The Phoenix Arizona Authority of Partnership to Open Deposit Account and to Procure Loans refers to the legal framework that governs partnerships in Phoenix, Arizona, in regard to opening a deposit account and obtaining loans. This authority ensures that partnerships have the necessary means to conduct financial transactions and access capital to support their business operations. In Phoenix, Arizona, partnerships are required to establish an authority that allows them to open a deposit account with a financial institution. This account serves as a secure place to hold funds and manage the partnership's financial activities. By opening a deposit account, partnerships can easily receive and disburse payments, track transactions, and maintain a clear record of their financial standing. Furthermore, the authority also enables partnerships to procure loans from various lenders and financial institutions. Partnerships often require additional capital to expand their operations, invest in new ventures, or meet their financial obligations. By having the authority to procure loans, partnerships can access these financial resources to fuel their growth and support their business activities. The Phoenix Arizona Authority of Partnership to Open Deposit Account and to Procure Loans encompasses various types of partnerships, each with its distinct characteristics. These include general partnerships, limited partnerships, and limited liability partnerships. 1. General Partnerships: General partnerships involve two or more individuals who agree to carry out a business together. In this type of partnership, all partners have joint authority and are equally responsible for the partnership's debts and liabilities. General partnerships enjoy the authority to open a deposit account and procure loans to support their collective business activities. 2. Limited Partnerships: Limited partnerships consist of at least one general partner and one limited partner. General partners have unlimited liability and are actively involved in managing the partnership, while limited partners have limited liability and contribute capital without participating in the day-to-day operations. Both general and limited partners can benefit from the authority to open a deposit account and procure loans. 3. Limited Liability Partnerships (LLP): Limited Liability Partnerships offer partners limited personal liability protection. In this type of partnership, partners' personal assets are safeguarded in case of any partnership obligations or debts. Laps can also establish the authority to open a deposit account and procure loans, allowing them to fulfill their financial requirements while enjoying liability protection. In conclusion, the Phoenix Arizona Authority of Partnership to Open Deposit Account and to Procure Loans facilitates financial transactions for partnerships in Phoenix, Arizona. Whether it is opening a deposit account or obtaining loans, partnerships of various types can benefit from this authority to meet their financial needs and drive their business growth.

Phoenix Arizona Authority of Partnership to Open Deposit Account and to Procure Loans

Description

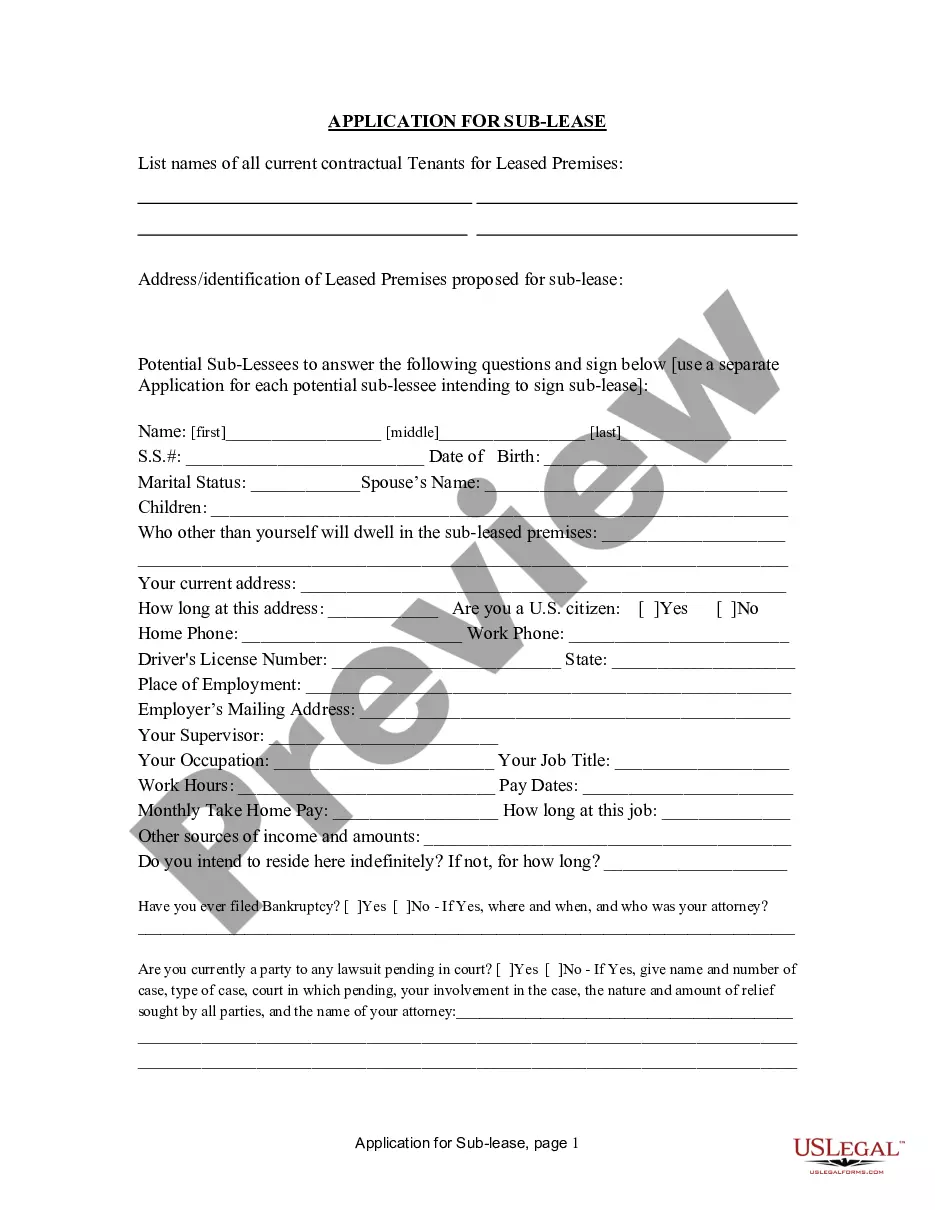

How to fill out Phoenix Arizona Authority Of Partnership To Open Deposit Account And To Procure Loans?

Whether you plan to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Phoenix Authority of Partnership to Open Deposit Account and to Procure Loans is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Phoenix Authority of Partnership to Open Deposit Account and to Procure Loans. Adhere to the instructions below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix Authority of Partnership to Open Deposit Account and to Procure Loans in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

The Community Reinvestment Act (CRA) requires banking regulators to assess bank and savings associations' record of helping to meet the credit needs of the communities in which they are chartered. Regulators must also consider an institution's record when evaluating certain corporate applications.

Banks may meet the criteria for CRA consideration in the lending, investment and services tests for offering financial inclusion programs. Activities that receive consideration include educational programs for low- and moderate-income families or loans and investments that incorporate a financial capability component.

The Community Reinvestment Act (CRA), enacted in 1977, requires the Federal Reserve and other federal banking regulators to encourage financial institutions to help meet the credit needs of the communities in which they do business, including low- and moderate-income (LMI) neighborhoods.

Bank Alfalah. Alfalah Home Finance is giving home loans in Pakistan on easy terms and conditions.HBL. Through 'HBL Home Loan,' you can apply for a loan amount starting Rs2 million to Rs.MCB. You can apply for a loan amount of up to Rs.Askari Bank.UBL.Bank Al Habib.JS Bank.Meezan Bank.

What is Commercial bank. As per the commercial bank definition, it is a financial institution whose purpose is to accept deposits from people and provide loans and other facilities. Commercial banks provide basic services of banking to their customers and small to medium-sized businesses.

A bank is a financial institution licensed to receive deposits and make loans. There are several types of banks including retail, commercial, and investment banks.

Those that accept deposits from customers?depository institutions?include commercial banks, savings banks, and credit unions; those that don't?nondepository institutions?include finance companies, insurance companies, and brokerage firms.

NBFCs lend and make investments and hence their activities are akin to that of banks; however there are a few differences as given below: i. NBFC cannot accept demand deposits; ii.

What is commercial bank? According to the commercial bank definition, it is a financial institution whose purpose is to accept deposits from customers and lend out loans.

In its role as a financial intermediary, a bank accepts deposits and makes loans. It derives a profit from the difference between the costs (including interest payments) of attracting and servicing deposits and the income it receives through interest charged to borrowers or earned through securities.