Dallas, Texas is a vibrant city known for its thriving economy, diverse culture, and rich history. Located in the southern part of the United States, Dallas is one of the largest cities in Texas and an important hub for business, commerce, and finance. In the legal realm, Dallas, Texas is no exception, offering various legal procedures, including the General Form of Assignment to Benefit Creditors. This legal process serves to assist creditors in recovering outstanding debts owed to them by a debtor. The General Form of Assignment to Benefit Creditors in Dallas, Texas is a comprehensive legal document that outlines the transfer of a debtor's assets and properties to a trustee, who is responsible for liquidating these assets and distributing the proceeds to the creditors according to their claims. This legal arrangement provides a structured and orderly process for creditors to recover their debts efficiently. There are different types of Dallas Texas General Form of Assignment to Benefit Creditors, depending on the specific circumstances and needs of the parties involved. Some common examples include: 1. Voluntary Assignment: This form of assignment is initiated by the debtor willingly, in an effort to address their financial obligations and settle outstanding debts. The debtor enters into an agreement with the trustee and transfers their assets for the benefit of the creditors. 2. Involuntary Assignment: In certain cases, creditors may petition the court to initiate an involuntary assignment of the debtor's assets. This occurs when the debtor has failed to satisfy their financial obligations or has become insolvent. 3. Formal Assignment: A formal assignment is a more typical and structured approach, involving the debtor, the trustee, and the creditors. It follows a more formal process and is governed by specific legal requirements. 4. Private Assignment: In some situations, the parties involved may opt for a private assignment, allowing for more flexibility and customization of the terms and conditions. This type may occur outside the formal court process and involve complex negotiations among the debtor, trustee, and creditors. Dallas, Texas General Form of Assignment to Benefit Creditors serves as an essential legal mechanism in debt recovery, offering a fair and organized framework for both debtors and creditors. It ensures that creditors have a better chance of receiving what is owed to them, while debtors have an opportunity to resolve their financial obligations systematically. By utilizing this legal tool, the city of Dallas underscores its commitment to facilitating a professional and well-regulated business environment.

Dallas Texas General Form of Assignment to Benefit Creditors

Description

How to fill out Dallas Texas General Form Of Assignment To Benefit Creditors?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Dallas General Form of Assignment to Benefit Creditors, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information materials and tutorials on the website to make any tasks related to document completion simple.

Here's how to purchase and download Dallas General Form of Assignment to Benefit Creditors.

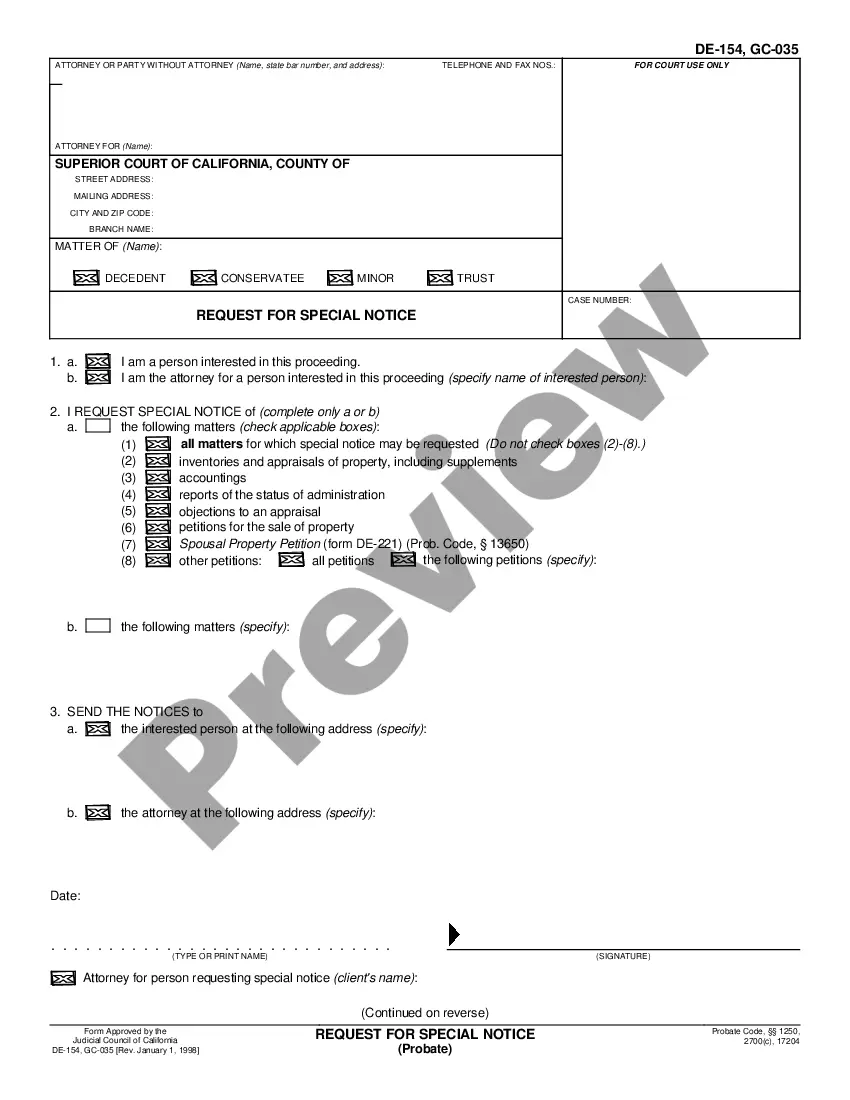

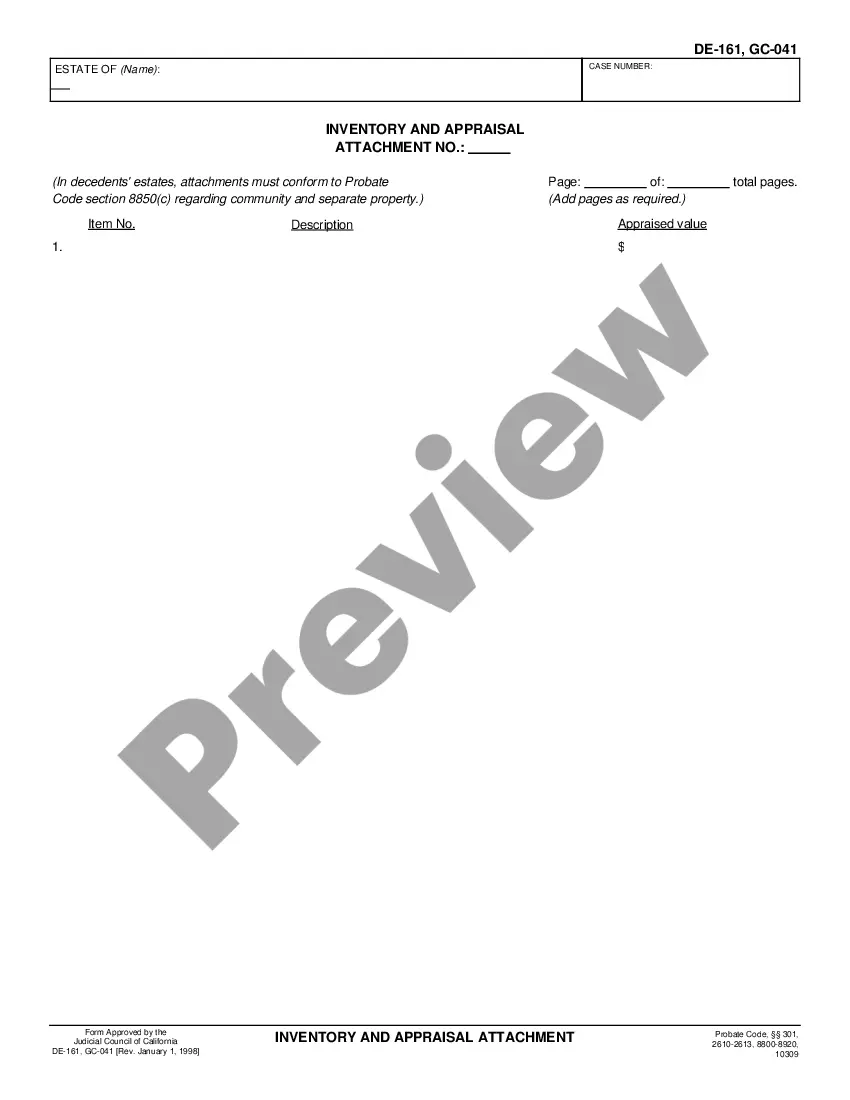

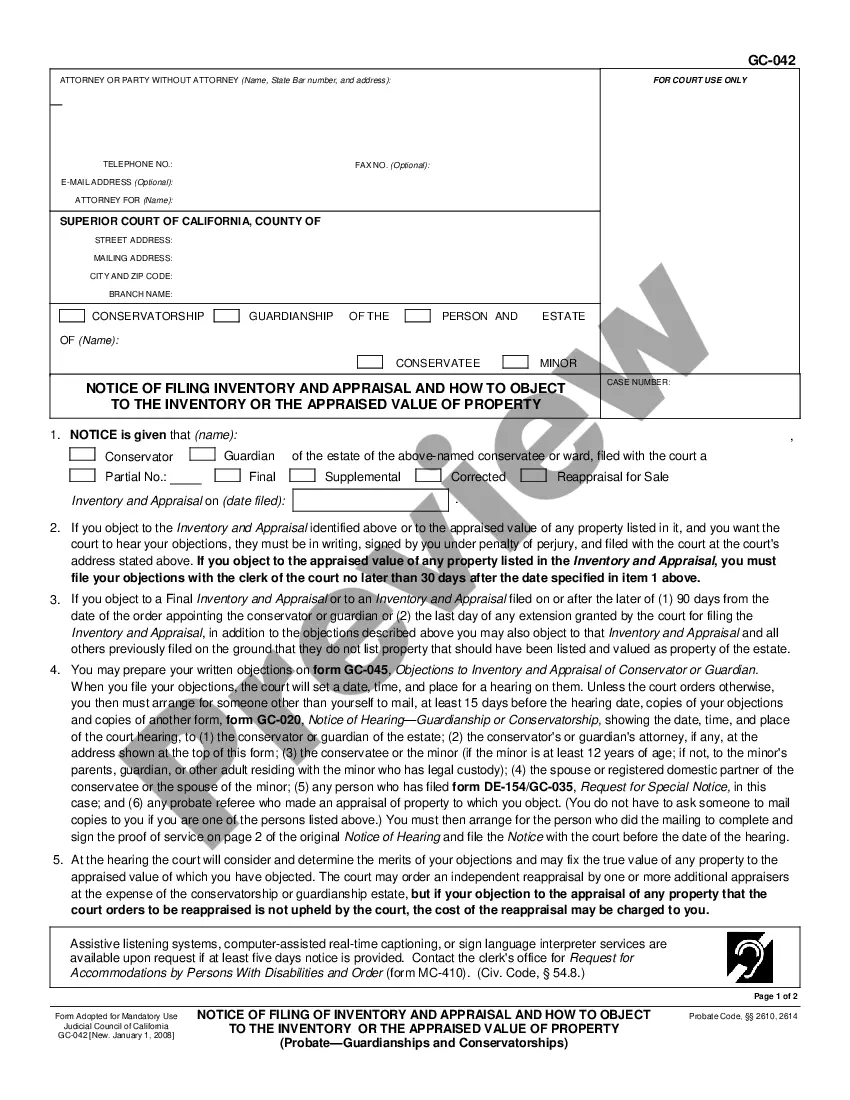

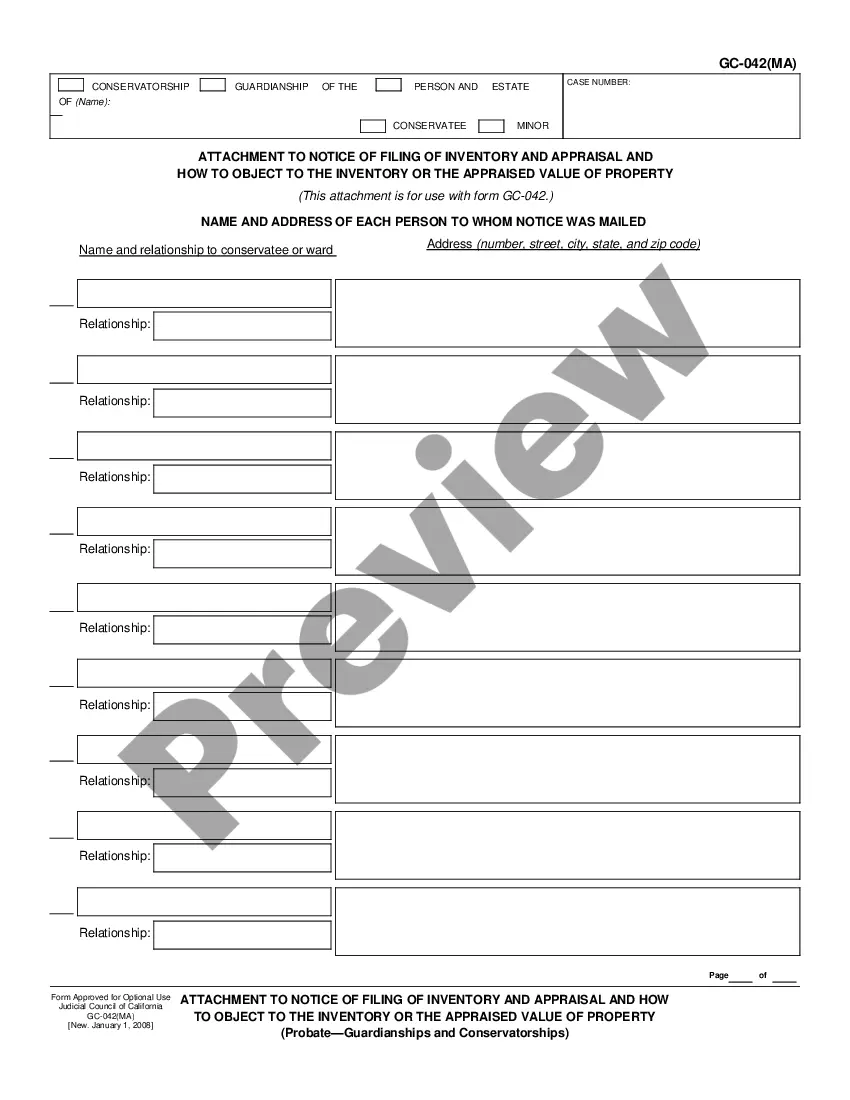

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Check the related forms or start the search over to locate the correct file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and buy Dallas General Form of Assignment to Benefit Creditors.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Dallas General Form of Assignment to Benefit Creditors, log in to your account, and download it. Needless to say, our website can’t replace a lawyer completely. If you need to deal with an exceptionally complicated case, we recommend getting an attorney to examine your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-compliant paperwork with ease!