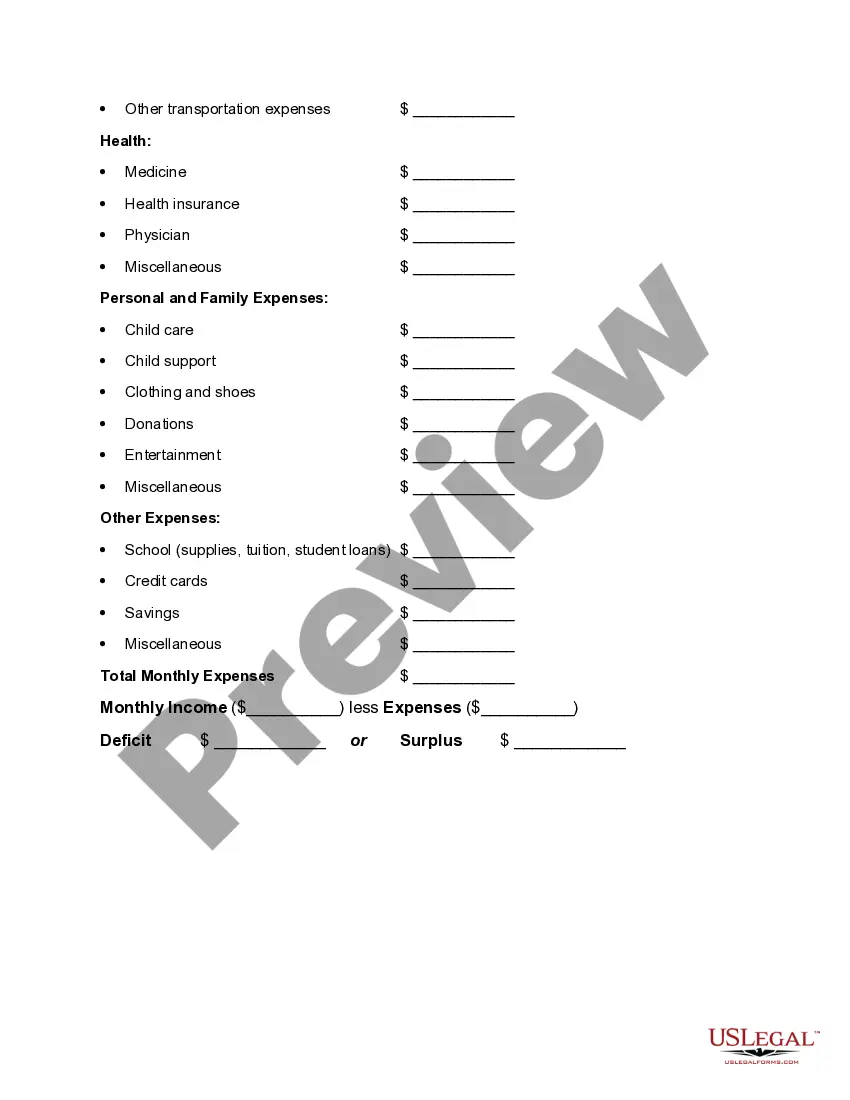

Suffolk New York Worksheet for Making a Budget serves as an essential tool for individuals looking to organize their finances and gain better control over their monetary matters. This detailed budgeting worksheet specifically caters to residents of Suffolk County, New York, providing them with relevant information and resources tailored to their local financial landscape. The Suffolk New York Worksheet for Making a Budget helps users analyze their income, expenses, and overall financial situation. By thoroughly assessing personal expenses and income sources, individuals can create a comprehensive budget plan that suits their unique needs, allowing them to better manage their money and achieve their financial goals. This budgeting worksheet typically consists of various sections to address different aspects of personal finances in Suffolk County. These sections may include: 1. Income: This section aids individuals in documenting their various sources of income, such as salary, bonuses, investments, or side gigs. By accurately recording their earnings, individuals can gain a clearer understanding of their overall financial resources. 2. Fixed Expenses: Fixed expenses incorporate regular financial obligations that remain relatively consistent each month, such as rent or mortgage payments, utility bills, insurance premiums, and loan repayments. Categorizing these expenses helps individuals identify areas where they can potentially reduce costs or seek better deals. 3. Variable Expenses: Variable expenses comprise discretionary spending areas that may fluctuate from month to month, including groceries, dining out, entertainment, travel, and personal care. Tracking variable expenses enables individuals to identify patterns, prioritize essential needs, and allocate funds accordingly. 4. Savings and Investments: This section emphasizes the importance of saving money and investing for long-term financial stability. It allows individuals to designate a portion of their income towards emergency funds, retirement accounts, or other investment vehicles, ensuring future financial security. 5. Debt Management: Addressing debt is another crucial aspect of the Suffolk New York Worksheet for Making a Budget. Users can list and track their debts, such as credit card balances, student loans, or car payments, and develop strategies to pay them off efficiently. 6. Financial Goals: Here, individuals can outline short-term and long-term financial goals, such as saving for a down payment on a home, paying off a loan, or funding a dream vacation. This section helps create a roadmap for achieving these goals, enabling individuals to allocate their resources accordingly. By utilizing the Suffolk New York Worksheet for Making a Budget, residents of Suffolk County can take control of their finances, make informed decisions, and improve their financial well-being. This tool serves as a valuable resource for individuals seeking financial stability and a brighter future.

Suffolk New York Worksheet for Making a Budget

Description

How to fill out Suffolk New York Worksheet For Making A Budget?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Suffolk Worksheet for Making a Budget, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Suffolk Worksheet for Making a Budget from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Suffolk Worksheet for Making a Budget:

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!