San Antonio, Texas Agreement — Statement of Account True, Correct, and Settled A San Antonio, Texas Agreement that Statement of Account is True, Correct and Settled refers to a legally binding document between parties involved in a financial transaction or business relationship. This agreement validates the accuracy of a statement of account, ensuring all parties agree that the account balance presented is true, correct, and settled. In such an agreement, various types or scenarios can arise, depending on the nature of the business or financial arrangement. Let's explore a few different instances where this type of agreement might be necessary: 1. Commercial Sales Agreement: In this scenario, a San Antonio business may enter into a commercial sales agreement with a vendor or supplier. When the vendor provides goods or services, they will subsequently send a statement of account to the San Antonio business. The parties may then execute an agreement confirming that the statement of account accurately reflects the transactions and the associated balance has been settled. 2. Rental or Lease Agreement: Landlords and tenants in San Antonio may utilize this agreement to settle any discrepancies related to the payment of rent, utilities, or other expenses. When a tenant vacates the premises, the landlord might provide a final statement of account, detailing any outstanding balances or deductions. By signing this agreement, both parties acknowledge the correctness of the statement of account and confirm that all financial obligations have been settled. 3. Construction Contract: In the construction industry, San Antonio contractors and clients can also utilize this agreement. Upon completion of a project, the contractor may provide a statement of account detailing all costs, expenses, and payments. The client and contractor can then sign an agreement, affirming that the statement of account accurately represents the financial aspects of the project, and all payments have been settled. 4. Business Loan Agreement: When a San Antonio business borrows funds from a bank or lender, the lender often provides periodic statements of account, reflecting the outstanding loan balance, interest payments, and other related details. Sometimes, both the lender and the borrower might execute an agreement, acknowledging the correctness of the statement of account and confirming that the loan has been settled as per the agreed terms. In all instances, a San Antonio, Texas Agreement that Statement of Account is True, Correct, and Settled plays a crucial role in legalizing the finality and accuracy of financial transactions. By signing such an agreement, parties accept and validate the information provided in the statement of account, ensuring transparency and finalizing the settlement of any outstanding balances or financial obligations.

San Antonio Texas Agreement that Statement of Account is True, Correct and Settled

Description

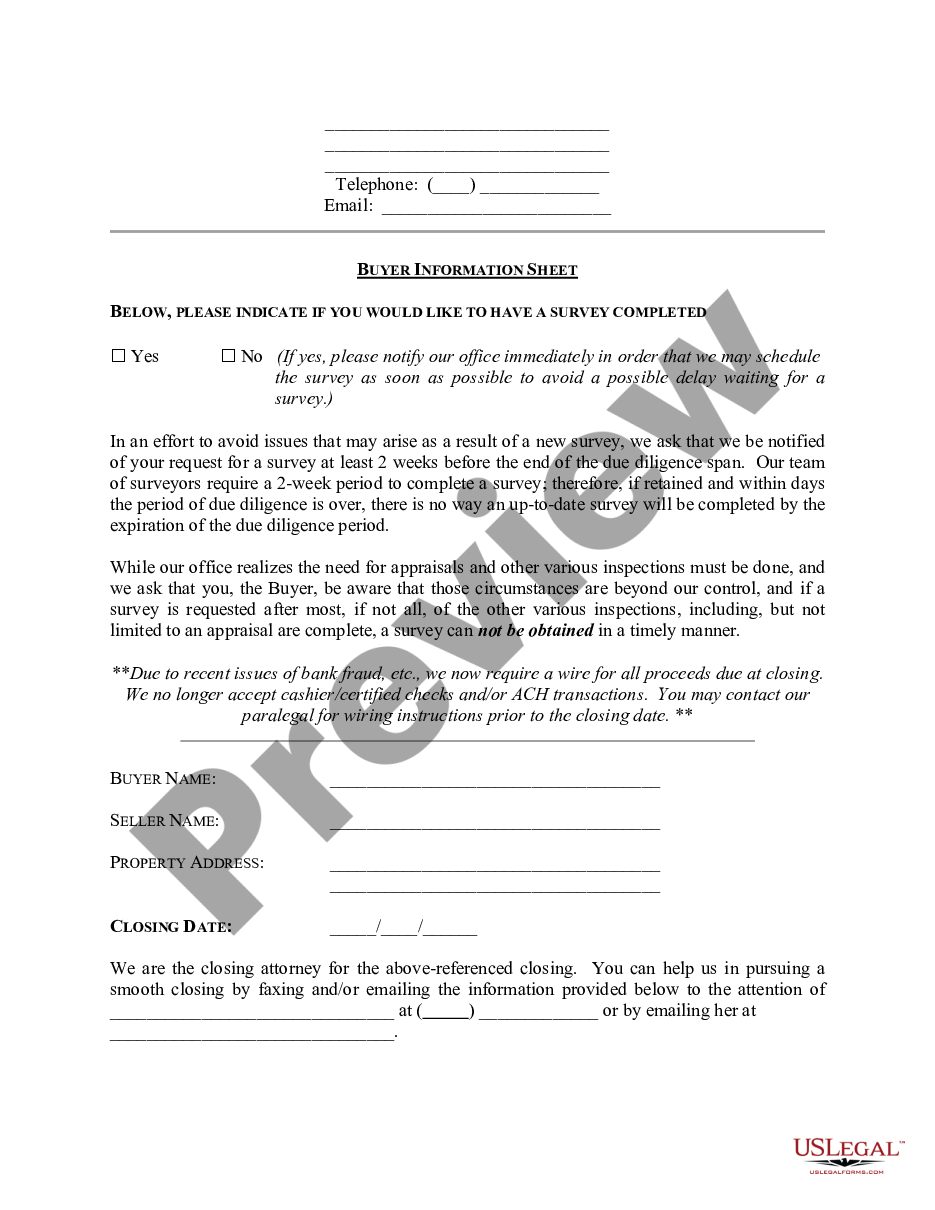

How to fill out San Antonio Texas Agreement That Statement Of Account Is True, Correct And Settled?

If you need to get a reliable legal form provider to get the San Antonio Agreement that Statement of Account is True, Correct and Settled, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support make it easy to find and complete different documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to look for or browse San Antonio Agreement that Statement of Account is True, Correct and Settled, either by a keyword or by the state/county the document is created for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the San Antonio Agreement that Statement of Account is True, Correct and Settled template and check the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes this experience less pricey and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate contract, or execute the San Antonio Agreement that Statement of Account is True, Correct and Settled - all from the convenience of your sofa.

Sign up for US Legal Forms now!