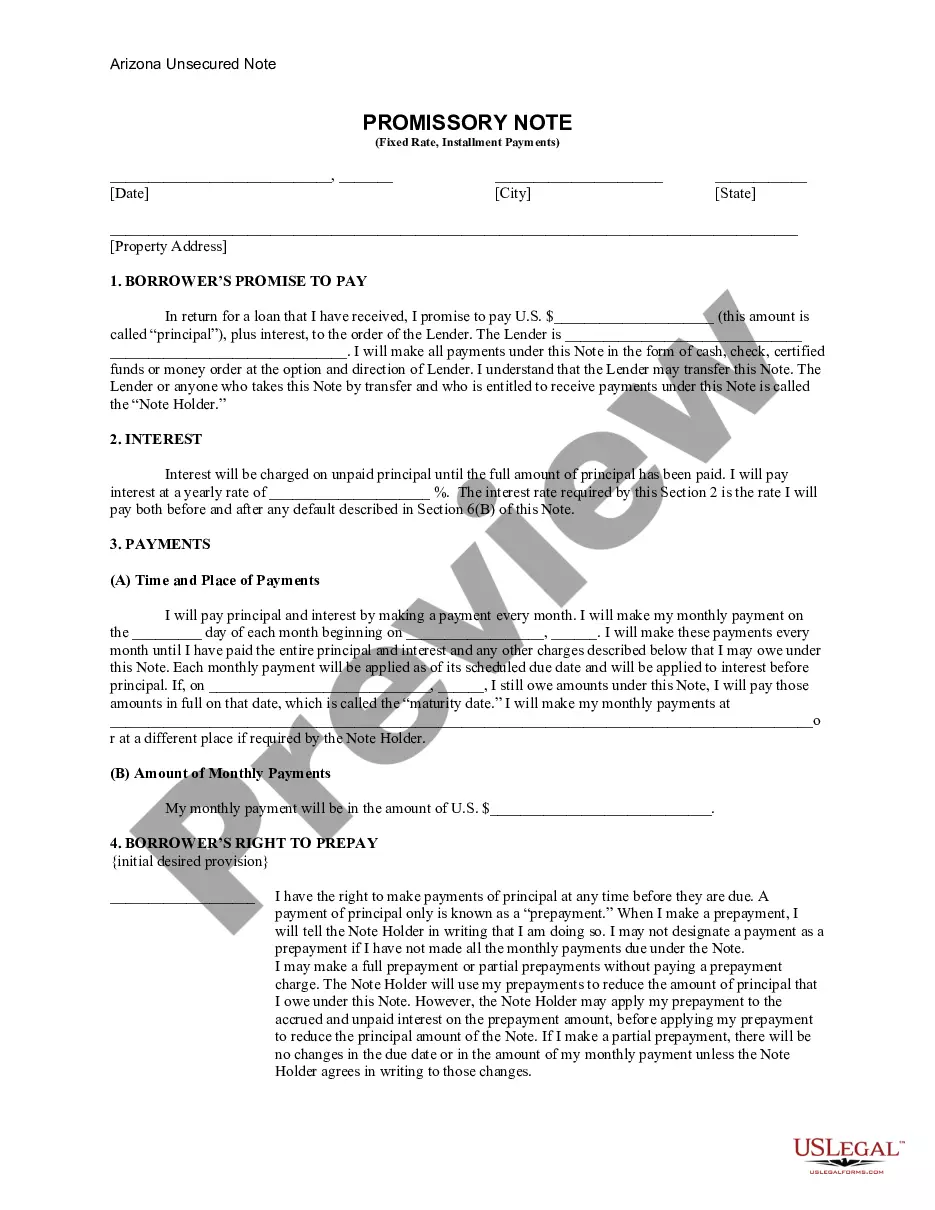

Maricopa, Arizona — Assignment of Principal Obligation and Guaranty In Maricopa, Arizona, an Assignment of Principal Obligation and Guaranty holds significant importance within the legal framework. This legal document defines the terms and conditions for transferring the primary obligation and guarantee from one party to another. The Assignment of Principal Obligation and Guaranty involves the transfer of both financial responsibility and guarantee from the original party, known as the assignor, to another party, called the assignee. This transfer typically occurs due to various reasons such as business acquisitions, changes in ownership, or loan transfers. The assignee, upon receiving the principal obligation, becomes responsible for fulfilling the obligations initially undertaken by the assignor. Key terms associated with the Maricopa, Arizona Assignment of Principal Obligation and Guaranty include: 1. Principal Obligation: This refers to the primary financial responsibility or commitment that is being transferred. It could be a loan, debt, or any other form of monetary obligation. 2. Guaranty: A guarantee provided by a third party to ensure the fulfillment of the principal obligation. A guaranty is a legally binding commitment to cover the obligation in case the assignee fails to fulfill it. 3. Assignor: The original party who holds the principal obligation and decides to transfer it to another party. The assignor typically seeks the consent of the assignee before initiating the assignment process. 4. Assignee: The party to whom the principal obligation and the associated guaranty are being transferred. The assignee willingly accepts the new responsibilities and agrees to fulfill the obligations according to the terms mentioned in the assignment document. Different types of Maricopa, Arizona Assignment of Principal Obligation and Guaranty may include: 1. Mortgage Assignment: This type of assignment refers to the transfer of a mortgage loan, where the assignor transfers both the principal obligation and the mortgage guarantee to the assignee. The assignee becomes the new lender or servicing entity responsible for collecting loan payments. 2. Business Acquisition Assignment: This type of assignment occurs when a business changes ownership. The assignor transfers the principal obligation and any associated guarantees to the assignee, ensuring the smooth continuation of business operations. 3. Loan Transfer Assignment: This type of assignment involves transferring a loan from one financial institution or lender to another. The assignor assigns the principal obligation and any associated guarantees to the assignee, allowing the assignee to take over the loan servicing and collection process. In conclusion, the Maricopa, Arizona Assignment of Principal Obligation and Guaranty is a crucial legal document that facilitates the transfer of financial obligations and guarantees from one party to another. It ensures a smooth transition of responsibilities and serves as a legal agreement between the assignor and the assignee. Different types of assignments may include mortgage assignment, business acquisition assignment, and loan transfer assignment.

Maricopa Arizona Assignment of Principal Obligation and Guaranty

Description

How to fill out Maricopa Arizona Assignment Of Principal Obligation And Guaranty?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Maricopa Assignment of Principal Obligation and Guaranty, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any tasks related to document completion straightforward.

Here's how to purchase and download Maricopa Assignment of Principal Obligation and Guaranty.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the legality of some records.

- Examine the similar forms or start the search over to find the right document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Maricopa Assignment of Principal Obligation and Guaranty.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Maricopa Assignment of Principal Obligation and Guaranty, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional completely. If you have to deal with an extremely challenging case, we advise getting a lawyer to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific documents with ease!