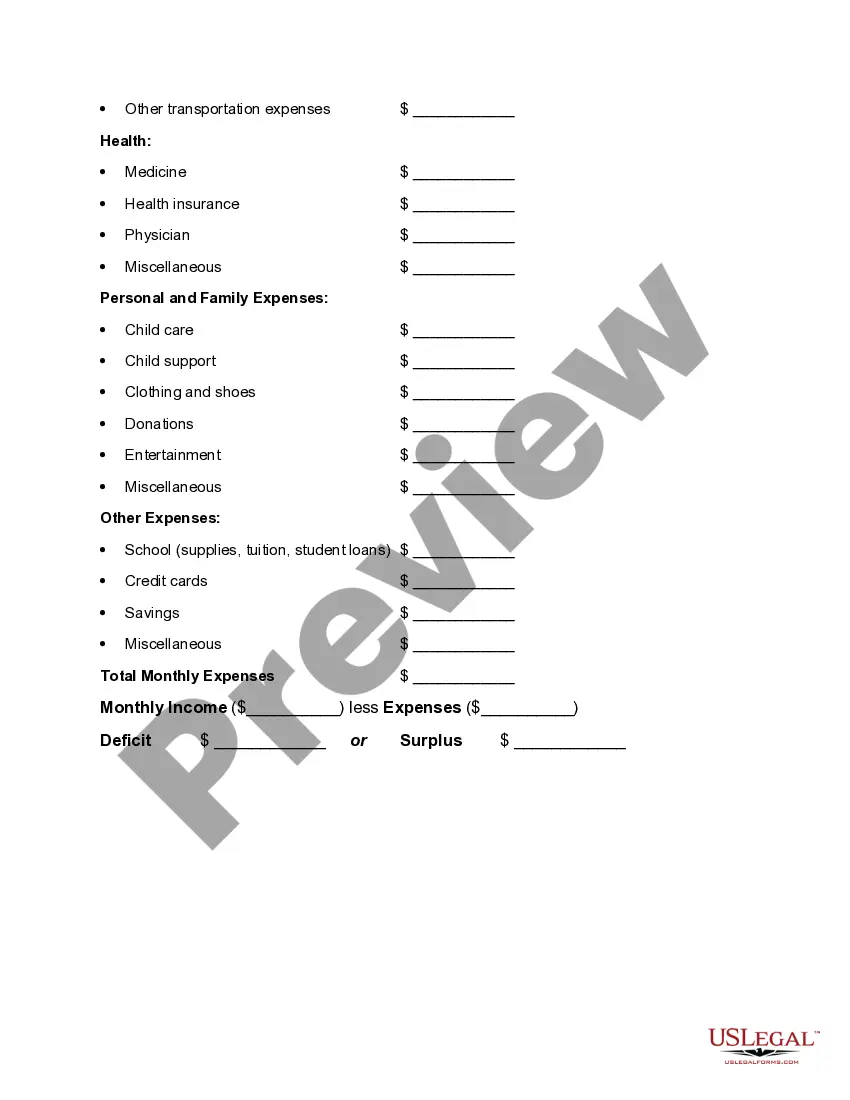

Cuyahoga County, Ohio Worksheet for Making a Budget: A Cuyahoga County Worksheet for Making a Budget is a comprehensive tool designed to help individuals, families, and businesses effectively manage their finances and create a budget plan. This worksheet provides a detailed breakdown of income and expenses, allowing users to track their spending habits, identify areas for potential savings, and prioritize financial goals. The Cuyahoga County Worksheet for Making a Budget typically includes multiple sections to cover various aspects of personal or business finances. Keywords related to this topic may include: 1. Monthly Income: This section enables users to record all sources of monthly income, such as salaries, wages, dividends, or rental income. It helps individuals understand their total earning potential. 2. Fixed Expenses: Fixed expenses refer to recurring costs that remain relatively constant each month, like rent/mortgage payments, utility bills, insurance premiums, or loan repayments. This section allows users to allocate funds for these essential expenses accurately. 3. Variable Expenses: Variable expenses cover other necessary monthly costs that may fluctuate, such as groceries, transportation, entertainment, dining out, or clothing. Users can track their spending patterns in this section to ensure their budget aligns with their financial goals. 4. Debt Payments: If applicable, this section helps users manage their debts by tracking the monthly payments and interest rates associated with loans, credit cards, or other outstanding balances. 5. Savings Goals: This section allows individuals to set savings targets for specific financial goals, like emergencies, education, retirement, or purchasing a new home. Users can allocate a portion of their income towards meeting these objectives. 6. Miscellaneous Expenses: This section accounts for other miscellaneous expenses that may not fall into fixed or variable expenses categories. It allows users to allocate funds for unexpected costs or irregular expenditures. Cuyahoga County offers different variations of the Worksheet for Making a Budget, tailored to specific demographics or purposes. Examples may include: 1. Cuyahoga County Family Budget Worksheet: This worksheet is specifically designed to help families manage their household finances, considering all family members' needs and expenses. 2. Cuyahoga County Business Budget Worksheet: Geared towards business owners, this worksheet enables entrepreneurs to track their income, expenses, and profits, aiding in making informed financial decisions. 3. Cuyahoga County Student Budget Worksheet: This variation focuses on students' financial management, addressing their unique income sources (e.g., part-time jobs, scholarships), expenses (e.g., tuition, books), and savings goals. In conclusion, a Cuyahoga County Worksheet for Making a Budget provides a detailed framework to help individuals, families, and businesses optimize their financial planning and achieve their financial objectives. By utilizing this tool and its various variations, individuals can gain better control over their spending, save money, and work towards their long-term financial stability.

Cuyahoga Ohio Worksheet for Making a Budget

Description

How to fill out Cuyahoga Ohio Worksheet For Making A Budget?

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Cuyahoga Worksheet for Making a Budget, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find information materials and tutorials on the website to make any activities related to document execution straightforward.

Here's how you can purchase and download Cuyahoga Worksheet for Making a Budget.

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the related document templates or start the search over to find the right document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Cuyahoga Worksheet for Making a Budget.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Cuyahoga Worksheet for Making a Budget, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you have to deal with an exceptionally challenging situation, we recommend getting a lawyer to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and get your state-specific paperwork with ease!