A Salt Lake Utah Debt Adjustment Agreement with a Creditor refers to a formal arrangement made between an individual or business in Salt Lake City, Utah, and their creditors in order to address and manage outstanding debts. This agreement is entered into when the debtor is struggling to make timely payments or has fallen behind on their obligations. There are various types of Debt Adjustment Agreements that can be negotiated and tailored to meet the specific needs of both debtors and creditors. Some common types include: 1. Debt Consolidation Agreement: This type of agreement involves consolidating multiple debts into a single loan or account, usually with a lower interest rate. By combining debts, the debtor can streamline their payments and potentially reduce their overall debt burden. 2. Debt Settlement Agreement: In a debt settlement agreement, the debtor negotiates with the creditor to settle the debt for a reduced amount. This can help debtors with significant financial hardships or those who are unable to repay the full amount owed. The creditor agrees to accept a lesser sum in full settlement of the debt, and the debtor makes a one-time payment or negotiates a structured repayment plan. 3. Debt Management Plan: A debt management plan is an arrangement where a credit counseling agency works with the debtor and the creditor to create a structured plan to repay debt over an extended period. The debtor makes monthly payments to the credit counseling agency, which then distributes the funds to the creditors. This type of agreement often includes negotiating lower interest rates, waiving fees, and creating affordable repayment terms. 4. Chapter 13 Bankruptcy: In certain cases, debtors may file for Chapter 13 bankruptcy in Salt Lake City. This allows them to create a court-approved repayment plan to repay their debts over a period of three to five years. It helps debtors who have a stable income but are unable to meet their current financial obligations. The agreement may involve repaying a portion of the debt while discharging the remaining balance. In conclusion, a Salt Lake Utah Debt Adjustment Agreement with a Creditor is a crucial tool for debtors and creditors in managing outstanding debts. The specific type of agreement will depend on the financial circumstances of the debtor and the willingness of the creditor to negotiate. It is essential for both parties to seek professional advice and support to ensure a fair and mutually beneficial agreement is reached.

Salt Lake Utah Debt Adjustment Agreement with Creditor

Description

How to fill out Salt Lake Utah Debt Adjustment Agreement With Creditor?

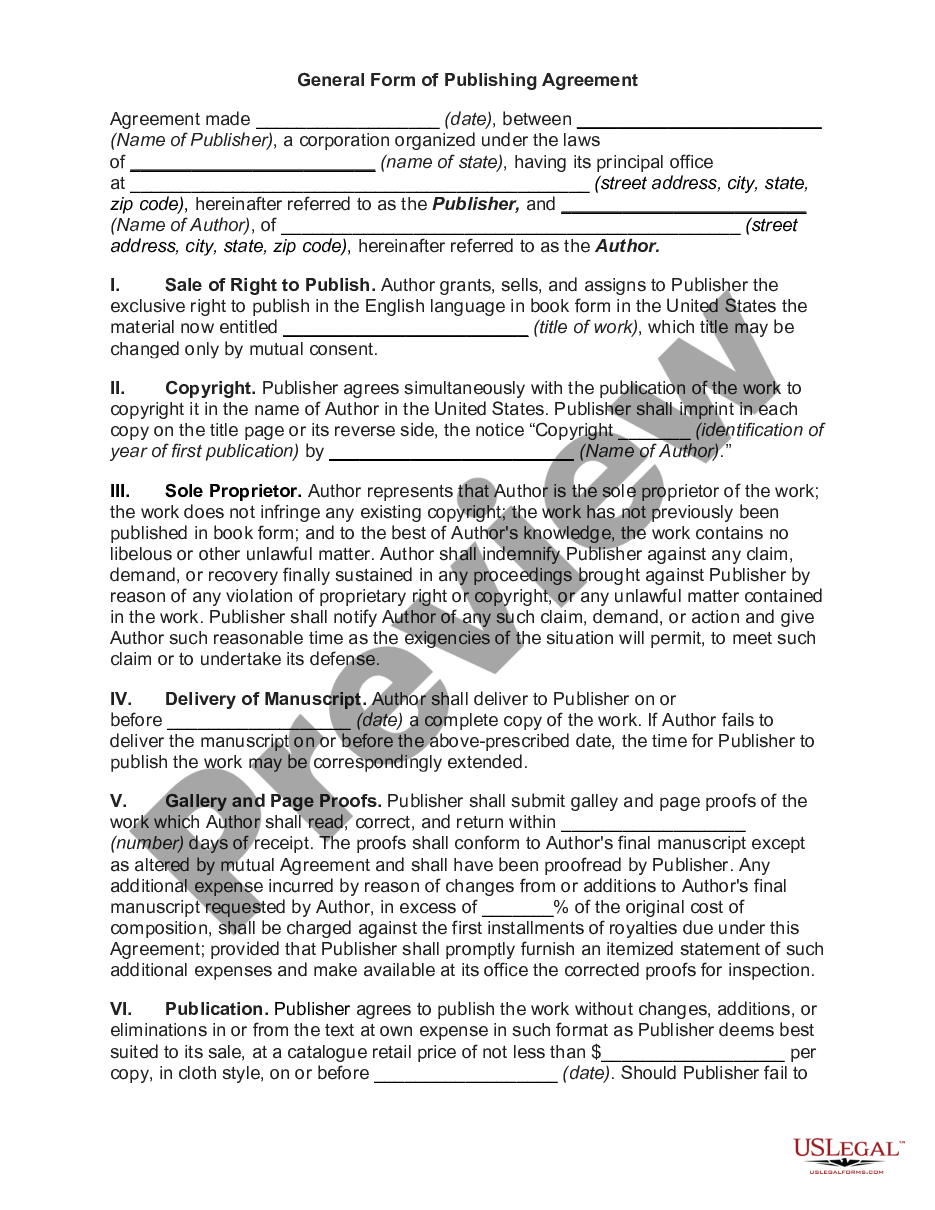

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Salt Lake Debt Adjustment Agreement with Creditor, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Consequently, if you need the latest version of the Salt Lake Debt Adjustment Agreement with Creditor, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Debt Adjustment Agreement with Creditor:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Salt Lake Debt Adjustment Agreement with Creditor and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!