Salt Lake Utah Agreement that Statement of Account is True, Correct and Settled

Description

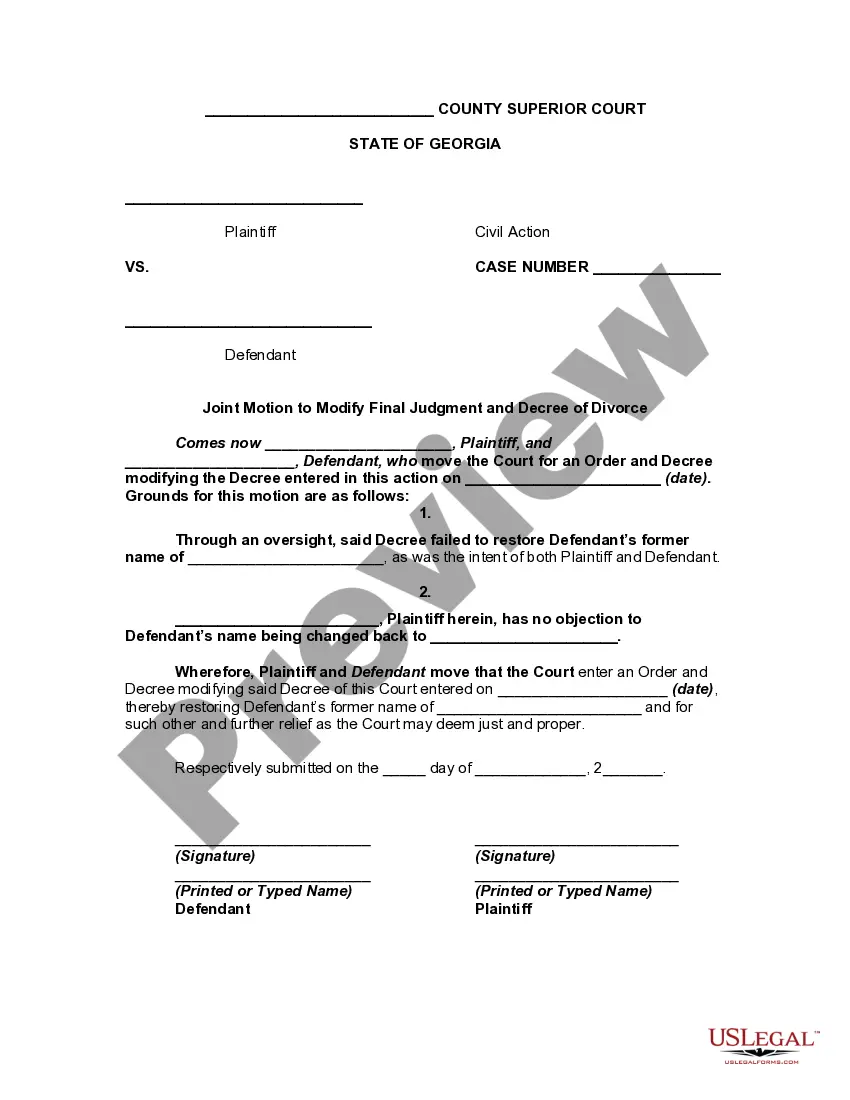

How to fill out Agreement That Statement Of Account Is True, Correct And Settled?

Drafting documents for business or personal requirements is always a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it is essential to consider all federal and state laws pertinent to the specific area.

Nonetheless, smaller counties and even municipalities also have legislative measures that must be taken into account.

The remarkable aspect of the US Legal Forms library is that all the paperwork you've ever purchased is never lost - you can retrieve it in your profile within the My documents section at any time. Join the platform and conveniently acquire validated legal templates for any purpose with just a few clicks!

- All these factors make it taxing and time-consuming to formulate a Salt Lake Agreement that Affirms the Statement of Account is Accurate, Correct and Resolved without expert help.

- It is feasible to circumvent unnecessary expenses on legal professionals for crafting your documents and generate a legally binding Salt Lake Agreement that Affirms the Statement of Account is Accurate, Correct and Resolved independently, utilizing the US Legal Forms online repository.

- This is the largest online database of state-specific legal documents that are professionally validated, ensuring their legitimacy when selecting a template for your county.

- Previously subscribed users only need to sign in to their accounts to download the necessary document.

- If you have not yet subscribed, follow the step-by-step guide below to obtain the Salt Lake Agreement that Affirms the Statement of Account is Accurate, Correct and Resolved.

- Browse the page you've accessed and verify if it contains the document you require.

- To do this, utilize the form description and preview if these features are available.

Form popularity

FAQ

A settlement agreement should be in writing....Those requirements include: An offer. This is what one party proposes to do, pay, etc. Acceptance.Valid consideration.Mutual assent.A legal purpose. A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

A settlement agreement is a legal contract that resolves the disputes among all parties by coming to an agreement. It is a legal document where all parties in a court case, in civil law, agree to an outcome of any judgment being made in advance.

Also called the terms of settlement, these include who will pay or do what, and what will happen after the payment is made or the actions completed. They should include details like a payment deadline. Release. Parties agree to release each other from all future claims, demands and actions.

If a settlement agreement has been signed by both parties and approved by a judge, then it is legally binding and enforceable. However, after a case has been dismissed, the court no longer has the power to enforce a settlement agreement.

1. An agreement that ends a dispute and results in the voluntary dismissal of any related litigation. Regardless of the exact terms, parties often choose to keep their settlement agreements private. 2. In business law, the payment, satisfaction, and closing of an account.

Those requirements include: An offer. This is what one party proposes to do, pay, etc. Acceptance.Valid consideration.Mutual assent.A legal purpose. A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

And a settlement agreement does not need to be in writing to be enforceable. An oral settlement agreement entered into by the parties can be enforceable so long as it does not violate the statute of frauds. This oral agreement would be interpreted in the same manner as any other contract.

Those requirements include: An offer. This is what one party proposes to do, pay, etc. Acceptance.Valid consideration.Mutual assent.A legal purpose. A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.