Cook Illinois Worksheet for Making a Budget

Description

How to fill out Worksheet For Making A Budget?

Laws and rules in every sector differ across the nation.

If you're not a lawyer, it's simple to become confused by different standards when it comes to composing legal documents.

To prevent expensive legal fees when creating the Cook Worksheet for Budgeting, you require a verified template applicable to your region.

That's the simplest and most cost-effective method to obtain current templates for any legal purposes. Discover them all with a few clicks and organize your paperwork with the US Legal Forms!

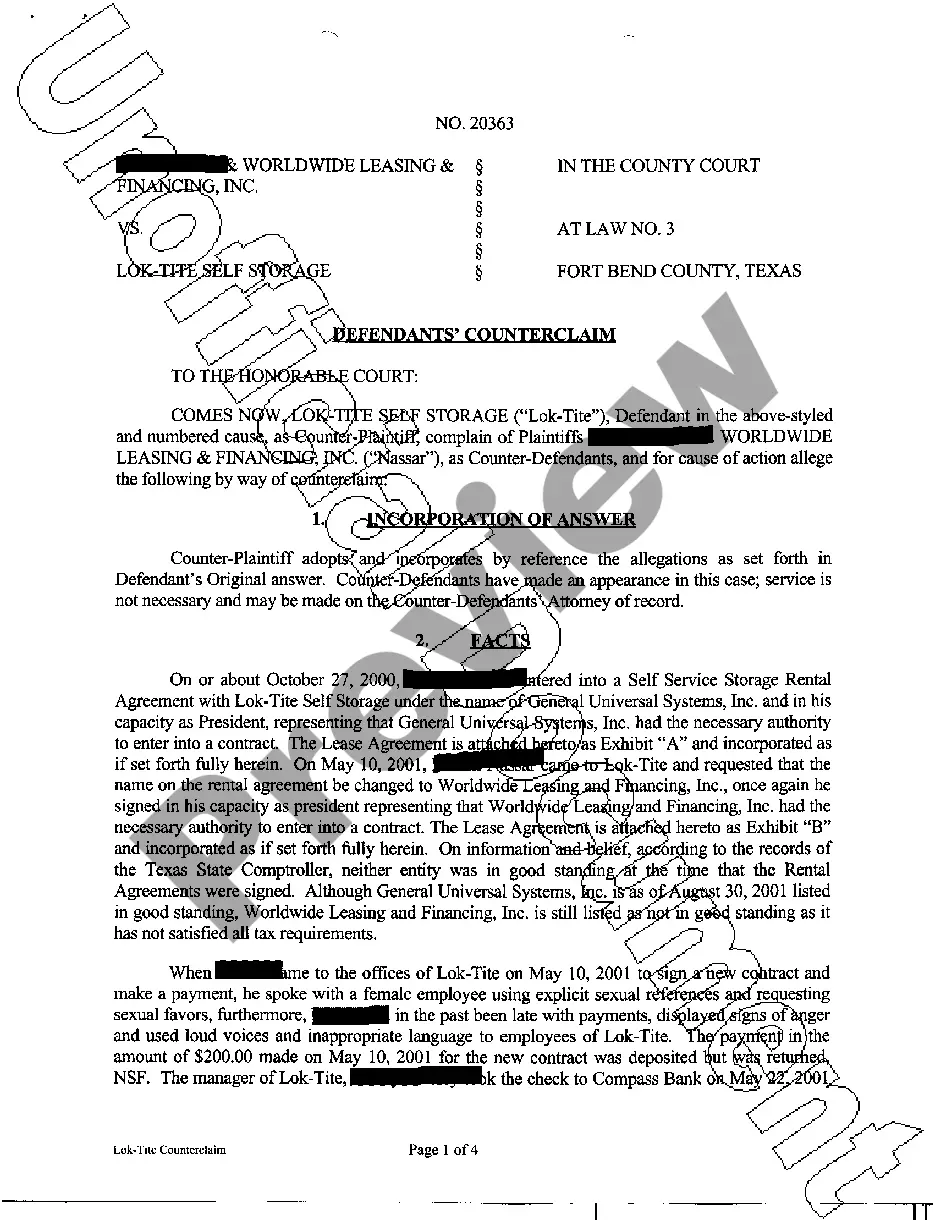

- Examine the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Seek another document if there are discrepancies with any of your requirements.

- Click on the Buy Now button to acquire the document once you find the suitable one.

- Select one of the subscription plans and Log In or create an account.

- Determine how you wish to pay for your subscription (with a credit card or PayPal).

- Choose the format you wish to save the file in and click Download.

- Complete and sign the document in writing after printing it or do everything electronically.

Form popularity

FAQ

Setting up a budget plan involves identifying your financial goals and allocating resources accordingly. Start with a clear outline of your income and a breakdown of your expenses. The Cook Illinois Worksheet for Making a Budget can greatly assist you in creating a plan that reflects your spending habits while guiding you toward your financial objectives.

To make a budget sheet in Sheets, open a new document and format it to include sections for income and various expense categories. Utilize formulas for automatic calculations to simplify your budgeting process. Using the Cook Illinois Worksheet for Making a Budget can serve as a functional tool to streamline your budgeting experience.

Creating a spreadsheet for income and expenses in Google Sheets is straightforward. Begin by labeling columns for income, fixed expenses, and variable expenses. Incorporating the Cook Illinois Worksheet for Making a Budget can ensure you cover all essential categories and give you a comprehensive view of your financial situation.

To make a budget sheet in Google Sheets, start with a blank spreadsheet, and input your income and expenses in separate columns. You can enhance the sheet by using formulas to calculate totals, making it easier to track your finances. Referencing the Cook Illinois Worksheet for Making a Budget will help you to organize your data efficiently.

Setting up a budget planner PDF begins by drafting your budget layout using accessible software. After designing the structure, you can convert your file into a PDF format for easy sharing and access. The Cook Illinois Worksheet for Making a Budget can inspire your layout design by providing essential categories for income and expenses.

To create a simple budget spreadsheet, you can start by listing your income sources and then detail your expenses. Utilize the Cook Illinois Worksheet for Making a Budget as a guide to categorize your spending efficiently. Include sections for fixed and variable expenses to gain a clearer financial picture.

Yes, Google Docs offers budget templates that you can easily access and customize for your personal use. These templates can simplify the budgeting process by providing a contextual layout. Alternatively, explore the Cook Illinois Worksheet for Making a Budget, which brings additional features and flexibility to your financial planning.

Filling out a budget worksheet involves entering your income at the top section followed by detail on your expenses. Be sure to categorize expenses into fixed and variable costs for clarity. By utilizing the Cook Illinois Worksheet for Making a Budget, you can ensure you are organized and thorough, making it easier to track and manage your finances effectively.

To create a simple budget template, you need to start with a clean spreadsheet. List all income sources at the top, followed by expense categories beneath. To simplify this process, you can use the Cook Illinois Worksheet for Making a Budget, which provides a user-friendly layout and helps you ensure you cover all essential aspects of budgeting. This approach can streamline your budgeting efforts.

Yes, Microsoft Office does offer budget templates that you can use in Excel or Word. These templates provide a structured format to help you create your budget effectively. For those looking for a more tailored approach, consider utilizing the Cook Illinois Worksheet for Making a Budget, which allows for customization to meet your specific financial goals.