The Oakland Michigan Agreement, also known as the Oakland County Michigan Agreement or simply the Oakland Agreement, is a legally binding contract that affirms the veracity, accuracy, and final resolution of a statement of account. This agreement is crucial for businesses, organizations, and individuals involved in financial transactions, as it provides a formal acknowledgment that the statement of account has been thoroughly examined, found to be factually correct, and considered fully settled. The Oakland Michigan Agreement serves as an assurance that both parties involved are in agreement regarding the contents of the statement of account. It encompasses the comprehensive verification of all financial records, including invoices, receipts, and related documents, and ensures that any discrepancies or disputes have been resolved prior to reaching this agreement. By signing the agreement, both parties indicate their consent and acceptance of the statement of account in its entirety. Key components of the Oakland Michigan Agreement may include the identification of the parties involved, details of the statement of account being addressed, a clear statement affirming the truthfulness and accuracy of the account, and a clause declaring that all disputes or outstanding issues have been settled. The agreement may also include a provision stating the consequences if either party breaches the terms of the agreement. While there may not be different types of Oakland Michigan Agreement specifically related to the statement of account being true, correct, and settled, variations or modifications of this agreement can exist depending on the specific context or circumstances. For instance, there might be separate agreements for different types of financial statements, such as balance sheets, profit and loss statements, or invoices. These agreements would still serve the general purpose of affirming the accuracy and settlement of the respective statements. In conclusion, the Oakland Michigan Agreement that Statement of Account is True, Correct, and Settled is an important legal contract used to validate the accuracy and finality of financial records. By signing this agreement, both parties confirm their agreement on the contents of the statement of account, ensuring the resolution of any disputes or outstanding issues.

Oakland Michigan Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out Oakland Michigan Agreement That Statement Of Account Is True, Correct And Settled?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your region, including the Oakland Agreement that Statement of Account is True, Correct and Settled.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Oakland Agreement that Statement of Account is True, Correct and Settled will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the Oakland Agreement that Statement of Account is True, Correct and Settled:

- Make sure you have opened the correct page with your local form.

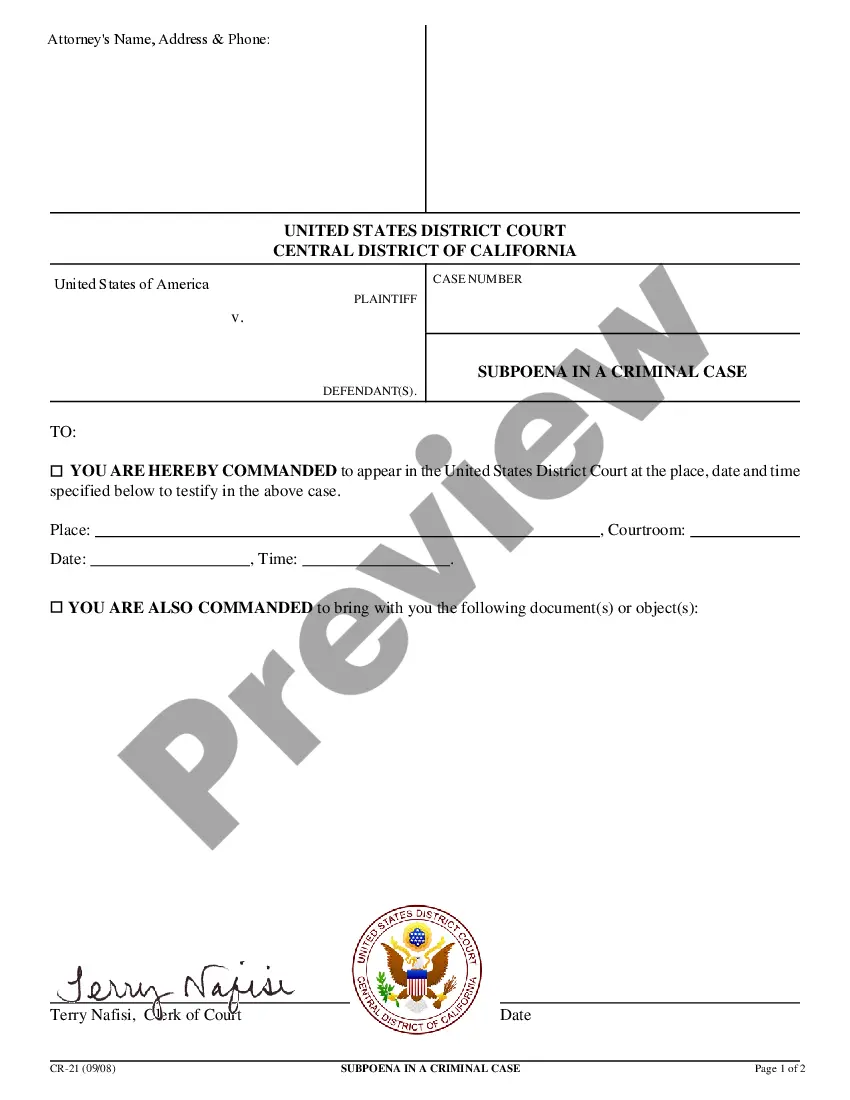

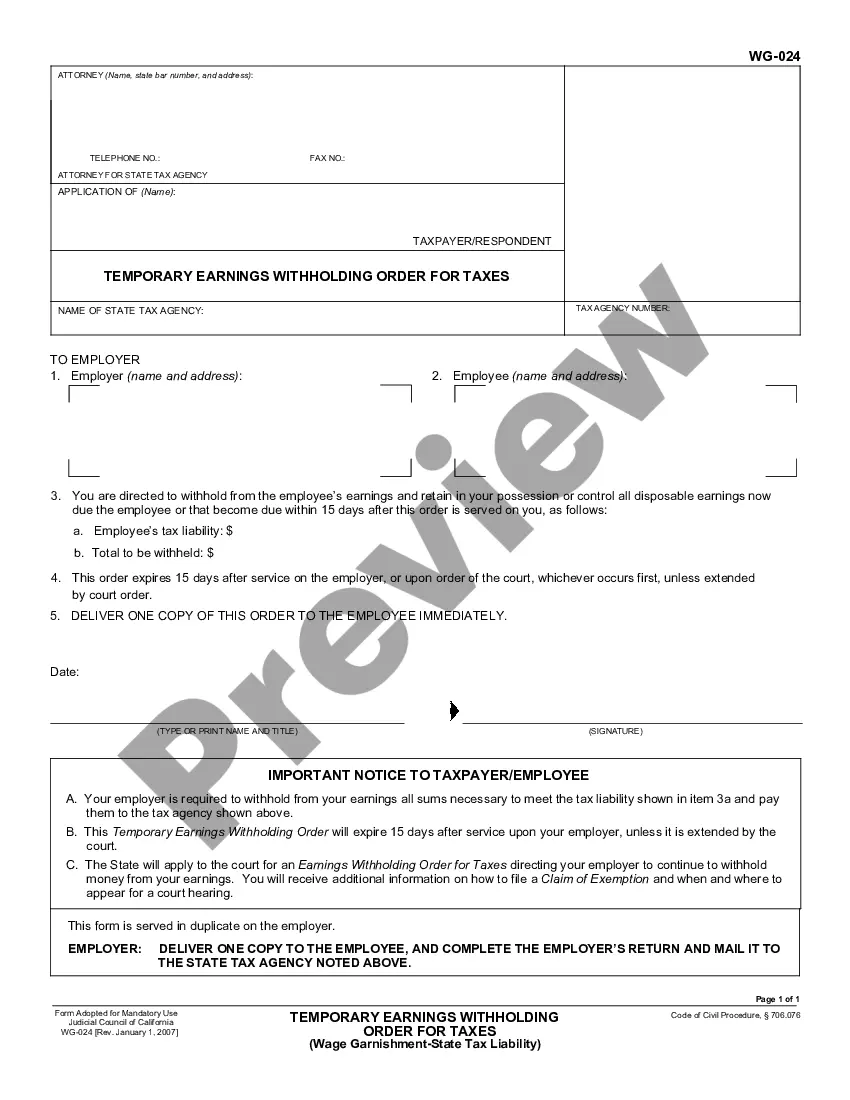

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Oakland Agreement that Statement of Account is True, Correct and Settled on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

A settlement agreement is a legally binding contract that outlines the resolution to a dispute. After negotiations but prior to a final judgement, parties can come to a mutual agreement to an outcome for the case and enter a legally binding settlement agreement.

A settlement agreement always includes monetary and/or non-monetary consideration provided to the claimant to settle known claims against the business.

A settlement agreement is a type of legal contract that helps to resolve disputes among parties by coming to a mutual agreement on the terms. Primarily used in civil law matters, the settlement agreement acts as a legally binding contract. Both parties agree to the judgment's outcome in advance.

Settlement agreements can therefore be offered and accepted at any stage of an employment relationship. For a settlement agreement to be legally binding, the following conditions must be met: The agreement must be in writing. The agreement must relate to a particular complaint or proceedings.

The parties have settled their differences and have agreed terms for the full and final settlement of the Dispute and wish to record those terms of settlement, on a binding basis, in this agreement (the Agreement). This should be the date on which the last person signs the agreement.

Settlement-agreement definition (law) A contractual agreement between parties to actual or potential litigation by which each party agrees to a resolution of the underlying dispute.

If the parties are unable to agree on the terms of an order following delivery or hearing of the reasons, they may take out an Appointment to Settle an Order (Civil Form 49 or Family Form F55).

Full and final settlement means that you ask your creditors to let you pay a lump sum instead of the full balance you owe on the debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt.

A settlement agreement is a legal contract that resolves the disputes among all parties by coming to an agreement. It is a legal document where all parties in a court case, in civil law, agree to an outcome of any judgment being made in advance.

1. An agreement that ends a dispute and results in the voluntary dismissal of any related litigation. Regardless of the exact terms, parties often choose to keep their settlement agreements private. 2. In business law, the payment, satisfaction, and closing of an account.