Fairfax Virginia Receipt for Payment Discharging Undisputed Claim in Full of Acceptance by Creditor of Amount Less Than Claim is a legal document that signifies the settlement of a claim between a debtor and a creditor in the context of Fairfax, Virginia. The document serves as proof that the debtor has made a payment to the creditor, effectively releasing them from any further obligations related to the outstanding claim. This receipt includes specific information on the payment made by the debtor, the details of the claim being settled, and the acceptance by the creditor of an amount less than the total claim. There are various types of Fairfax Virginia Receipt for Payment Discharging Undisputed Claim in Full of Acceptance by Creditor of Amount Less Than Claim, including: 1. Consumer Debt Settlement Receipt: This type of receipt is typically used to settle a debt obligation arising from a consumer-related transaction, such as credit card debt, personal loans, or medical bills. 2. Business Debt Settlement Receipt: Businesses often use this type of receipt to resolve outstanding debts owed to suppliers, service providers, or vendors. 3. Real Estate Debt Settlement Receipt: In real estate transactions, this receipt may be utilized to discharge a claim related to a mortgage, home loan, or property-related debt. 4. Medical Debt Settlement Receipt: In cases where a medical service provider negotiates the settlement of an unpaid medical bill, this receipt is used to confirm the payment made by the patient to discharge the claim. 5. Commercial Debt Settlement Receipt: For businesses engaged in commercial transactions or contractual agreements, this receipt is employed to settle disputes or outstanding debts with other businesses. The Fairfax Virginia Receipt for Payment Discharging Undisputed Claim in Full of Acceptance by Creditor of Amount Less Than Claim should contain the following essential elements: 1. Creditor's Information: The name, address, and contact details of the creditor should be clearly stated in the receipt. 2. Debtor's Information: The receipt should include the name, address, and contact details of the debtor. 3. Claim Details: The specific details of the claim being settled should be outlined, including the date, nature, and amount of the claim. 4. Payment Information: The receipt should specify the payment made by the debtor, including the amount paid, the payment method used, and the date of payment. 5. Acceptance of Lesser Amount: The receipt should explicitly state that the creditor accepts the payment made by the debtor as a full and final settlement of the claim, despite the payment being less than the total amount claimed. 6. Signatures: The creditor and debtor must sign the receipt to validate the acceptance of the settlement terms. By utilizing a Fairfax Virginia Receipt for Payment Discharging Undisputed Claim in Full of Acceptance by Creditor of Amount Less Than Claim, both parties can ensure a legally binding settlement while providing documentation to protect their respective interests.

Fairfax Virginia Receipt for Payment Discharging Undisputed Claim in Full with Acceptance by Creditor of Amount Less Than Claim

Description

How to fill out Fairfax Virginia Receipt For Payment Discharging Undisputed Claim In Full With Acceptance By Creditor Of Amount Less Than Claim?

Drafting documents for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Fairfax Receipt for Payment Discharging Undisputed Claim in Full with Acceptance by Creditor of Amount Less Than Claim without expert help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Fairfax Receipt for Payment Discharging Undisputed Claim in Full with Acceptance by Creditor of Amount Less Than Claim on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Fairfax Receipt for Payment Discharging Undisputed Claim in Full with Acceptance by Creditor of Amount Less Than Claim:

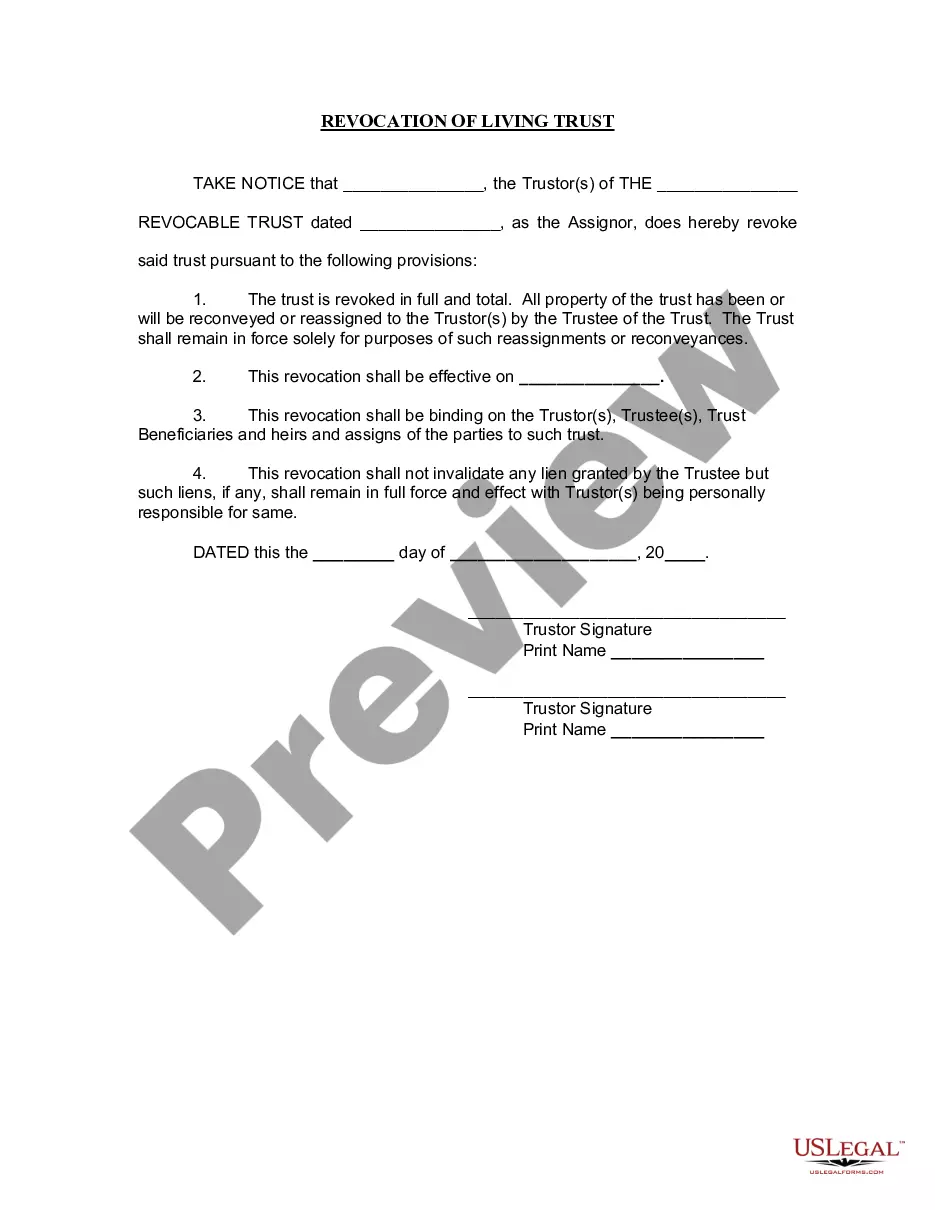

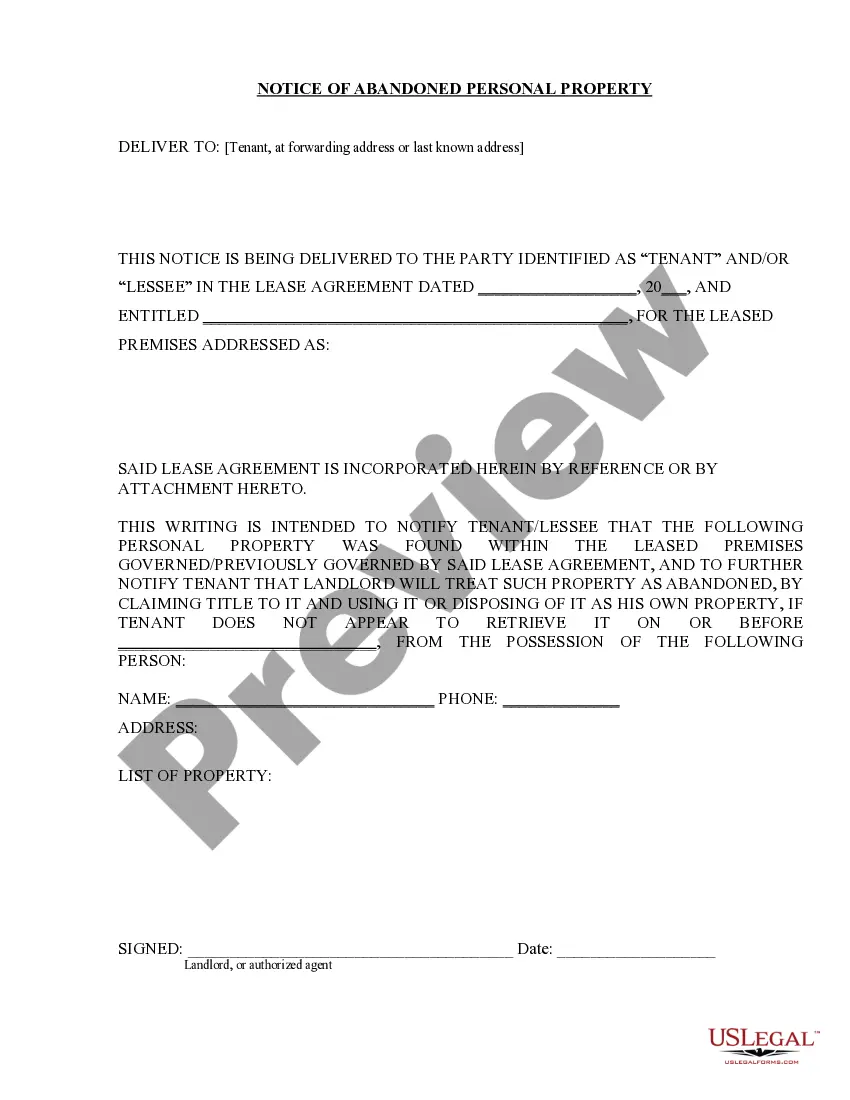

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

In Virginia, there is a statute of limitations, also known as the length of time debt collectors have to recover the unpaid debt. In a written contract, debt collectors generally have a five-year period to try and collect or take legal action. However, a three-year period applies for oral contracts.

Full and final settlement means that you ask your creditors to let you pay a lump sum instead of the full balance you owe on the debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt.

Your employer can't fire you the first time your wages are garnished. A garnishment is good for 30, 60, 90 or 180 days, at the choice of the judgment-creditor. The garnished money is under the control of the court until the garnishment period is over.

What Is Satisfaction and Release? Satisfaction and release is the formal paperwork stating that a consumer has paid the full amount owed under a court judgment. A satisfaction and release proves that they have paid their debt and prevents creditors from trying to recover more money from them.

A debtor cannot settle a claim by paying less than the full amount even if additional consideration is given. Past performance by one party to a contract is always legally sufficient consideration for a new promise by the second party.

F) Composition with Creditors - Occasionally a group of creditors will cooperatively agree to accept less than what they are entitled to, in full satisfaction of their claims against a debtor. In return, the debtor agrees not to file for bankruptcy. This is called a composition with creditors.

What is Past Consideration? In terms of a contract, past consideration is used to mean a promise or an act that was made or performed prior to a contract. Past consideration typically comes into play when someone is trying to enforce a new promise.

Full and final settlement means that you ask your creditors to let you pay a lump sum instead of the full balance you owe on the debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt.

Lesson 8-2: Questionable Consideration ABThe type of agreement that exists if two parties compromise on the amount of a debtaccord or satisfactiona settlement made by parties when the liability is unliquidatedreleasea group of creditors who agree to accept less than what they are entitled to from a debtorcomposition7 more rows

Under the new Virginia law that became effective January 1, 2022, judgments entered in a Virginia circuit court after July 1, 2021, have a 10-year limitations period and may only be extended up to two additional 10-year periods, for a maximum limitations period of 30 years.