Maricopa, Arizona Debt Adjustment Agreement with Creditor: A Comprehensive Overview In Maricopa, Arizona, a Debt Adjustment Agreement (DAA) with a creditor is a legal document that outlines the terms and conditions for restructuring debt payments in order to alleviate financial burdens faced by individuals or businesses. This agreement serves as a means to negotiate a more manageable payment plan with the creditor, allowing the debtor to regain control of their financial situation and avoid bankruptcy proceedings. Key Functions and Benefits of Maricopa, Arizona Debt Adjustment Agreement with Creditor: 1. Debt Restructuring: The primary objective of a DAA is to restructure the outstanding debts owed by the debtor to the creditor. This process involves modifying the existing payment terms, interest rates, and sometimes even the principal amount owed. By spreading the repayments over a longer period or reducing the interest rates, the debtor can achieve a more affordable monthly payment. 2. Avoidance of Bankruptcy: Undergoing a DAA with a creditor in Maricopa, Arizona, can be an effective alternative to filing for bankruptcy. Bankruptcy can have long-lasting negative consequences on one's credit score and financial reputation. By entering into a DAA, debtors can resolve their debts without the need for legal intervention, preserving their credit score and financial standing. 3. Reduction of Financial Stress: Unmanageable debts can have a significant impact on mental and emotional well-being. Maricopa Debt Adjustment Agreements with creditors provide relief from this stress by providing a feasible plan to repay debts. By negotiating reasonable terms, debtors are better able to fulfill their obligations and experience a sense of financial stability. Different Types of Maricopa, Arizona Debt Adjustment Agreements with Creditors: 1. Individual Debt Adjustment Agreement: Designed for individuals struggling with personal debts, this type of DAA focuses on restructuring personal loans, credit card debts, medical bill payments, and other non-business related liabilities. 2. Business Debt Adjustment Agreement: Aimed at assisting struggling businesses, this DAA type focuses on resolving commercial debts, including business loans, lines of credit, supplier payments, and other financial obligations related to business operations. 3. Creditor-Specific Debt Adjustment Agreement: In certain cases, debtors may work out unique Debt Adjustment Agreements that cater to the specific requirements of a creditor. These agreements may entail a tailored repayment plan or other provisions that address the creditor's concerns while ensuring the debtor's financial recovery. Maricopa, Arizona provides a legal framework to support debtors in negotiating Debt Adjustment Agreements with their creditors. However, it is crucial for both parties to consult legal experts or credit counseling agencies to ensure compliance with applicable laws and regulations while undertaking this process. In conclusion, a Maricopa, Arizona Debt Adjustment Agreement with a Creditor offers debtors an opportunity to restructure their debts, avoid bankruptcy, and regain financial stability. By negotiating viable terms with creditors, individuals and businesses can alleviate their financial burdens and pave the way for a brighter financial future.

Maricopa Arizona Debt Adjustment Agreement with Creditor

Description

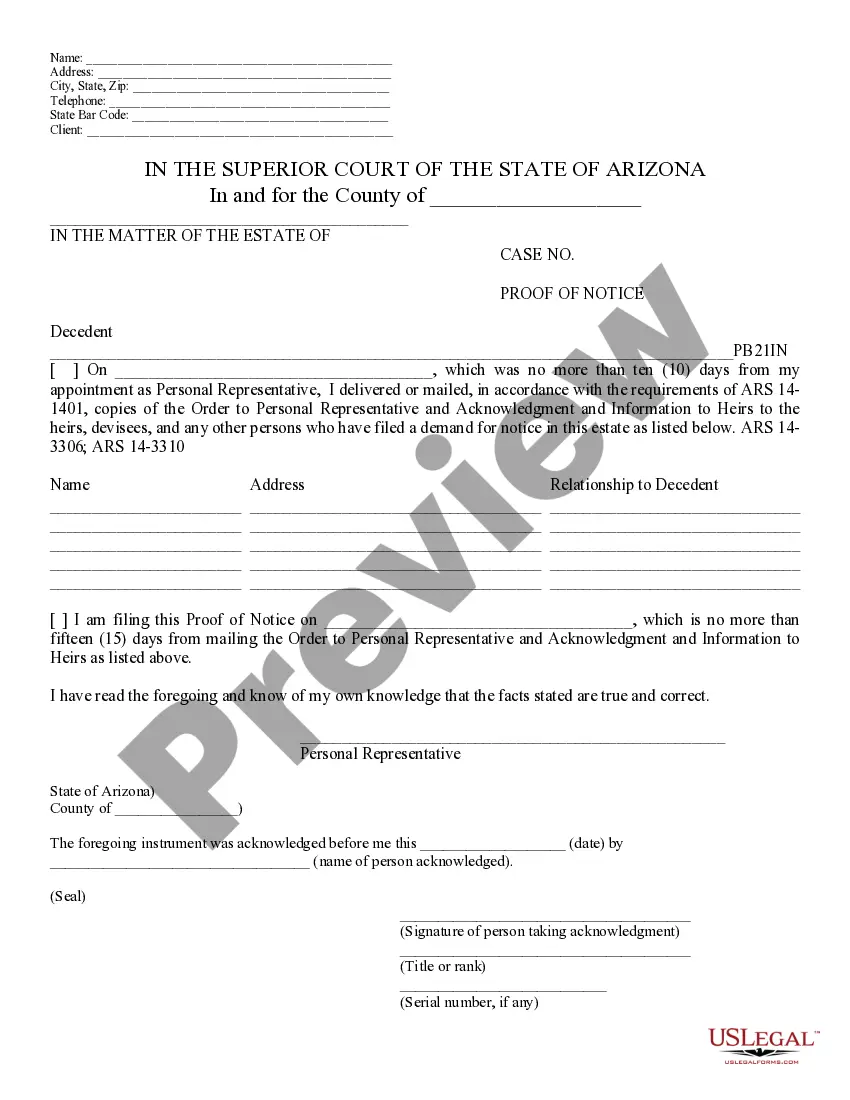

How to fill out Maricopa Arizona Debt Adjustment Agreement With Creditor?

Creating paperwork, like Maricopa Debt Adjustment Agreement with Creditor, to manage your legal matters is a tough and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task expensive. However, you can get your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for different scenarios and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Maricopa Debt Adjustment Agreement with Creditor form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before getting Maricopa Debt Adjustment Agreement with Creditor:

- Ensure that your form is specific to your state/county since the rules for creating legal paperwork may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Maricopa Debt Adjustment Agreement with Creditor isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our website and download the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!