Kings New York Debt Adjustment Agreement with Creditor — Understanding the Process and Types The Kings New York Debt Adjustment Agreement with Creditor is a legal arrangement designed to help individuals or businesses struggling with overwhelming debt find a feasible solution to repay their creditors. This agreement allows for negotiations and modifications to be made with the creditor in order to establish a manageable repayment plan. It is vital to understand the intricacies of this agreement, as it can play a significant role in one's financial well-being. Types of Kings New York Debt Adjustment Agreements with Creditors: 1. Debt Consolidation Agreement: In this type of agreement, multiple debts are combined into a single loan or repayment plan. The debtor works closely with a Kings New York debt adjustment professional to negotiate reduced interest rates or extended repayment terms. This streamlines the debt repayment process and helps the debtor avoid the hassle of managing multiple creditors. 2. Debt Modification Agreement: A debt modification agreement involves renegotiating the terms and conditions of the existing debt with the creditor. This typically includes lowering interest rates, reducing penalties, or extending the repayment period. The goal is to make the debt more manageable for the debtor, considering their current financial situation. 3. Debt Settlement Agreement: A debt settlement agreement enables debtors to pay off a portion of their debt to the creditor in exchange for the remaining balance being forgiven. Professional negotiators work on behalf of the debtor to reach a settlement amount that is agreeable to both parties. This option is often pursued when the debtor is unable to repay the full amount owed. 4. Debt Repayment Plan: The debt repayment plan is an agreement that sets out a structured payment schedule for the debtor. This plan is typically based on the debtor's ability to repay and usually involves fixed monthly payments over a specified period. The creditor agrees to this plan, provided it adequately addresses the outstanding debt and covers the interest. 5. Debt Management Agreement: A debt management agreement allows debtors to work with a credit counseling agency or debt management company to set up a repayment plan. The agency or company contacts the creditors on behalf of the debtor to negotiate reduced interest rates and affordable monthly payments. This agreement aims to help debtors regain control of their finances. In summary, Kings New York Debt Adjustment Agreement with Creditor encompasses various types of agreements that aim to alleviate the burden of excessive debt. These agreements can be customized to fit the unique financial circumstances of individuals and businesses seeking assistance. It is important to consult with professionals specializing in debt adjustment to explore the most suitable option based on personal circumstances and goals.

Kings New York Debt Adjustment Agreement with Creditor

Description

How to fill out Kings New York Debt Adjustment Agreement With Creditor?

Draftwing forms, like Kings Debt Adjustment Agreement with Creditor, to take care of your legal matters is a tough and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for a variety of cases and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Kings Debt Adjustment Agreement with Creditor template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before getting Kings Debt Adjustment Agreement with Creditor:

- Ensure that your template is specific to your state/county since the rules for writing legal documents may differ from one state another.

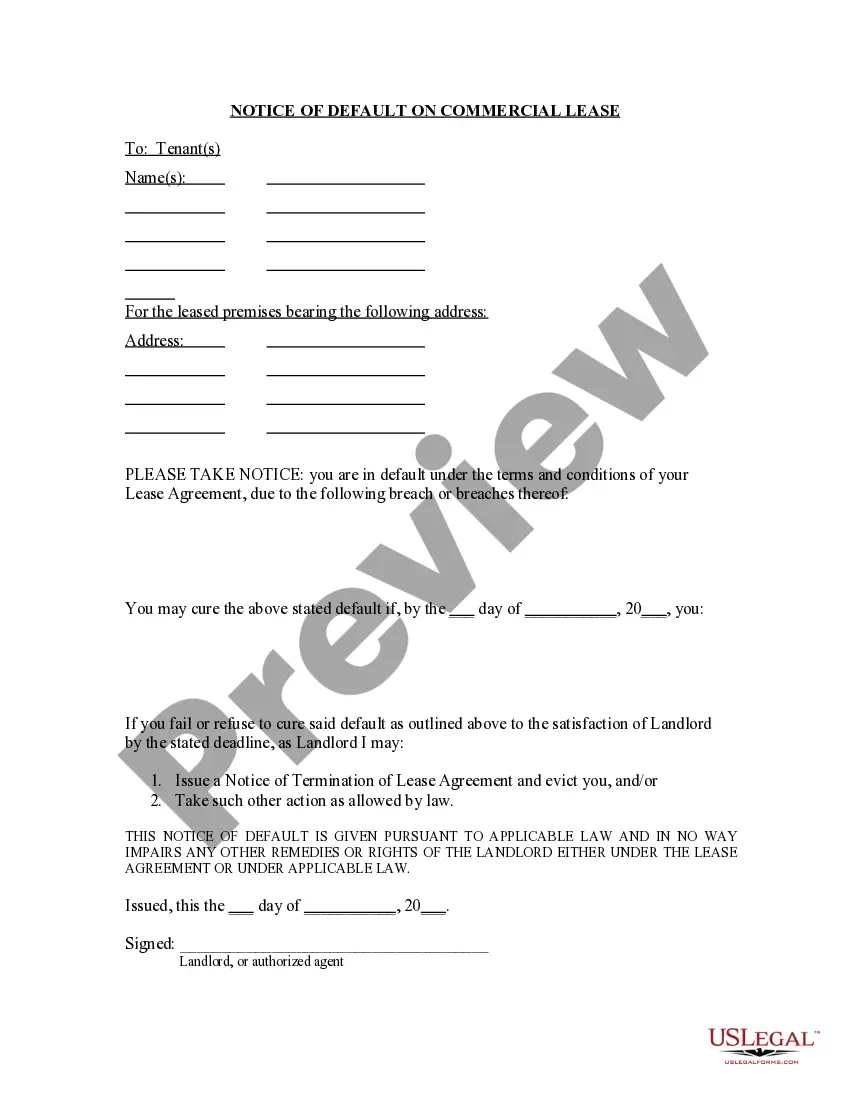

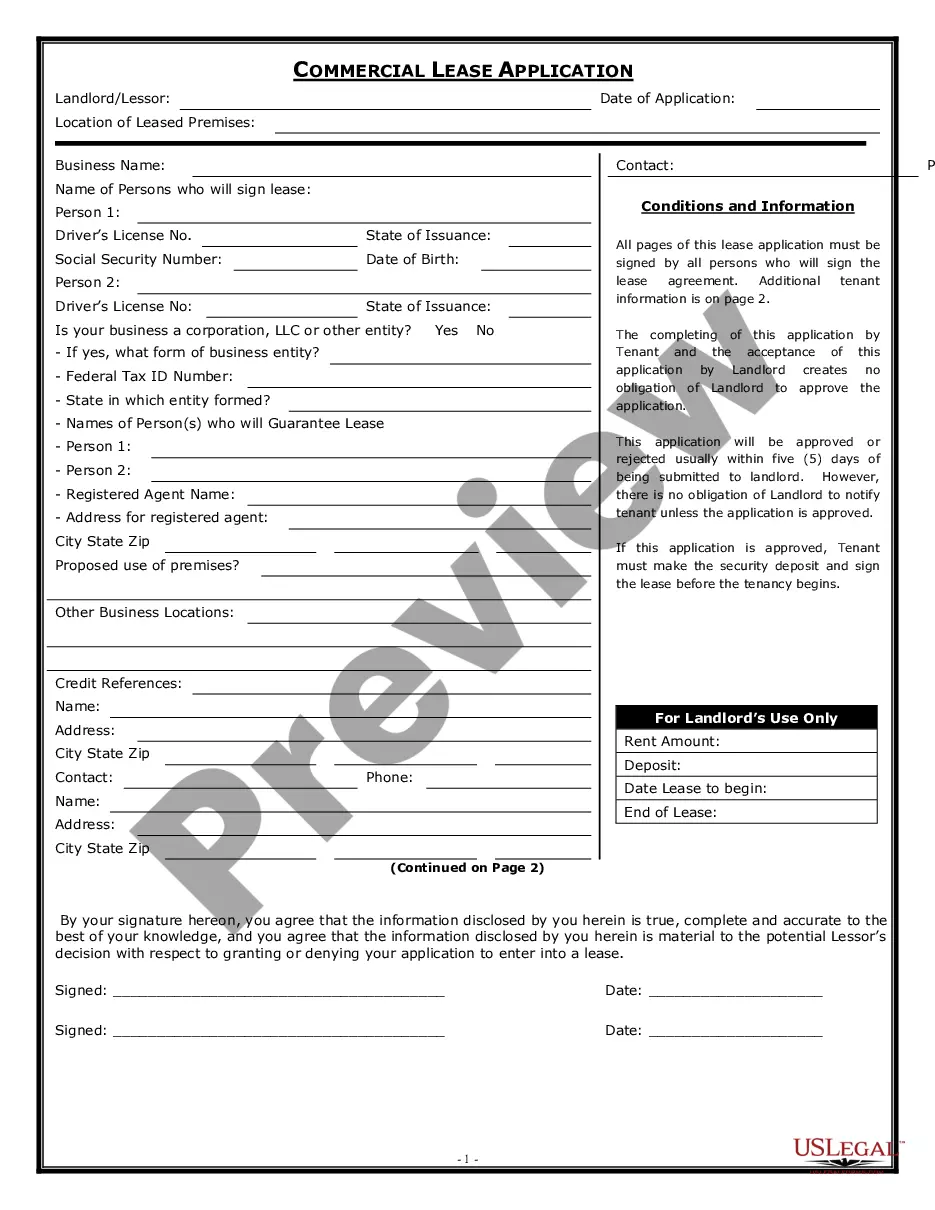

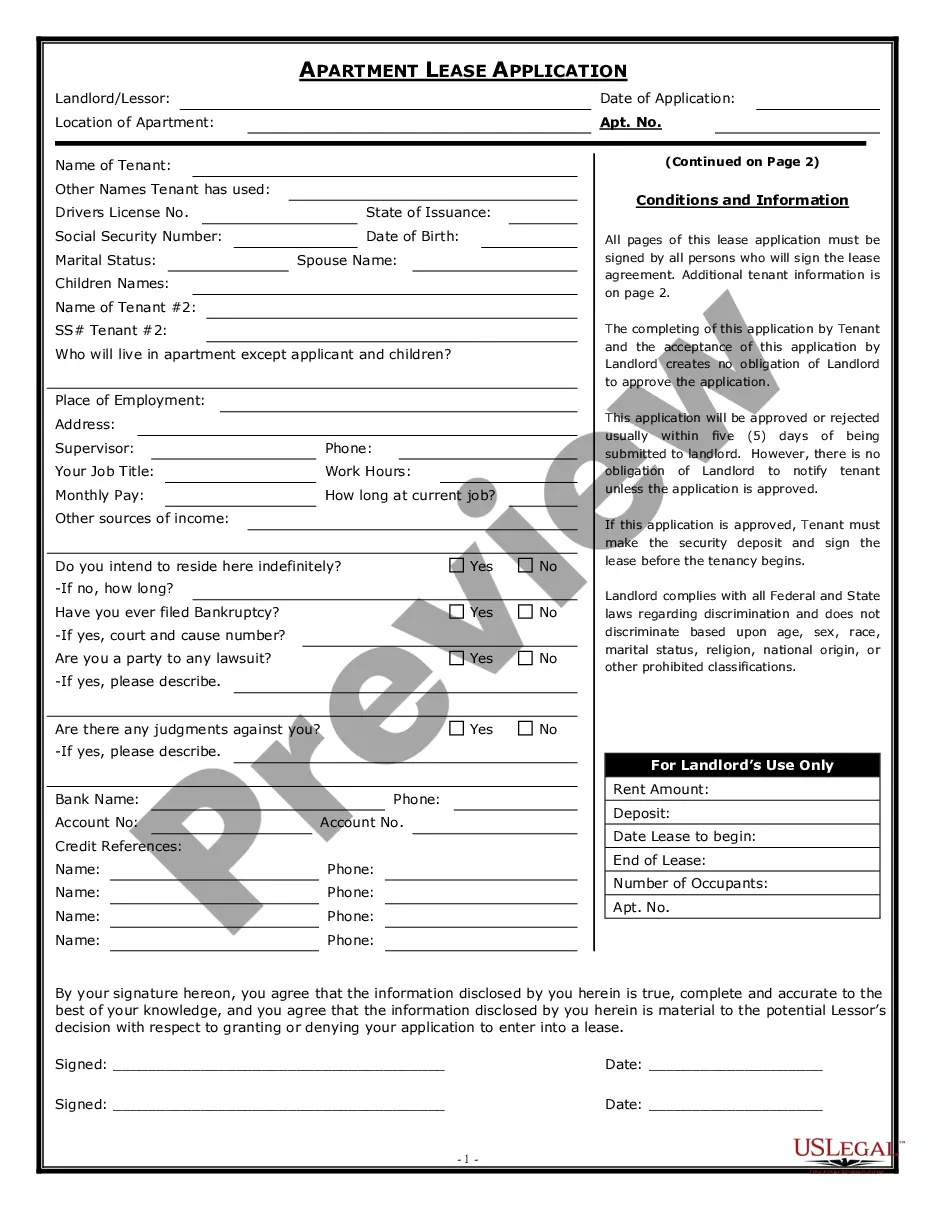

- Find out more about the form by previewing it or going through a quick intro. If the Kings Debt Adjustment Agreement with Creditor isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin utilizing our service and download the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!