The Dallas Texas Authority of Partnership to Open Deposit Account and to Procure Loans is a financial organization that allows partnerships in Dallas, Texas to access a wide range of banking services. This authority enables partnerships to open deposit accounts and avail loans to meet their financial needs. By partnering with the Dallas Texas Authority, businesses in Dallas can benefit from various services and opportunities. One of the primary functions of this authority is facilitating the opening of deposit accounts for partnerships. With these accounts, businesses can securely deposit their funds, earn interest, and efficiently manage their finances. In addition to deposit accounts, the Dallas Texas Authority of Partnership to Open Deposit Account and to Procure Loans offers partnerships the opportunity to procure loans. This service allows businesses to access capital for various purposes, such as expansion, purchasing new equipment, or funding operational expenses. Loans obtained through this authority often come with favorable terms and competitive interest rates, providing partnerships with the financial flexibility necessary for growth and success. The authority also offers different types of deposit accounts and loan options to cater to the diverse needs of partnerships. Some deposit account options include checking accounts, savings accounts, money market accounts, and certificates of deposit. Each account type offers unique features and benefits that partnerships can choose according to their specific requirements. Regarding loan options, partnerships can avail themselves of various types, such as business loans, working capital loans, equipment loans, and lines of credit. These loans can be customized based on the amount needed, the repayment period, and the purpose of the loan. Partnering with the Dallas Texas Authority of Partnership to Open Deposit Account and to Procure Loans brings several advantages. Firstly, it provides partnerships with a reliable and secure platform to manage their financial transactions. Secondly, partnerships can benefit from expert financial advice and guidance tailored to their needs. Lastly, partnerships gain access to a range of financial products and services that can contribute to their growth and success in the competitive business landscape of Dallas, Texas. In summary, the Dallas Texas Authority of Partnership to Open Deposit Account and to Procure Loans is a valuable financial institution for partnerships in Dallas, Texas. It allows businesses to open deposit accounts, obtain loans, and access a variety of financial services. The authority offers different types of deposit accounts and loan options, enabling partnerships to choose the best-suited options for their specific needs. Partnering with this authority can provide partnerships with financial stability, growth opportunities, and expert guidance for their business endeavors.

Dallas Texas Authority of Partnership to Open Deposit Account and to Procure Loans

Description

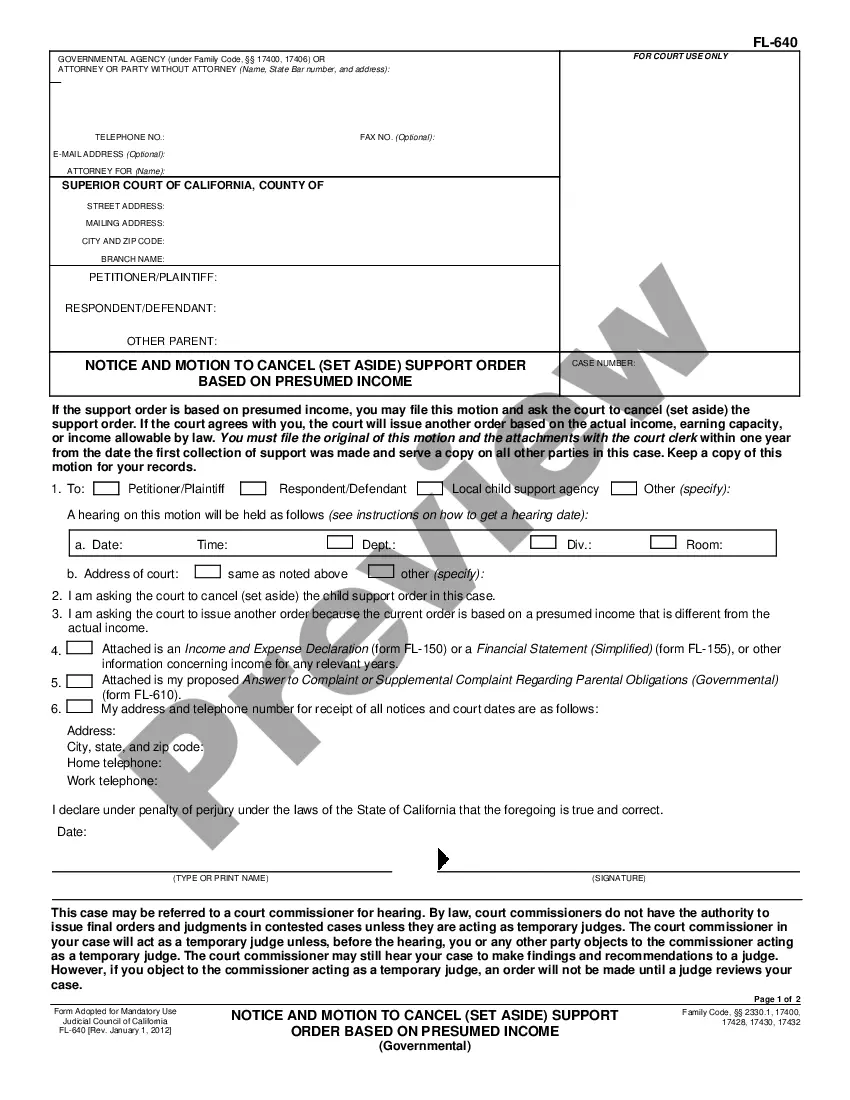

How to fill out Dallas Texas Authority Of Partnership To Open Deposit Account And To Procure Loans?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business case. All files are collected by state and area of use, so opting for a copy like Dallas Authority of Partnership to Open Deposit Account and to Procure Loans is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Dallas Authority of Partnership to Open Deposit Account and to Procure Loans. Follow the guide below:

- Make certain the sample meets your individual needs and state law regulations.

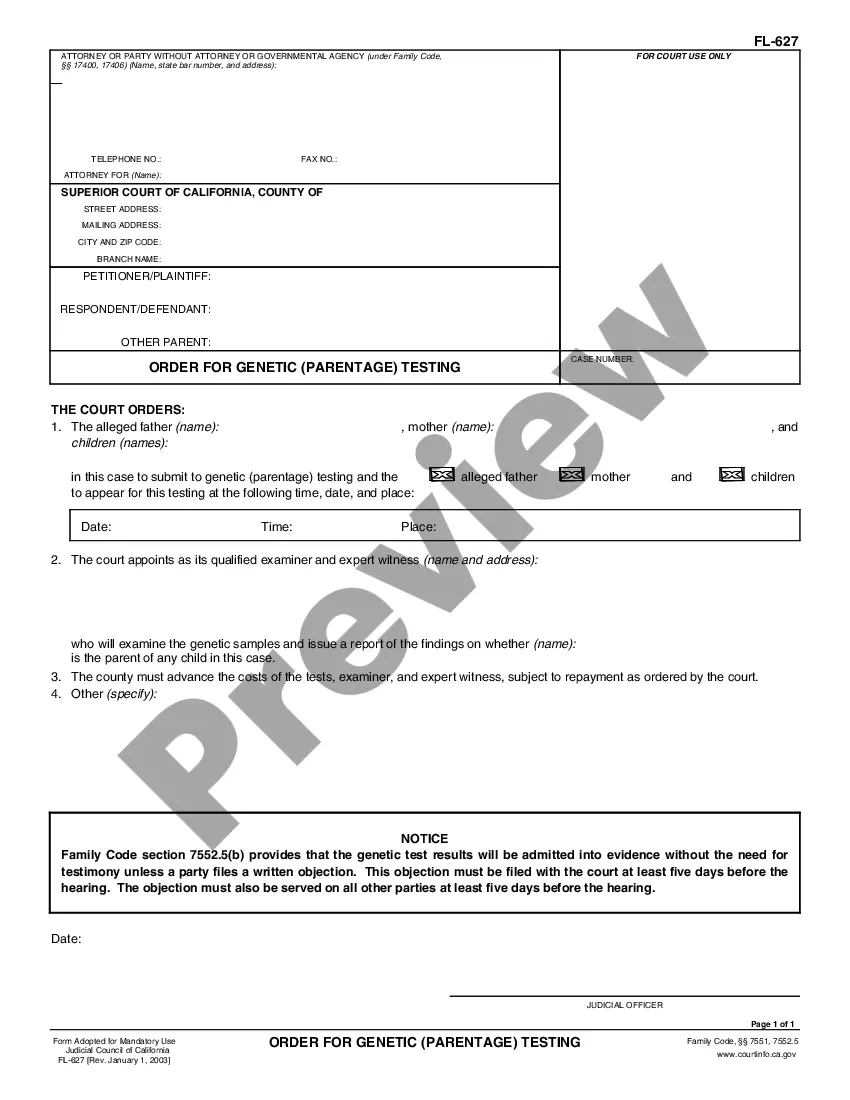

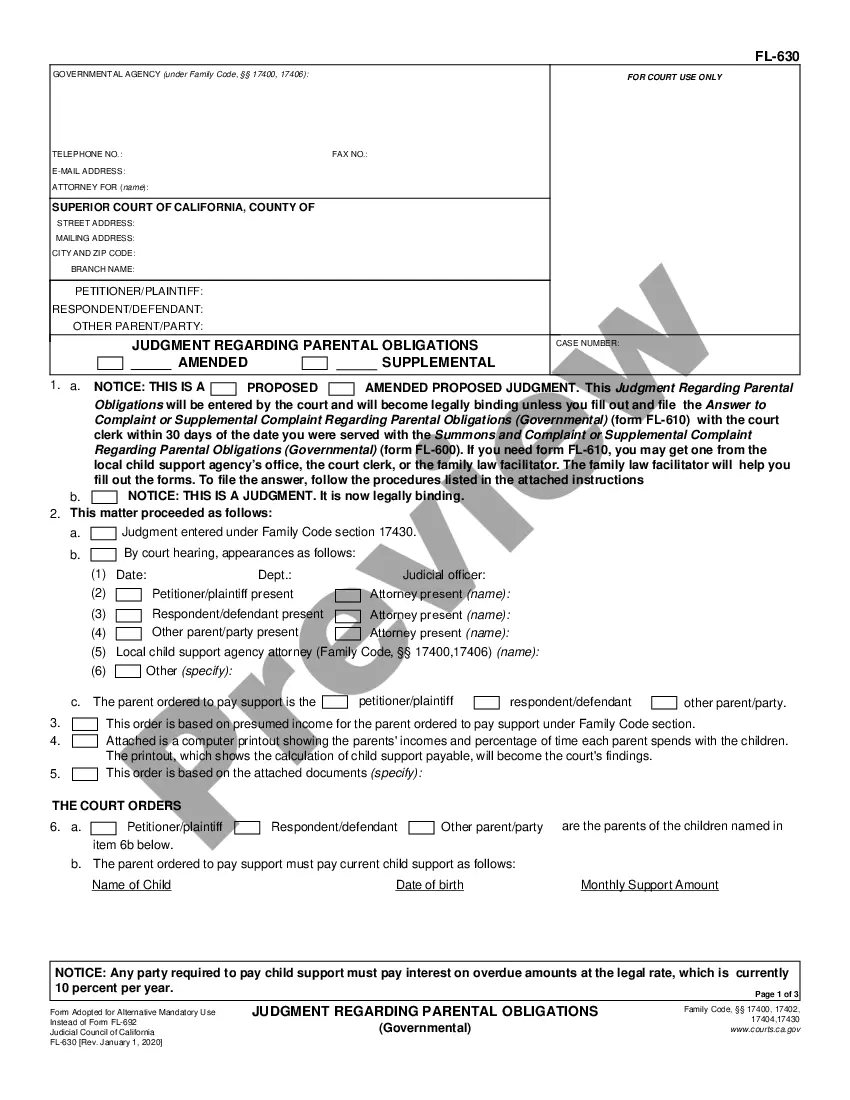

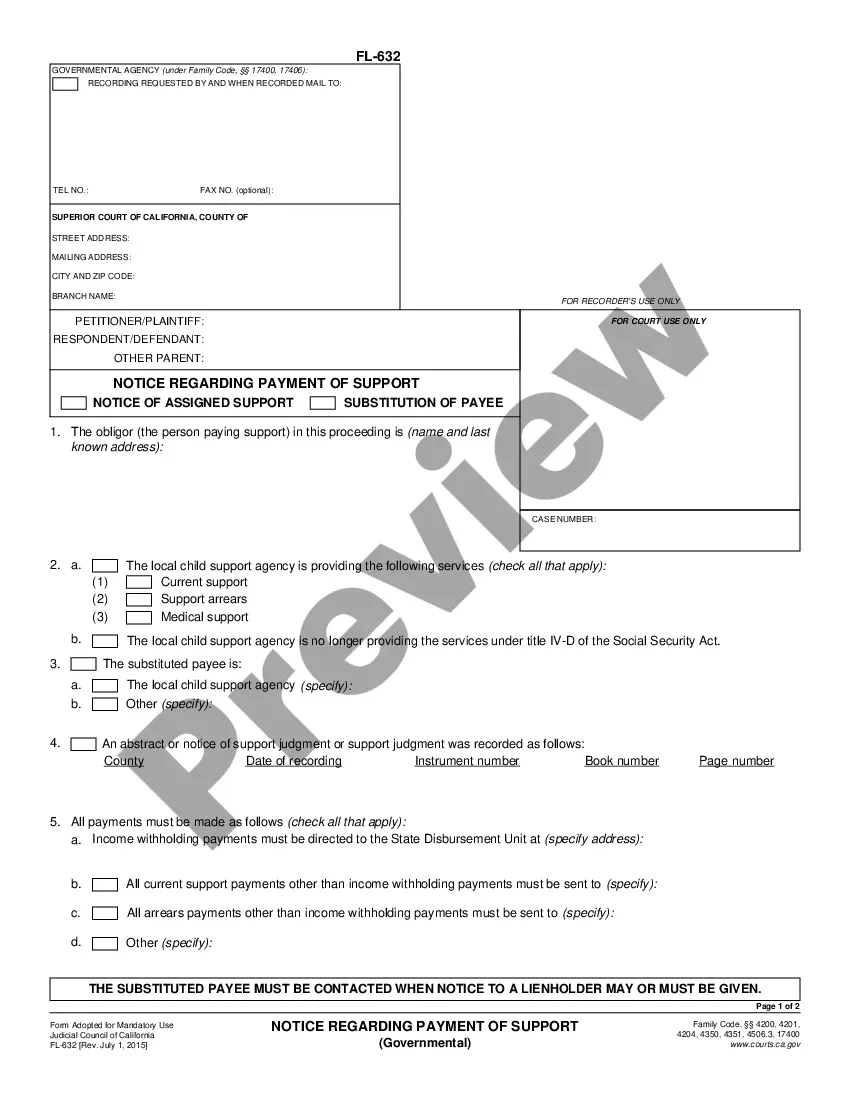

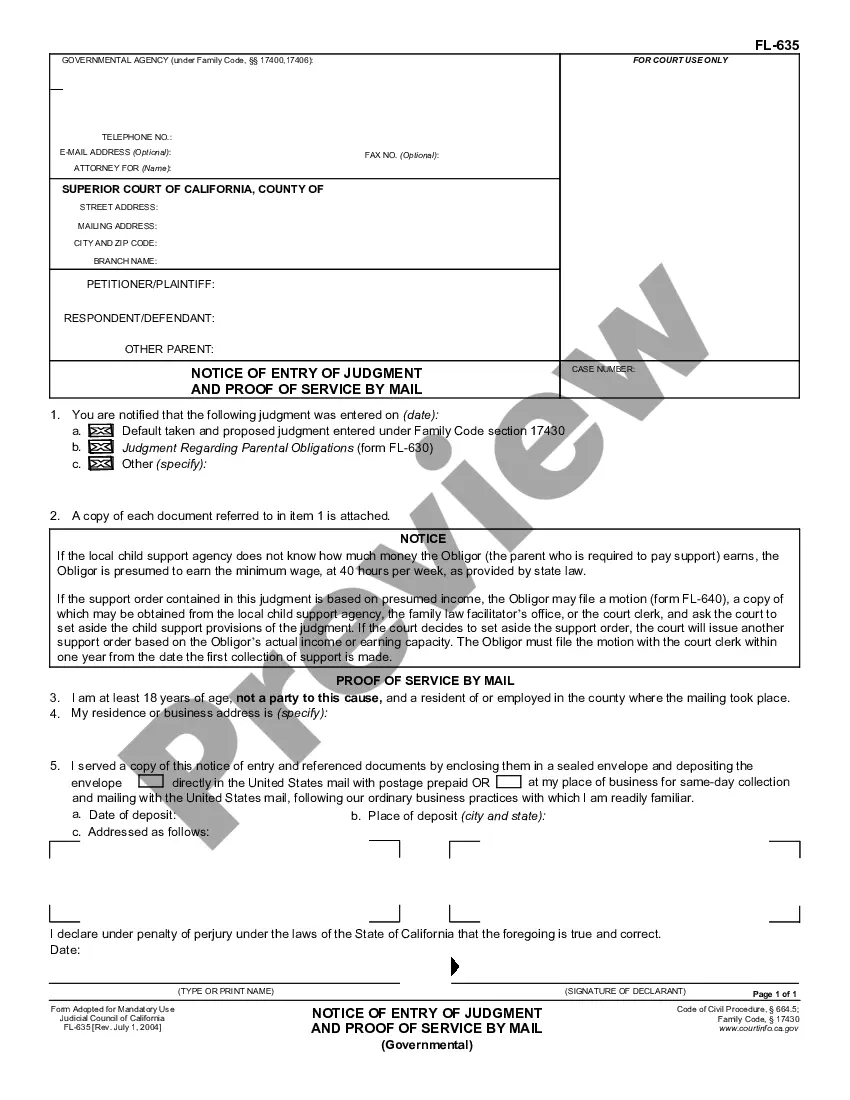

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Authority of Partnership to Open Deposit Account and to Procure Loans in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!