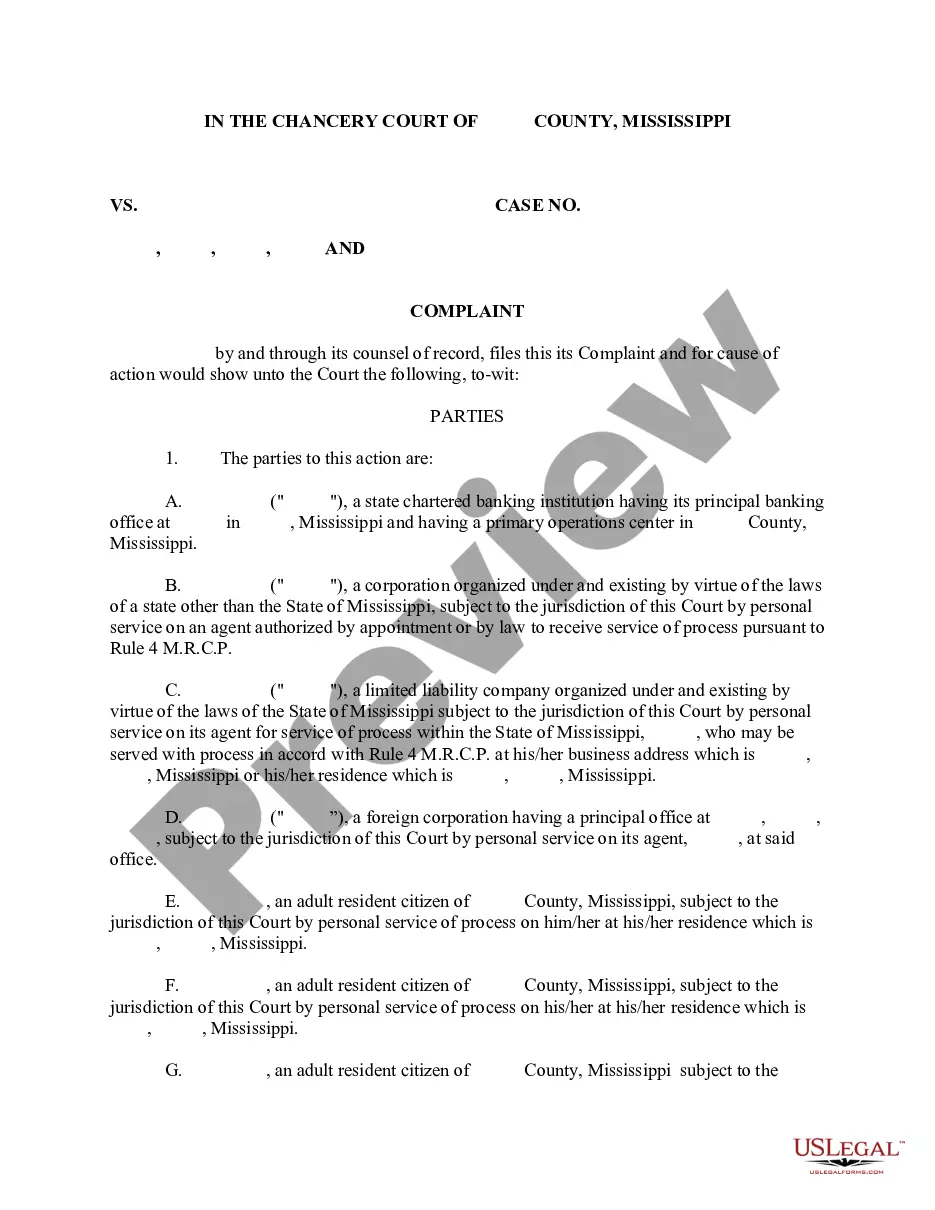

Philadelphia Pennsylvania Expense Account Form is a document used by individuals and businesses to track and report their expenses related to activities conducted in Philadelphia, Pennsylvania. This form is tailored specifically to comply with the regulations and guidelines set forth by the city authorities, ensuring accurate and reliable expense reporting. The Philadelphia Pennsylvania Expense Account Form serves as a comprehensive tool for recording various types of expenses incurred in the city. It allows users to carefully note down expenditures such as transportation costs, accommodation charges, meals and entertainment expenses, conference fees, and other incidentals. This detailed documentation is crucial to substantiate business-related outlays and claim deductions or reimbursements. There are different types of Philadelphia Pennsylvania Expense Account Forms available, depending on the nature and purpose of the expenses. These may include: 1. Philadelphia Pennsylvania Expense Account Form for Business Travel: This form is specifically designed for individuals or employees who undertake business trips to Philadelphia, Pennsylvania. It enables them to systematically document their travel-related expenses such as airfare, hotel charges, ground transportation, and meals. 2. Philadelphia Pennsylvania Expense Account Form for Conferences and Events: Attending conferences, seminars, or events in Philadelphia often involves various expenses. This type of expense account form allows participants to itemize costs associated with registration fees, accommodation, meals, and travel. 3. Philadelphia Pennsylvania Expense Account Form for Entertainment: This form caters to individuals or businesses that incur entertainment expenses in Philadelphia. It provides a structured way to record expenditures related to client dinners, networking events, and other business-related entertainment activities. 4. Philadelphia Pennsylvania Expense Account Form for Local Expenses: This form is applicable for residents or businesses based in Philadelphia, documenting expenses incurred within the city. It allows for the capture of expenditures such as transportation within the city, utility bills, office supplies, and other everyday expenses necessary for business operations. By using the Philadelphia Pennsylvania Expense Account Form, individuals and businesses can ensure compliance with the city's regulations, accurately track expenses, and simplify the process of filing taxes or seeking reimbursements. It helps maintain transparency and accountability, benefiting both organizations and the city of Philadelphia.

Philadelphia Pennsylvania Expense Account Form

Description

How to fill out Philadelphia Pennsylvania Expense Account Form?

If you need to find a trustworthy legal document provider to find the Philadelphia Expense Account Form, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning materials, and dedicated support make it easy to get and complete various papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to search or browse Philadelphia Expense Account Form, either by a keyword or by the state/county the document is intended for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Philadelphia Expense Account Form template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less pricey and more affordable. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Philadelphia Expense Account Form - all from the convenience of your home.

Sign up for US Legal Forms now!