The Harris Texas Debt Adjustment Agreement with Creditor is a legal document that outlines the terms and conditions for debt settlement between a debtor residing in Harris County, Texas, and their creditor. This agreement allows for the adjustment of the debtor's outstanding debt, aiming to find a mutually beneficial solution that satisfies both parties involved. The Harris Texas Debt Adjustment Agreement serves as a formal agreement between the debtor and the creditor, establishing the terms of repayment and any adjustments to the original debt amount. It provides a structured framework for resolving the debtor's financial obligations while offering some relief from the burdensome debt load. Keywords: Harris, Texas, Debt Adjustment Agreement, Creditor, debt settlement, debtor, Harris County, terms and conditions, outstanding debt, mutually beneficial solution, repayment plan, financial obligations, relief. Different types of Harris Texas Debt Adjustment Agreements with Creditor may include: 1. Lump Sum Settlement Agreement: This type of agreement involves the debtor making a one-time payment, usually for a reduced amount, to settle the debt in full. This allows the debtor to resolve their debt promptly, potentially avoiding further interest and penalties. 2. Installment Payment Plan Agreement: In this type of agreement, the debtor and creditor agree upon a specific repayment plan, typically spread over a period of time. The debtor makes regular installment payments until the debt is fully paid off, often with a reduced interest rate or lower monthly payment. 3. Debt Consolidation Agreement: This agreement involves combining multiple debts into a single, more manageable loan. The debtor secures new financing, often at a lower interest rate, to pay off all existing debts. It simplifies the repayment process by consolidating the debts into one monthly payment. 4. Debt Restructuring Agreement: This type of agreement allows for the restructuring of the debt, potentially modifying the interest rate, payment terms, or overall debt amount. The debtor and creditor collaborate to create a revised repayment plan that is more feasible for the debtor to meet their financial obligations. 5. Creditor Negotiated Settlement Agreement: In some cases, the creditor may be willing to negotiate a settlement for a reduced debt amount. This type of agreement involves the creditor agreeing to accept a lower payment to settle the debt, often due to financial hardship or to avoid legal complications. Ultimately, the specific type of Harris Texas Debt Adjustment Agreement with Creditor will vary depending on the unique circumstances of the debtor and creditor, their respective interests, and the goals they seek to achieve through the debt adjustment process. It is essential for both parties to carefully review and understand the terms and conditions before signing such an agreement.

Harris Texas Debt Adjustment Agreement with Creditor

Description

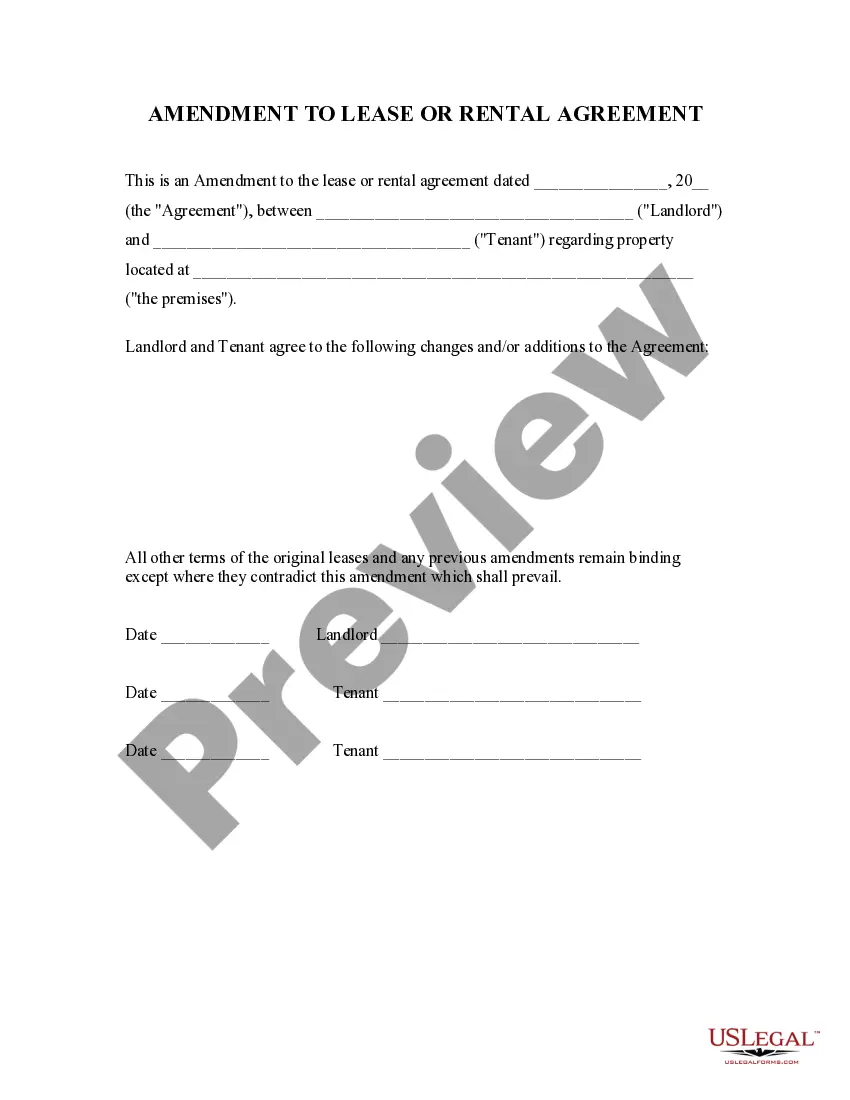

How to fill out Harris Texas Debt Adjustment Agreement With Creditor?

If you need to find a trustworthy legal paperwork provider to get the Harris Debt Adjustment Agreement with Creditor, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it easy to locate and complete different documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to look for or browse Harris Debt Adjustment Agreement with Creditor, either by a keyword or by the state/county the form is intended for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Harris Debt Adjustment Agreement with Creditor template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more affordable. Set up your first business, arrange your advance care planning, create a real estate contract, or execute the Harris Debt Adjustment Agreement with Creditor - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Believe it or not, though, it's possible to negotiate with a collection agent and end up paying less than you owe. Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don't have to recover the entire amount to make a profit.

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

Within 30 days of receiving the written notice of debt, send a written dispute to the debt collection agency. You can use this sample dispute letter (PDF) as a model. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt.

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

Offer a Lump-Sum Settlement If you decide to offer a lump sum to pay off the debt for less than you owe, understand that no general rule applies to all collection agencies. Some want 75%80% of what you owe. Others will take 50%, while others might settle for one-third or less.

Most collection agencies will accept an offer on a debt if it considers the offer a reasonable one. If the agency does not accept your first offer, consider a revision. Offer a different amount that may appeal to the agency and help facilitate the acceptance of a settlement offer.

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

Negotiate with the debt collector using your proposed repayment plan Explain your plan. When you talk to the debt collector, explain your financial situation.Record your agreement. Sometimes, debt collectors and consumers don't remember their conversations the same way.