Salt Lake Utah Expense Account Form: A Comprehensive Guide The Salt Lake Utah Expense Account Form is a crucial document utilized by businesses, organizations, and institutions operating within the Salt Lake City area in Utah. This detailed description aims to provide useful information and relevant keywords to help individuals understand and navigate through this important form. 1. Definition: The Salt Lake Utah Expense Account Form is an official document used by employees to request reimbursement for expenses incurred during work-related activities or business travel in the Salt Lake City region of Utah. This expense report serves as a financial record, allowing employers to track and manage expenses while ensuring transparency and compliance with company policies and financial regulations. 2. Purpose: The main purpose of the Salt Lake Utah Expense Account Form is to facilitate the reimbursement process for employees. By accurately recording and itemizing expenses, individuals can seek reimbursement for eligible expenditures such as travel, accommodation, meals, transportation, and other miscellaneous costs incurred during business-related activities. 3. Key Components: a. Employee and Organization Information: The form typically requires the employee's name, contact details, employee ID, department, and supervisor information. Additionally, it may entail the organization's name, address, and other relevant details. b. Expense Details: This section prompts the employee to provide a thorough breakdown of each expense incurred, including the date, purpose, type of expense, vendor/merchant information, and a brief description. A receipt or supporting documentation might also be required. c. Expense Authorization: In some cases, the employee's supervisor or appropriate personnel must review and approve the expense account form before reimbursement. This section allows for their signature, name, and designation. d. Total Calculation and Currency: The form includes sections for the employee to specify the currency used and calculate the total expenses claimed. e. Bank Account Details: To ensure seamless reimbursement, a section may be included to provide the necessary bank account information for direct deposit. 4. Types of Salt Lake Utah Expense Account Forms: While the exact naming conventions may vary across organizations, you may encounter different types or variations of the Salt Lake Utah Expense Account Form, including: a. Travel Expense Account Form: Used specifically for reimbursing expenses related to business travel, such as airfare, lodging, meals, transportation, and conference fees. b. Mileage Expense Account Form: Focused on reimbursing employees for mileage and fuel expenses incurred during business-related travel using their personal vehicles. c. Entertainment Expense Account Form: This variation of the form primarily covers expenses associated with client entertainment, business meetings, or corporate events. d. Miscellaneous Expense Account Form: For expenses that do not fall into standard categories, such as office supplies, business-related subscriptions, or other ad hoc expenses. In conclusion, the Salt Lake Utah Expense Account Form offers a structured and organized approach for employees seeking reimbursement for expenses related to work activities in the Salt Lake City region. Through accurate reporting and careful documentation, this form facilitates efficient and transparent accounting processes, ultimately benefiting both employees and employers.

Salt Lake Utah Expense Account Form

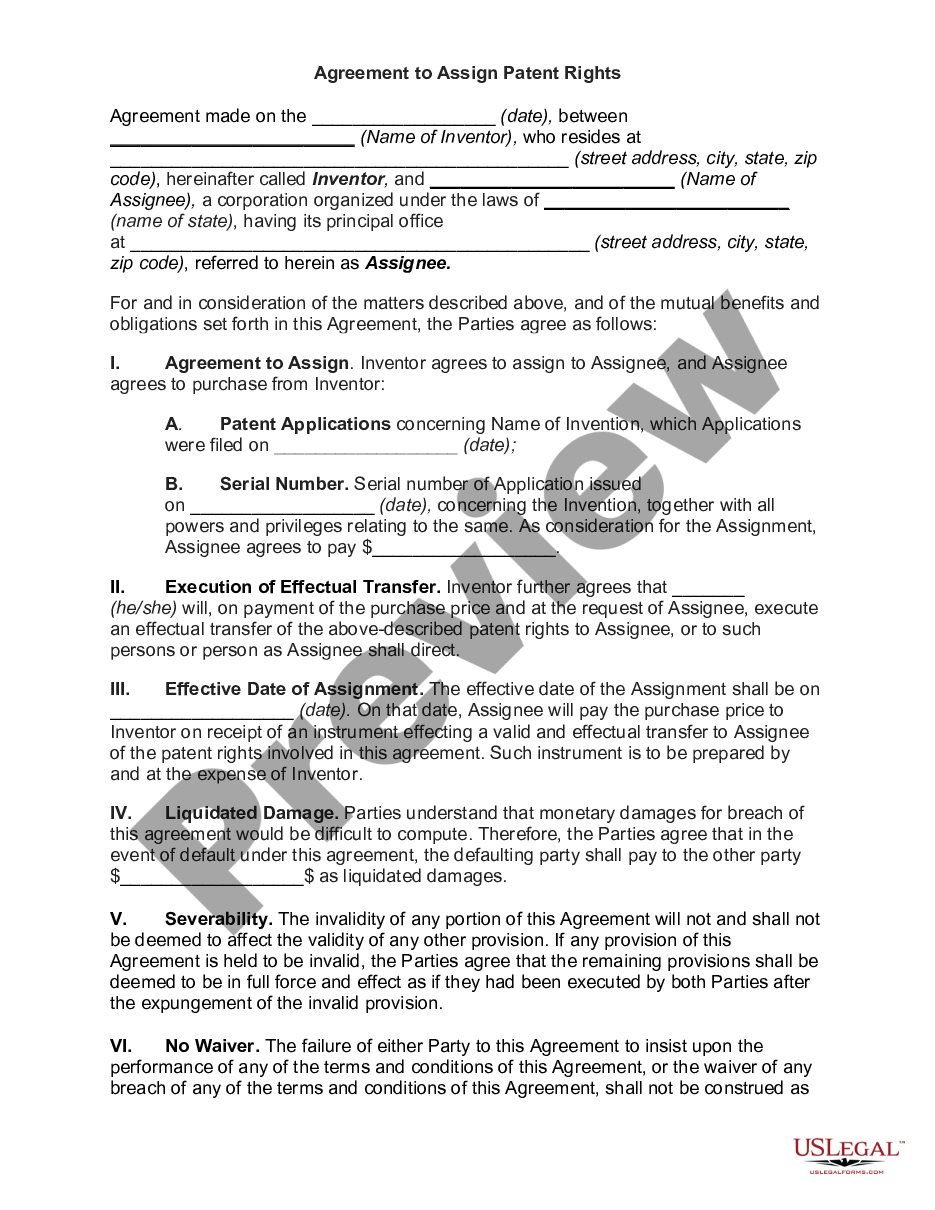

Description

How to fill out Salt Lake Utah Expense Account Form?

Do you need to quickly create a legally-binding Salt Lake Expense Account Form or probably any other document to take control of your personal or corporate matters? You can go with two options: hire a professional to write a legal document for you or draft it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Salt Lake Expense Account Form and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, carefully verify if the Salt Lake Expense Account Form is tailored to your state's or county's laws.

- If the document comes with a desciption, make sure to check what it's suitable for.

- Start the search over if the document isn’t what you were seeking by utilizing the search bar in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Salt Lake Expense Account Form template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Additionally, the templates we provide are reviewed by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!