Salt Lake Utah Authority of Partnership to Open Deposit Account and to Procure Loans is a financial institution located in Salt Lake City, Utah. It is a recognized authority that provides partnership entities with the ability to open deposit accounts and procure loans for their business needs. As a trusted authority, Salt Lake Utah Authority of Partnership ensures a seamless and efficient process for partnership entities to establish deposit accounts. By opening a deposit account, businesses can securely store their funds while enjoying the benefits of interest accumulation and convenient transactional services. This allows partnership entities to effectively manage their finances and access funds when needed. In addition to deposit account services, the Salt Lake Utah Authority of Partnership also enables businesses to procure loans. Through this service, partnership entities can obtain the necessary funds to invest in their growth and expansion plans, capitalizing on new opportunities or covering unexpected expenses. With competitive interest rates and flexible repayment terms, the Authority strives to be a trusted partner in the financial success of these entities. The Salt Lake Utah Authority of Partnership offers various types of deposit accounts and loans to cater to the specific financial needs of partnership entities. These may include: 1. Business Checking Accounts: Designed for daily operational needs, this account provides partnership entities with convenient access to funds, check writing capabilities, and other essential banking services. 2. Savings Accounts: Partnership entities can open savings accounts to accumulate funds and earn interest over time. These accounts provide a secure and separate space for businesses to save profit or allocate funds for future investments. 3. Certificates of Deposit (CDs): The Authority also offers CDs, which are time deposits with fixed maturity dates and higher interest rates. This option allows partnership entities to lock in their funds for a specified period, ensuring steady growth of their savings. 4. Business Loans: Partnership entities can avail themselves of different types of loans such as term loans, lines of credit, or equipment financing. These loans cater to varying business needs, including expansion, working capital, equipment purchases, and more. Salt Lake Utah Authority of Partnership to Open Deposit Account and to Procure Loans understands the unique requirements of partnership entities and strives to provide tailored financial solutions to support their success. With a commitment to customer service and financial expertise, they aim to be the go-to financial partner for partnership entities in the Salt Lake City area.

Salt Lake Utah Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Salt Lake Utah Authority Of Partnership To Open Deposit Account And To Procure Loans?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Salt Lake Authority of Partnership to Open Deposit Account and to Procure Loans, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the current version of the Salt Lake Authority of Partnership to Open Deposit Account and to Procure Loans, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Authority of Partnership to Open Deposit Account and to Procure Loans:

- Look through the page and verify there is a sample for your region.

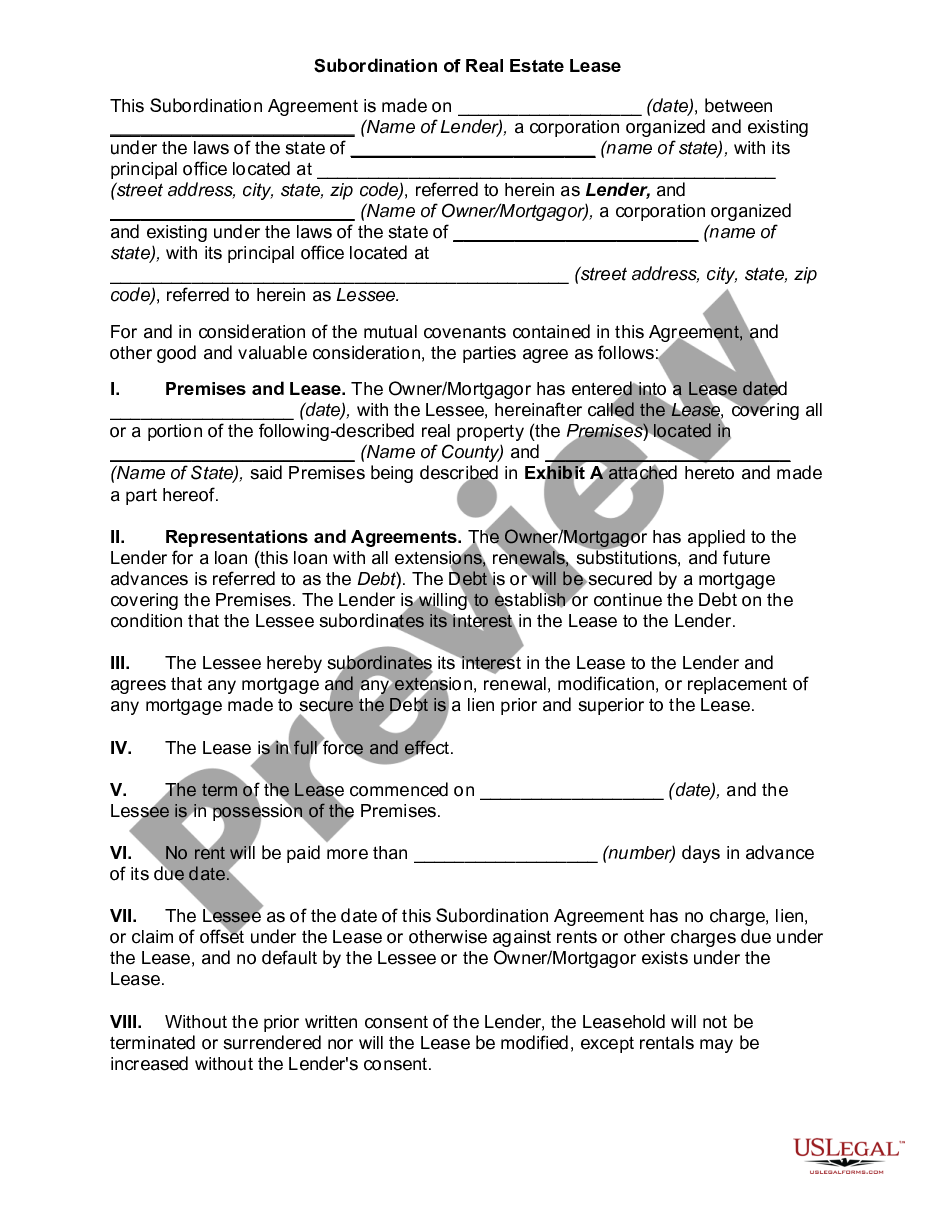

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Salt Lake Authority of Partnership to Open Deposit Account and to Procure Loans and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!