Tarrant Texas Expense Account Form is a crucial document used by individuals or organizations located in Tarrant County, Texas, to track and record expenses incurred during official business travel or other authorized expenditures. It serves as a comprehensive record-keeping tool that enables employees to report their expenses accurately while adhering to the organization's expense reimbursement policy. The Tarrant Texas Expense Account Form typically consists of several sections that collect relevant information regarding the nature and purpose of the expenses. These sections may include fields for the employee's name, department, employee ID, and contact details. Additionally, there are sections to input the date of travel or expense, a detailed description of the expense, expense category, and total amount spent. To ensure accurate reimbursement, the form may require attaching supporting documentation such as receipts, invoices, or travel itineraries. This enables the business or organization to establish a comprehensive audit trail and validate the validity of each expense claim. Different types of Tarrant Texas Expense Account Forms may exist based on specific purposes or variations in expense categories. Some common variations include: 1. Travel Expense Account Form: Used to report expenses incurred during official business travel, including accommodation, transportation, meals, and incidental expenses. This form helps maintain clarity and accountability for travel-related expenses. 2. Mileage Expense Account Form: Specifically designed for employees who use their personal vehicles for business-related travel. This form allows employees to record the mileage covered, purpose of the trip, and associated expenses such as tolls or parking fees. 3. Entertainment Expense Account Form: Certain businesses or organizations may require a separate form for recording entertainment-related expenses, such as client meetings, business meals, or event expenses. This form ensures transparency and compliance with entertainment expense policies. 4. Miscellaneous Expense Account Form: For any additional expenses that do not fit into predefined categories, a miscellaneous expense form may be utilized. It caters to unexpected expenses or those that may be unique to a particular business or industry. Overall, the Tarrant Texas Expense Account Form serves as a vital tool to monitor and control expenditures, maintain financial records, and provide accurate reimbursement to employees or individuals undertaking business-related activities.

Tarrant Texas Expense Account Form

Description

How to fill out Tarrant Texas Expense Account Form?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Tarrant Expense Account Form, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Tarrant Expense Account Form from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Tarrant Expense Account Form:

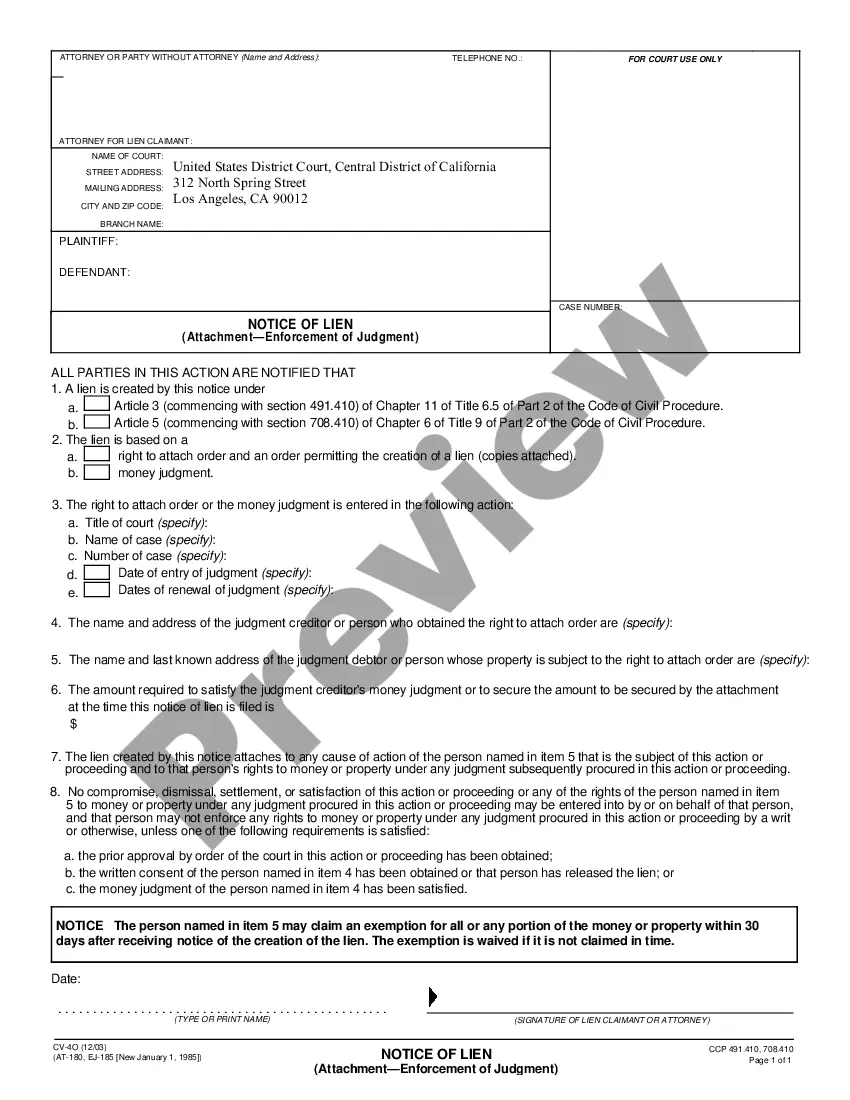

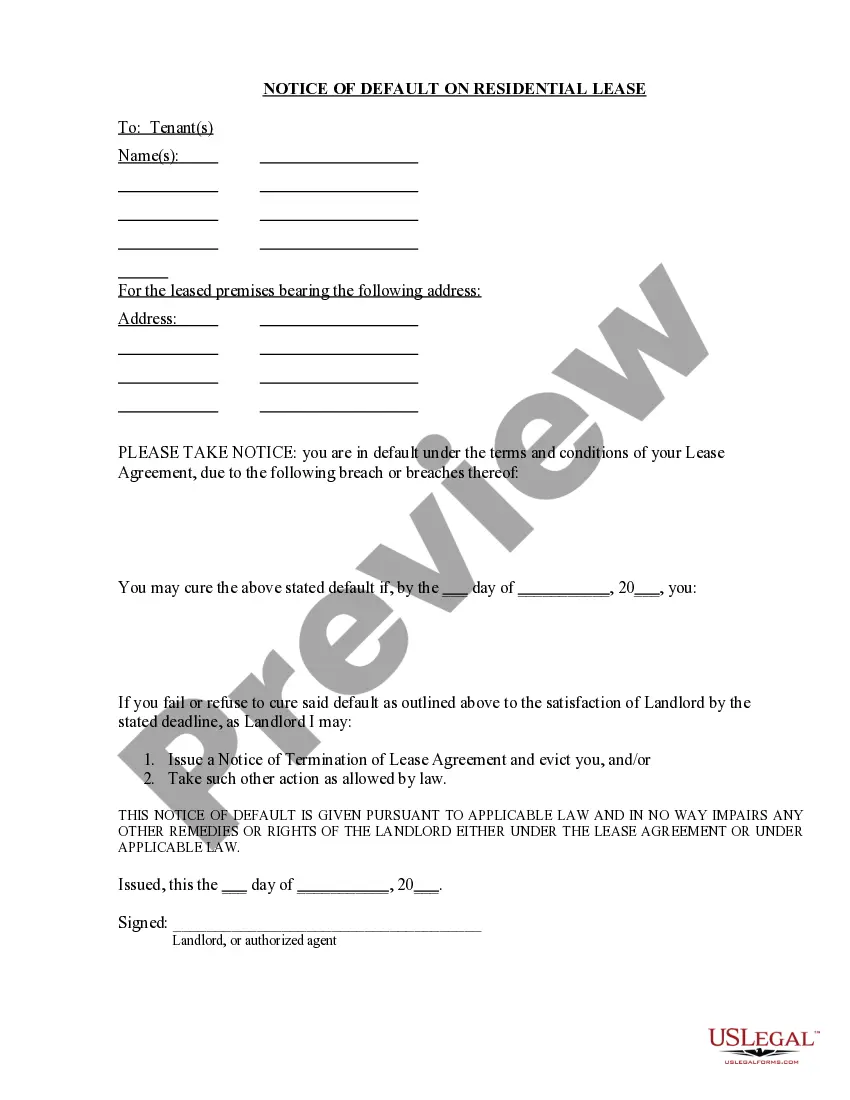

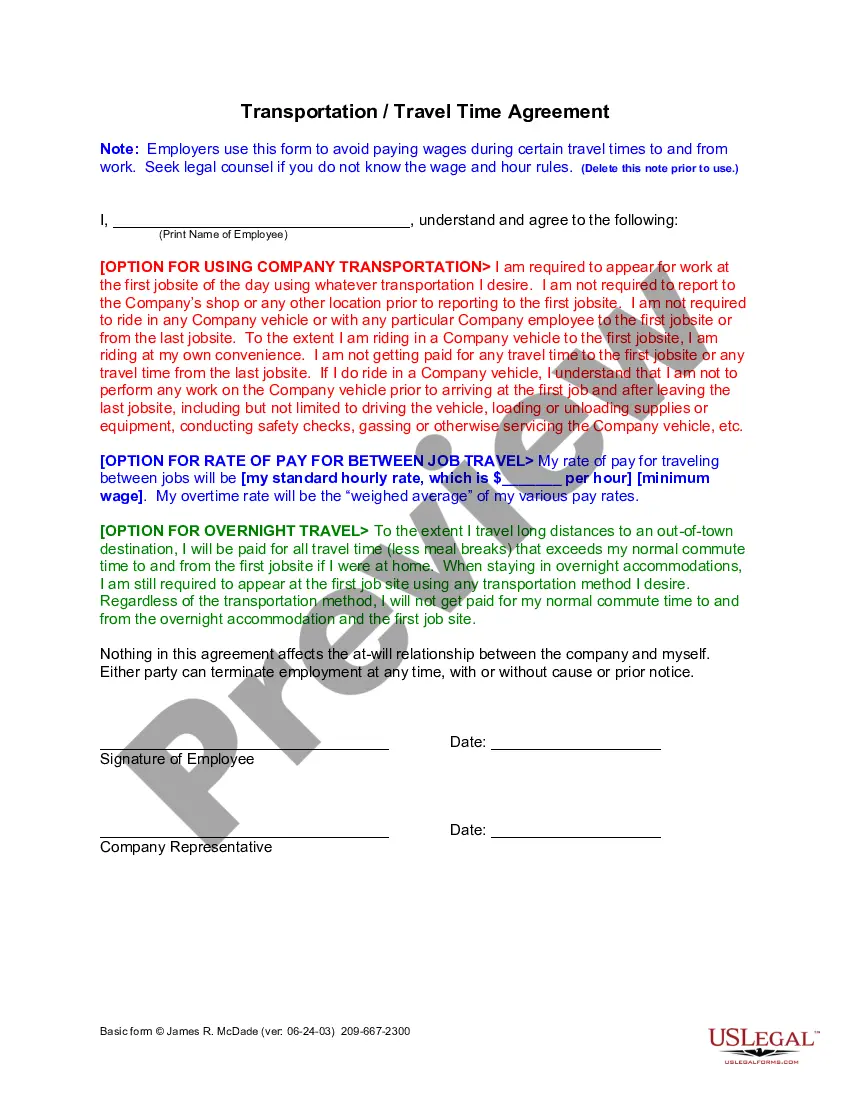

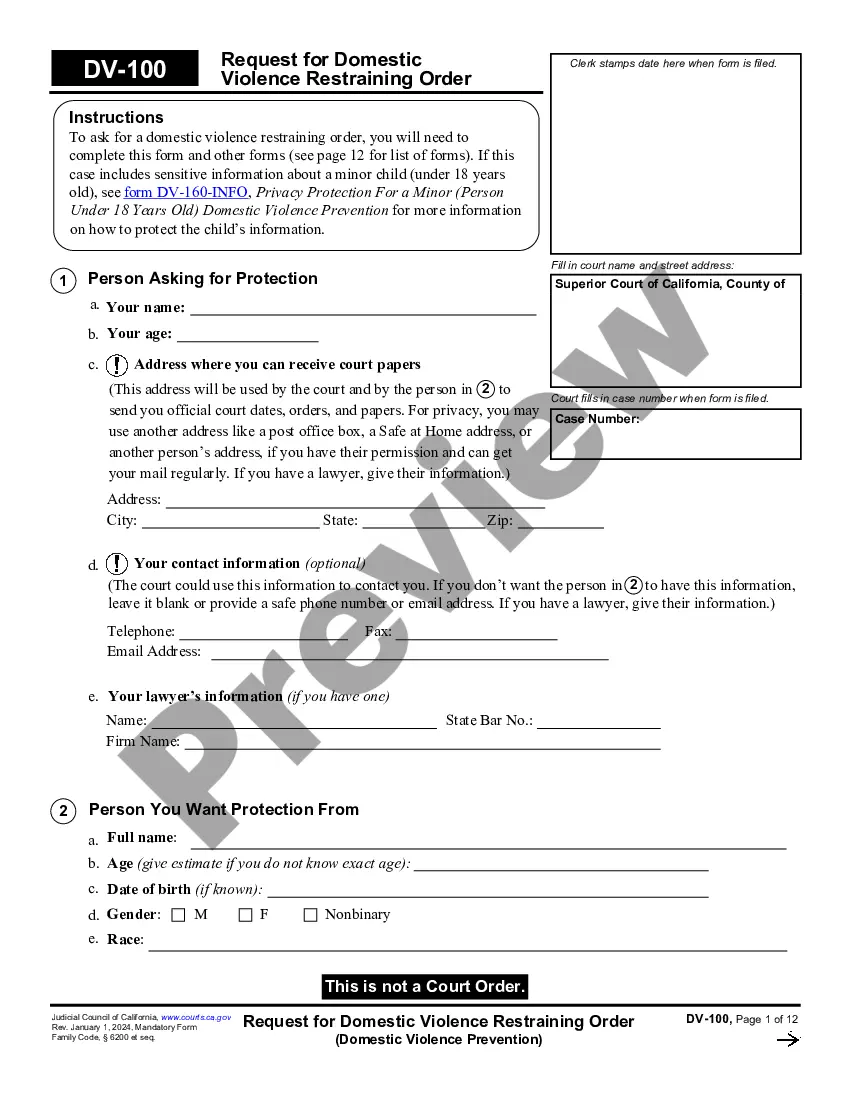

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

An application for a D.B.A. (Doing Business As) can be downloaded from the County Clerk's office via the internet listing for our Vital Statistics office or picked up in person at any of our office locations. The locations are: 200 Taylor Street, 3rd Floor, Fort Worth, TX. 6551 Granbury Rd, Ft.

Online Payments case. during regular business hours, Monday through Friday, a.m. to 5 p.m. (excluding weekends and County holidays). A 2.35 percent convenience fee, $1.50 minimum, payable to nCourt will apply. This will be shown as a separate transaction on your credit/debit card statement.

An Assumed Name / DBA (Doing Business as) should be filed with the County Clerk's Office in which business is to be conducted. Unincorporated assumed name certificate forms can be completed in person or submitted by mail if notarized.

Fort Worth TX Business Startup Checklist Overview: Create a Business Plan. Determine Legal Structure and Legal Formation. Obtain an EIN Number. Register for State Taxes and a State Tax ID. Apply for Local Business Licenses and Permits. Open a Business Bank Account. Set Up Accounting. Obtain Insurance.

Submit the DBA form to the Secretary of State. After signing the application and having it notarized, send it to the Secretary of State's office. The Secretary of State's address is: P.O. Box 13697, Austin, TX 78711-3697. Include a $25 fee with this application, either as a check or money order.

After you filled out the form you'll need to get your signature notarized or acknowledged. So don'tMoreAfter you filled out the form you'll need to get your signature notarized or acknowledged. So don't sign it until you're in front of a notary or someone who can officially test your signature.

An Assumed Name / DBA (Doing Business as) should be filed with the County Clerk's Office in which business is to be conducted. Unincorporated assumed name certificate forms can be completed in person or submitted by mail if notarized.

If the project is located in Tarrant county, then yes, you will want to record your lien with the Tarrant County Clerk's office.

Tarrant County Courthouse TX Business Startup Checklist Overview: Create a Business Plan. Determine Legal Structure and Legal Formation. Obtain an EIN Number. Register for State Taxes and a State Tax ID. Apply for Local Business Licenses and Permits. Open a Business Bank Account. Set Up Accounting. Obtain Insurance.

The fee is $6 for each copy. If you are the owner of an active Assumed Name (DBA) and need a replacement certificate, you can obtain the certificate by mail or in person at any Tarrant County Clerk office location. The fee is $6 for each replacement certificate.