Queens New York Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Queens New York Authority Of Partnership To Open Deposit Account And To Procure Loans?

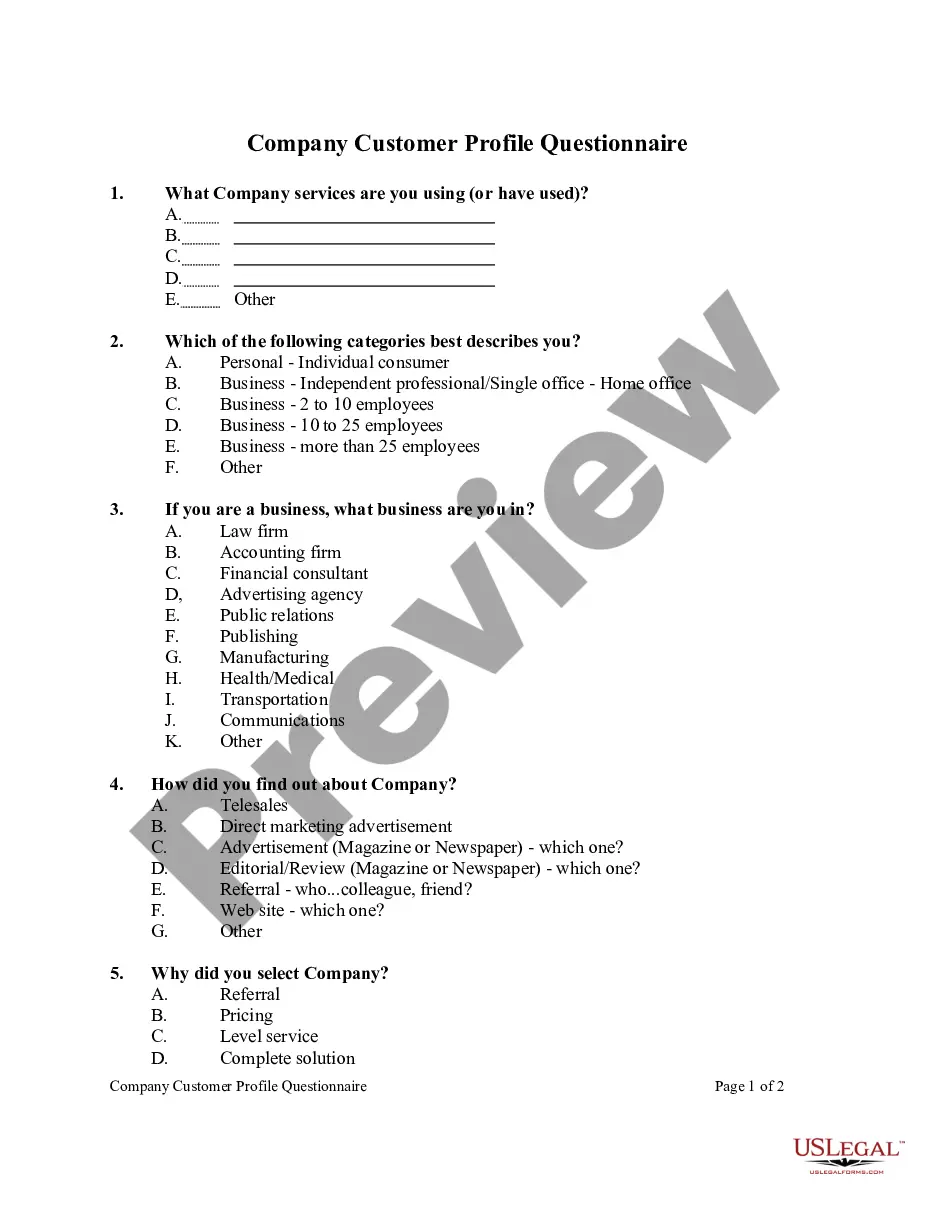

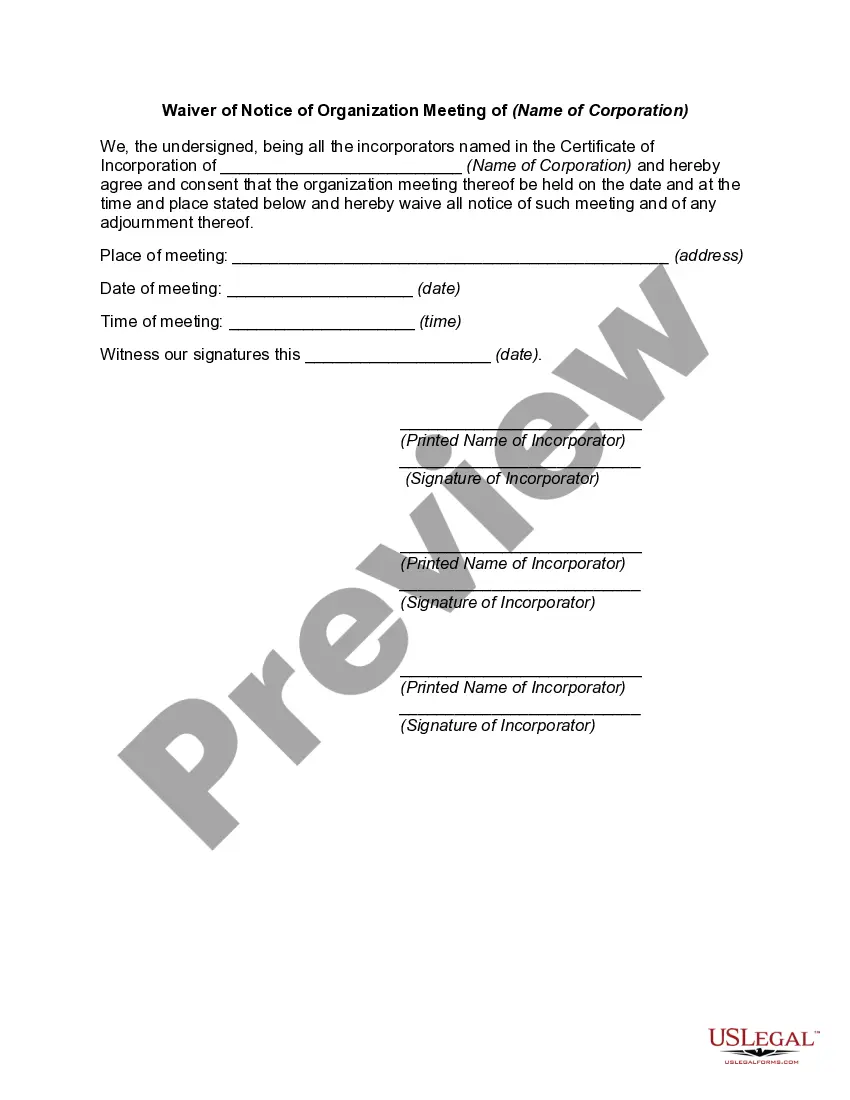

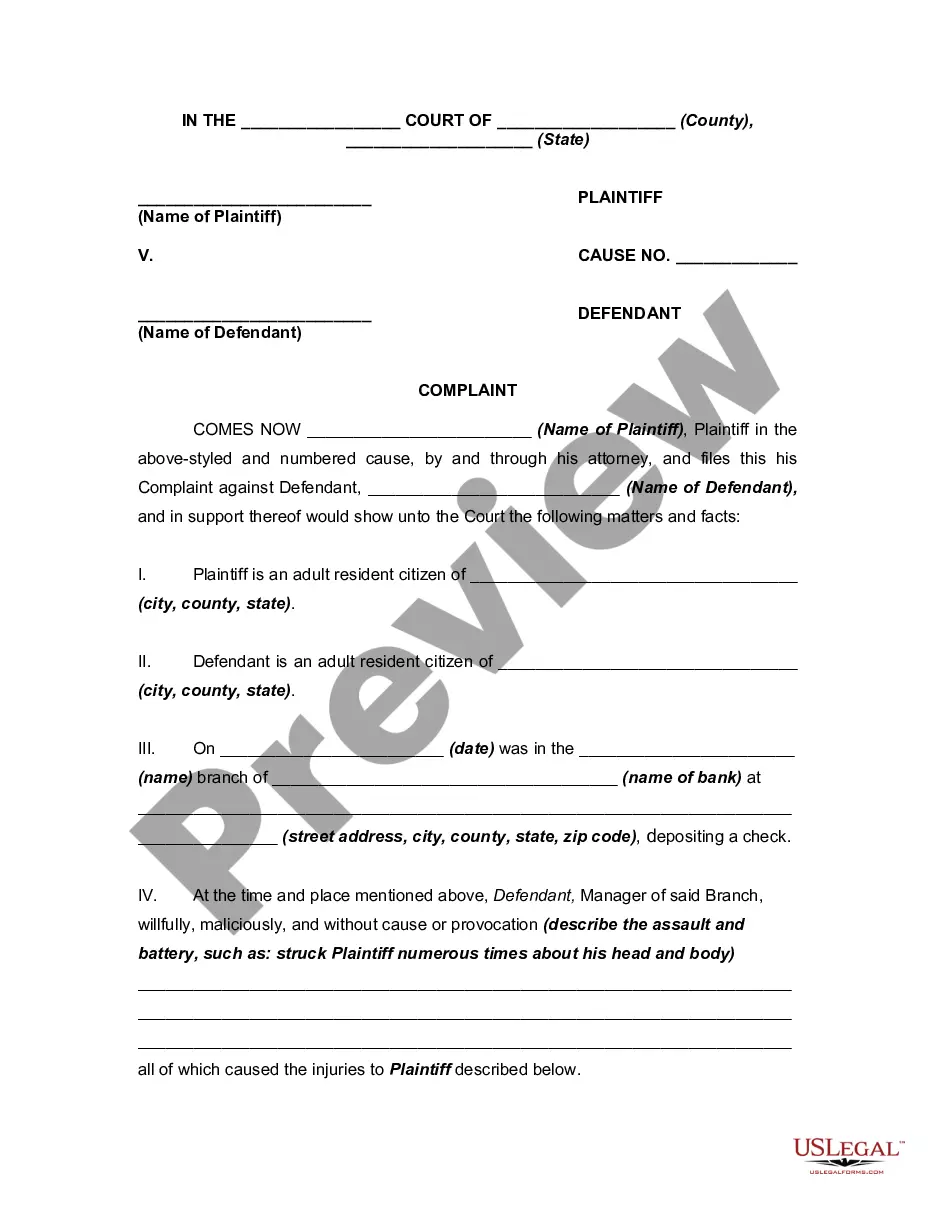

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Queens Authority of Partnership to Open Deposit Account and to Procure Loans, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Consequently, if you need the latest version of the Queens Authority of Partnership to Open Deposit Account and to Procure Loans, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Queens Authority of Partnership to Open Deposit Account and to Procure Loans:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Queens Authority of Partnership to Open Deposit Account and to Procure Loans and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

How to Form a New York Limited Partnership (in 6 Steps) Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Limited Partnership.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

If you have any corporate partners taxable under Article 9-A, or you have any partners that are partnerships or LLCs, you must also complete Form IT-204.1.

The Form IT-204-IP provided to you by your partnership lists your distributive share of any credits, credit components, credit factors, recapture of credits, and any other information reported by the partnership during the tax year. You need this information when completing your individual income tax return.

Reporting Partnership Income A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

Partnership Return; Description of Form IT-204. Used to report income, deductions, gains, losses and credits from the operation of a partnership.

If the due date falls on a Saturday, Sunday, or legal holiday, Form IT-204-LL and the annual filing fee may be filed on the next business day. If you fail to timely file Form IT-204-LL, or fail to pay the full amount of the filing fee by the due date, you may be subject to penalties and interest.

Line F1, Article 22: A partner that is an individual, partnership or LLC treated as partnership for federal purposes, a trust, or estate.

Limited Partnership (LP) A California LP may provide limited liability for some partners. There must be at least one general partner that acts as the controlling partner and one limited partner whose liability is normally limited to the amount of control or participation of the limited partner.

The completed Certificate of Limited Partnership, together with the filing fee of $200, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Key Takeaways. A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their investment. An LP is defined as having limited partners and a general partner, which has unlimited liability.