The Harris Texas Merger Agreement for Type A Reorganization is a legal document that outlines the terms and conditions of merging two companies in Harris County, Texas, under a specific type of reorganization, known as a Type A reorganization. This agreement sets forth the rights, obligations, and procedures that both parties must follow throughout the merger process. In a Type A reorganization, the two merging companies combine their assets, liabilities, and operations to form a new entity. This type of reorganization typically involves the transfer of the entire business or selected assets from one company to another, resulting in the surviving company holding all assets and assuming all liabilities of the merging companies. The Harris Texas Merger Agreement for Type A Reorganization includes various key components, such as: 1. Parties involved: The agreement identifies the merging companies and stipulates their respective roles in the merger process. It provides details regarding the surviving company and any subsidiary entities that may be created. 2. Terms and conditions: The agreement outlines the specific terms and conditions of the merger, including the effective date, duration, and any termination provisions. 3. Exchange of shares: If the merger involves a stock-for-stock transaction, the agreement specifies the exchange ratio of shares between the merging companies. This ensures fair treatment of shareholders and determines their ownership percentage in the surviving company. 4. Assets and liabilities: The agreement describes the assets, contracts, and liabilities that are transferred from the target company to the surviving company. It outlines the details of the due diligence process to be conducted to evaluate the value and condition of these assets and liabilities. 5. Transfer of employees: If the merger involves the transfer of employees, the agreement may include provisions related to employee benefits, retention, and potential redundancies. It may also outline the process for integrating the workforce and addressing any potential labor issues. Different types of Harris Texas Merger Agreement for Type A Reorganization may include: 1. Horizontal Merger Agreement: This type of merger involves the combination of two companies operating within the same industry or market segment. 2. Vertical Merger Agreement: This type of merger occurs between companies operating at different stages of the production or distribution chain, such as a manufacturer merging with a supplier or distributor. 3. Conglomerate Merger Agreement: This type of merger involves companies from unrelated industries or market segments merging to diversify their operations and gain synergies. 4. Reverse Merger Agreement: In this type of merger, a privately held company merges with a publicly traded company, allowing the private company to go public without a traditional initial public offering (IPO). In conclusion, the Harris Texas Merger Agreement for Type A Reorganization is a comprehensive legal document that defines the terms and procedures for merging two companies under a Type A reorganization. It covers various aspects of the merger, including the exchange of shares, assets and liabilities, employee transfers, and other relevant provisions.

Harris Texas Merger Agreement for Type A Reorganization

Description

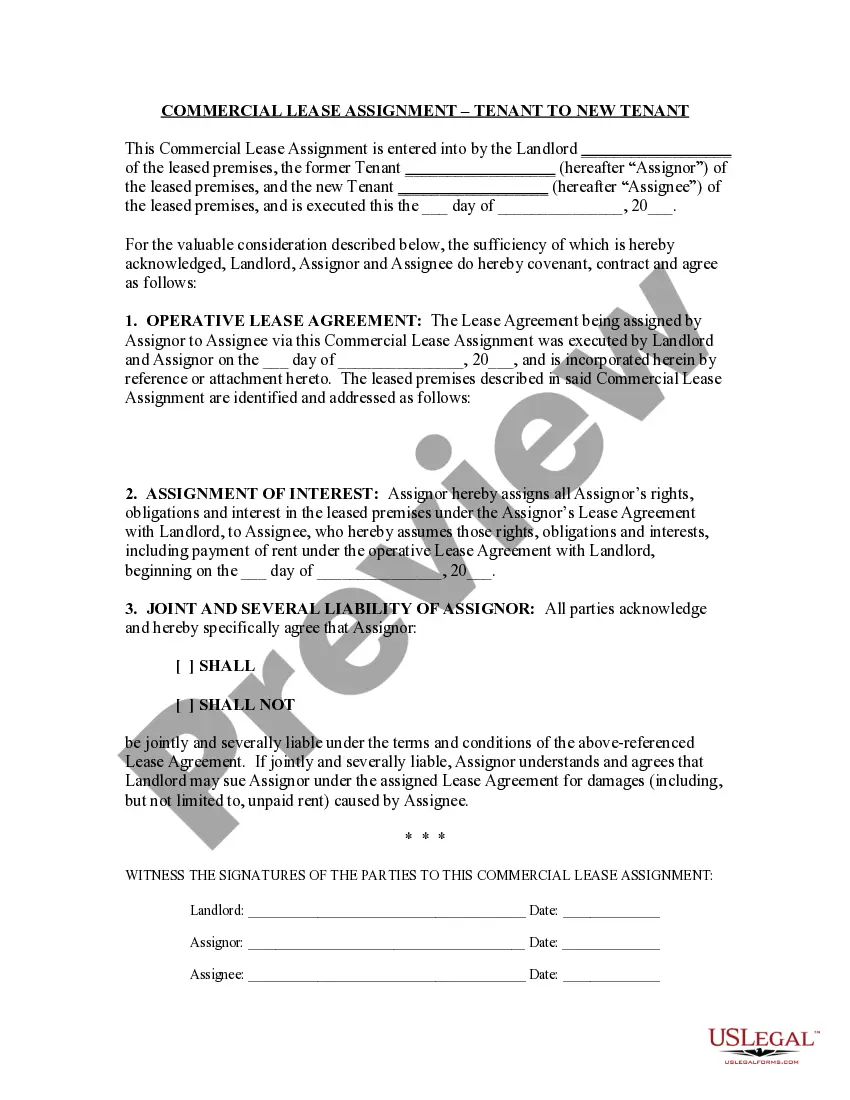

How to fill out Harris Texas Merger Agreement For Type A Reorganization?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, finding a Harris Merger Agreement for Type A Reorganization meeting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the Harris Merger Agreement for Type A Reorganization, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Harris Merger Agreement for Type A Reorganization:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Merger Agreement for Type A Reorganization.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!