Bexar Texas General Form of Assignment to Benefit Creditors

Description

How to fill out General Form Of Assignment To Benefit Creditors?

Laws and statutes in every domain vary across the nation.

If you're not an attorney, it's simple to become confused by the numerous standards when it comes to creating legal documents.

To prevent expensive legal fees when drafting the Bexar General Form of Assignment to Benefit Creditors, you require a confirmed template applicable for your county.

That's the easiest and most economical method to acquire current templates for any legal circumstances. Find them all with just a few clicks and maintain your documentation organized with the US Legal Forms!

- That's where utilizing the US Legal Forms platform proves to be advantageous.

- US Legal Forms is a reliable web repository trusted by millions, containing over 85,000 state-specific legal templates.

- It's an ideal solution for both professionals and individuals seeking do-it-yourself templates for various life and business scenarios.

- All the documents can be reused multiple times: once you acquire a sample, it stays available in your profile for future use.

- Thus, if you possess an account with an active subscription, you can simply Log In and re-download the Bexar General Form of Assignment to Benefit Creditors from the My documents section.

- For newcomers, you need to follow a few additional steps to obtain the Bexar General Form of Assignment to Benefit Creditors.

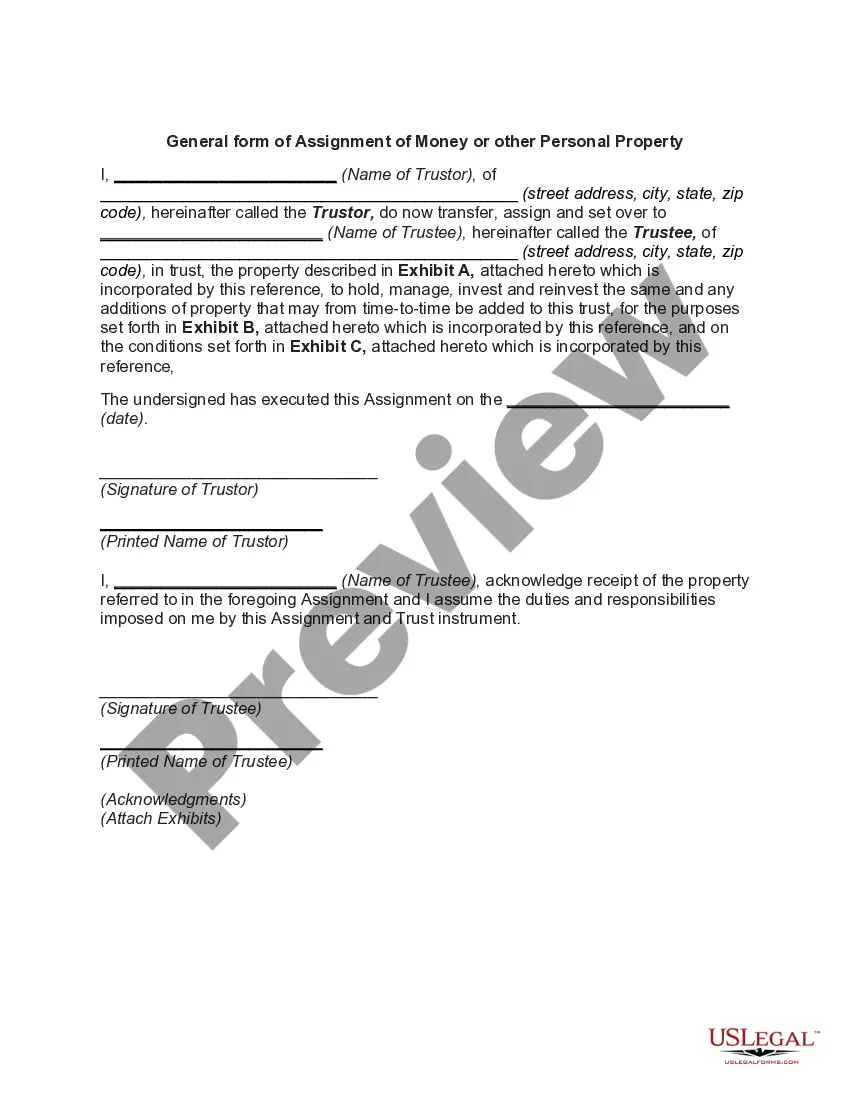

- Review the content on the page to confirm you have located the correct sample.

- Utilize the Preview feature or read the form description if available.

Form popularity

FAQ

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets.

If the debtor enters into insolvency, the assignee will be considered to be the creditor for dividend purposes.

In the United States, a general assignment or an assignment for the benefit of creditors is simply a contract whereby the insolvent entity ("Assignor") transfers legal and equitable title, as well as custody and control of its property, to a third party ("Assignee") in trust, to apply the proceeds of sale to the

Pensions, 401k plans, IRAs, and other tax-deferred retirement assets are protected from creditors in Florida under Section 222.21 of Florida Statutes. All forms of tax-deferred retirement plans are protected.

The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt.

An assignment for the benefit of creditors is one of the vehicles utilized to liquidate a failed or no longer viable business under state law. This method of liquidating or transferring assets has long been popular in Florida.

Description. It is the creditor's responsibility to get a court order and provide any information that can assist MEP in securing payment. The creditor must respond to any changes in the court order that the debtor applies for and advise MEP of any changes in the creditor's address and phone numbers.

Debt assignment is a transfer of debt, and all the associated rights and obligations, from a creditor to a third party (often a debt collector). The company assigning the debt may do so to improve its liquidity and/or to reduce its risk exposure.

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets.